“Dividend cancellations from WPP and Smiths Group mean that thirteen FTSE 100 members have now decided to withhold £2.7 billion of payments for either 2019 or 2020 but Royal Dutch Shell seems determined that it will not add to the list,” says Russ Mould, AJ Bell Investment Director.

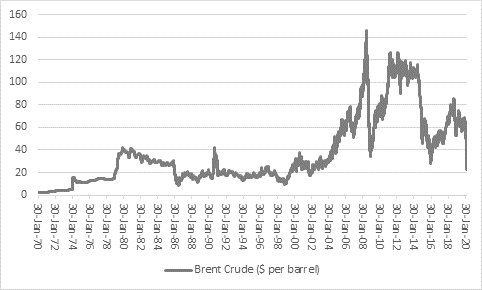

“Even though Brent crude oil is stuck near 17-year lows at $27 a barrel, the oil major’s trading statement provides updates on production volumes, capacity utilisation rates and an analysis of how sensitive cash flow from operations (CFFO) is to movements in the oil price – but no mention of the quarterly $0.47-a-share dividend.

Source: Refinitiv data

“Instead, Shell simply highlights how it has opened a new $12 billion credit facility with its banks. This supplements that $10 billion facility offered by its banks last December and supplements a $20 billion cash pile and additional capacity to raise short-term debt, should it be needed.

“Shell’s board therefore seems to be sending a clear message that the dividend payment is not under discussion.

“Previously announced plans (23 Mar) to wring an extra $8-9 billion of free cash flow out of the company, by reducing costs, cutting capital investment and sweating net working capital could be topped by asset disposals and now the fresh debt. This combination saw Shell – and its dividend – through the 2015-16 oil price collapse and management clearly believes it can do so again now, as the board seeks to avoid reducing its dividend for the first time in over 70 years and wade its way through a gathering oil glut.

“If you assume that profits go back to 2015’s lows it is possible to see how free cash flow just about covers the $15 billion annual dividend payment. Disposals would take care of the rest, if Shell can get to its $10 billion asset-sale target.

