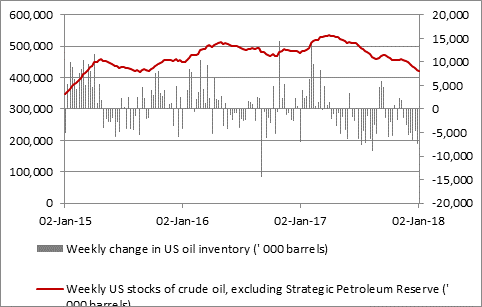

“Production cuts at OPEC and non-OPEC producers have surprised many because they have held firm for over a year, while unrest in Iran and financial strife in Venezuela both raise the risk of disruption to output. In addition, oil inventories in the USA stand 13% lower than they did a year ago, excluding the strategic reserve, and are now down to levels last seen in summer 2015, even as global demand continues to grow fairly consistently.

Source: US Energy Information Agency

“For those investors who think OPEC will stick to its guns on the production cuts and that improved global economic momentum will sustain the price of the black stuff there are plenty of ways to get involved.”

1. Dedicated energy equity fund.

“There are a select number of actively-managed funds which specialise in investing in firms related to the energy industry and oil and oil equipment and services stocks in particular. Guinness Global Energy is one example. Just under half of its assets are in US-listed stocks with 15% in Canada and 11% in the UK. The largest individual stocks positions include US oil equipment and services giants Halliburton and Schlumberger, US oil producers Hess and Devon Energy and Canadian oil sands specialist Suncor.

“Another option to consider here is the ETFS US Energy Infrastructure ETF (EPIC code MLPX). Listed on the London Stock Exchange, this tracker is designed to provide the performance of a basket of 24 American energy pipeline, storage and logistics firms, a lot of whose share prices have fallen hard alongside the actual oil price. The tracker is SIPP and ISA eligible and comes with a total expense ratio of 0.25%.

2. UK equity tracker fund.

“The iShares Core FTSE 100 ETF is big (£5.7 billion in assets), cheap (0.07% total expense ratio) and has both BP and Shell in its top-five holdings list, with an overall weighting toward energy of 16.1%, although it is by no means a pure play.

3. Actively managed UK equity income fund

“A lot of the top performers in the UK Equity Income category have low weightings in the oils so they have a big decision to take, as to whether to jump back in or not. One fund which already has big holdings in both BP and Shell is River & Mercantile UK Equity Income. They are the two single biggest holdings in the £312 million collective, which comes with a 15% weighting toward energy, a 3.9% dividend yield and a 0.90% ongoing charge.

4. Oil tracker

“Investors may want to avoid stock specific risk and just follow the oil price. ETFS Crude Oil ETC (EPIC code CRUD) tracks the US benchmark, West Texas Intermediate, and ETFS Brent Crude (EPIC code BRNT) the equivalent European oil benchmark. Note that both trackers follow a basket of oil futures prices, not the spot price, and both use synthetic replication (derivatives) to achieve this. Besides movements in the oil futures, investors are also exposed to the roll yield and collateral yield for their total return on investment.

5. Oil stocks and oil-related stocks

“According to the London Stock Exchange website there are 138 oil and gas related stocks listed on the Main Market and AIM with a combined value of £318 billion, ranging from Endeavour’s market cap of £900,000 to Shell’s at £196 billion.

“BP and Shell will generally respond favourably to the higher oil price as the higher crude goes, the safer their fat dividend yields become – both offer earnings cover of around one times in 2018 when a ratio of at least two times is ideal. However, cash flow is improving fast and this means the dividend is now far less reliant on selling assets or raising debt, both of which looked like they could be a major contributor when oil hit $30.

“BP currently offers a 2018 dividend yield of 5.7% and Shell 5.6%, based on consensus analysts’ forecasts.

“Less well developed, pure play producers like FTSE 250 firms Cairn and Tullow could also benefit, but the operational and exploration risks are higher here.

“Then the riskiest oil plays are the AIM-quoted junior explorers which may not even be producing or have a find, but whose share prices could welcome more positive sentiment toward their industry.

“Oil exploration firm Eco Atlantic Oil & Gas shows what can happen as its shares have soared this year, thanks to an announcement that US oil major ExxonMobil announcing a sixth big discovery on the Stabroek block, Guyana. This asset neighbours Eco’s 40%-owned Orinduik block. French energy giant Total is currently working through seismic data with an option to acquire a 25% stake in Orinduik for $13.5 million.

“The London Stock Exchange is host to more than a dozen firms which provide equipment and services to the oil industry. None of them feature in the FTSE 100, although Wood and Petrofac were both once part of the UK’s elite index. Other names to note include Lamprell, Cape and Hunting, although do note they all have different client, geographic and product exposures. Wood has just completed a bid for industry rival Amec Foster Wheeler.

6. Other overseas markets

“Intrepid investors may look overseas for their oil plays. France’s Total, Italy’s ENI, and Spain’s Repsol are all mega-cap stocks, while in the US ExxonMobil, Chevron and ConocoPhillips can all be traded via UK-based brokers and platforms.”