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020E* |

|

Operating profit |

30,118 |

3,935 |

8,809 |

22,172 |

39,366 |

40,628 |

3,935 |

|

Depreciation & amortisation |

24,499 |

26,714 |

24,993 |

26,222 |

22,135 |

28,701 |

30,000 |

|

Impairments / gains |

(3,212) |

(3,460) |

(2,141) |

(1,640) |

(3,265) |

(1,301) |

0 |

|

Net working capital |

6,405 |

5,521 |

(6,289) |

(2,250) |

3,442 |

(4,779) |

2,000 |

|

Tax |

(14,299) |

(7,673) |

(4,434) |

(6,307) |

(9,671) |

(7,605) |

(2,000) |

|

Capex |

(31,676) |

(26,131) |

(22,116) |

(20,845) |

(23,011) |

(22,971) |

(20,000) |

|

Operating free cash flow |

11,835 |

(1,094) |

(1,178) |

17,352 |

28,996 |

28,722 |

13,935 |

|

|

|

|

|

|

|

|

|

|

Dividends |

9,444 |

9,370 |

9,677 |

10,877 |

15,675 |

15,918 |

15,918 |

|

Free cash flow cover |

1.25 x |

-0.12 x |

-0.12 x |

1.60 x |

1.85 x |

1.80 x |

0.88 x |

|

|

|

|

|

|

|

|

|

|

Operating free cash flow |

11,835 |

(1,094) |

(1,178) |

17,352 |

28,996 |

28,722 |

13,935 |

|

Disposals |

14,036 |

4,996 |

3,637 |

10,985 |

5,960 |

7,871 |

2,100 |

|

Change in debt |

357 |

15,024 |

(5,172) |

(12,372) |

(7,935) |

(3,107) |

0 |

|

Total cash flow + disposals + debt |

26,228 |

18,926 |

(2,713) |

15,965 |

27,021 |

26,728 |

16,035 |

|

Total minus Dividends |

16,784 |

9,556 |

(12,390) |

5,088 |

11,346 |

11,149 |

117 |

|

|

|

|

|

|

|

|

|

|

Short-term debt |

5,917 |

7,366 |

7,868 |

11,795 |

10,134 |

15,064 |

|

|

Long-term debt |

37,065 |

45,575 |

73,005 |

73,870 |

66,990 |

81,360 |

|

|

Cash |

19,027 |

26,981 |

11,019 |

20,312 |

26,741 |

18,054 |

|

|

Stated net debt |

23,955 |

25,960 |

69,854 |

65,353 |

50,383 |

78,370 |

|

|

Equity |

180,992 |

178,008 |

198,014 |

197,812 |

196,660 |

190,483 |

|

|

Gearing (%) |

13% |

15% |

35% |

33% |

26% |

41% |

|

Source: Company accounts. *2020E based on company cost and cash flow guidance on 23 March 2020 and assumes 2020 profits equal 2015 lows.

“The risk is that oil goes lower still, as Saudi Arabia and Russia persist in maintaining supply in their efforts to deliver a crushing blow to the US shale industry which continues to chip away at their control of the commodity.

“That could force Shell to borrow more heavily to maintain the dividend. While that would bring succour to shareholders in the near term, the longer Shell has to rely on capex cuts, asset disposals and debt the greater the potential long-term damage to the company’s competitive position, especially as it still faces the issue of how to reposition itself for a lower-carbon future and invest in that transition.

“After 13 dividend cuts for FTSE 100 firms for either 2019 or 2020, income investors may be inclined to put aside such long-term worries and bank Shell’s dividends, as the firm is forecast to be the single-largest distributor once more in 2020. Those cuts represent some £2.7 billion to shareholders, so the damage is still relatively light, considering that the FTSE 100 – before the viral outbreak – was forecast by analysts to offer £89 billion in dividends in 2019 and £91 billion in 2020. If the ten biggest payers can maintain their distributions – and the understandable gathering pressure on the banks means this is by no means certain – then the FTSE 100 could yet offer value, especially to income seekers.

|

Ten biggest dividend payers in the FTSE 100, 2020E |

|||

|

|

Dividend (£ million) |

Dividend yield (%) |

Dividend cover (x) |

|

Royal Dutch Shell |

11,552 |

10.7% |

1.42x |

|

HSBC |

8,013 |

8.5% |

1.38x |

|

BP |

6,497 |

9.6% |

1.31x |

|

British American Tobacco |

5,118 |

8.3% |

1.53x |

|

GlaxoSmithKline |

3,991 |

5.3% |

1.49x |

|

Rio Tinto |

3,286 |

7.2% |

1.59x |

|

AstraZeneca |

2,876 |

3.1% |

1.50x |

|

Lloyds |

2,473 |

10.3% |

2.00x |

|

BHP Group |

2,161 |

3.3% |

1.51x |

|

Vodafone |

2,093 |

6.8% |

1.09x |

|

AVERAGE |

|

7.3% |

1.37x |

Source: Sharecast, consensus analysts’ forecasts

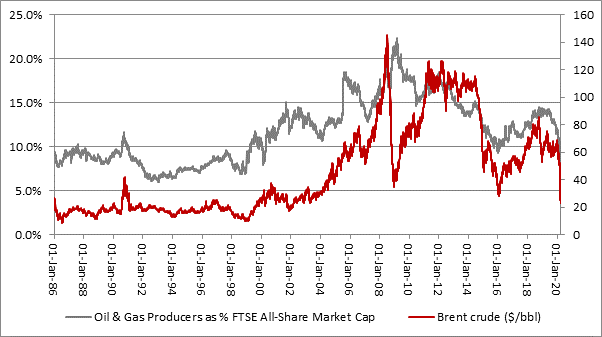

“In addition, the share price may already be braced for a cut, so if Shell can hold firm that could be a huge support for the stock. The Oil & Gas Producers sector represented just 7.9% of the FTSE All-Share’s total market cap on 18 March, the lowest figure since mid-1998, when oil was $14 a barrel.

Source: Refinitiv data