| 2018 E | |||

Company | Dividend (£bn) | % of FTSE 100 total dividend | Dividend yield | Dividend cover |

Shell | 11.1 | 13% | 5.3% | 1.25x |

HSBC | 7.3 | 8% | 5.2% | 1.45x |

BP | 5.7 | 7% | 5.5% | 1.11x |

BAT | 4.7 | 5% | 5.5% | 1.52x |

GlaxoSmithKline | 4.0 | 5% | 5.6% | 1.34x |

Vodafone | 3.6 | 4% | 6.4% | 0.74x |

Lloyds | 3.0 | 3% | 6.3% | 1.75x |

Rio Tinto | 2.7 | 3% | 5.0% | 1.64x |

AstraZeneca | 2.6 | 3% | 4.1% | 1.22x |

Glencore | 1.9 | 2% | 3.5% | 2.41x |

FTSE 100 | 87.3 | 100% | 4.2% | 1.72x |

Source: Digital Look, consensus analysts’ estimates

“For the last two years, Shell has been dogged by concerns that its $0.47-a-quarter dividend was at risk of a cut owing to a downturn in oil and natural gas prices – and earnings cover for the dividend is still thinner than ideal.

“The consensus earnings per share figure of 173.2p ($2.43) compares to expectations of an unchanged dividend of 133.6p ($1.88), using a sterling-dollar cross-rate of $1.4075, for an earnings cover ratio of barely 1.30 times.

“But it is cash that pays dividends, as shareholders in Carillion and Capita will know to their cost, and (odd as it may sound) profit is just one component of cash flow.

“And once profit is adjusted for depreciation and working capital, and tax and capital investment are taken off, Shell generated some $6 billlion of free cash flow in the first quarter – a figure which covers the $4 billion quarterly dividend payment by 1.5 times.

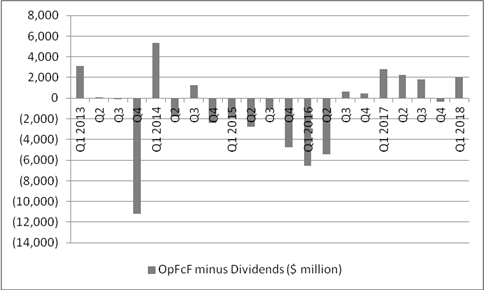

“That $2 billion margin of safety means that free cash flow has covered the dividend four times in the last five quarters (after a run of seven quarters when it did not).

Source: Company accounts

“This also helps to explain why the company stopped paying some of its dividend in shares (or scrip) late last year.

“Shell’s shares have responded to the greater visibility on cash flow and thus the dividend, helped by buoyant oil and gas prices and this can be seen in the company’s dividend yield.”

“At the time of the Q1 results a year ago, Shell was the second-highest yielder in the FTSE 100, at 7% (behind only Direct Line, at the time). This reflected concern over whether oil’s then-nascent recovery was sustainable and whether the dividend was safe, as investors demanded a high yield (by paying a lower share price) to compensate for the risks associated with owning the stock.

“Shell’s yield is now a still-meaty 5.3% - but that is enough now to rank it just 23rd by dividend yield within the FTSE 100 as investors seem to feel the yield (and thus the investment case) are on a more solid footing.

“However, oil has risen by 46% in dollar terms over the past year and Shell’s shares have risen by 23%.

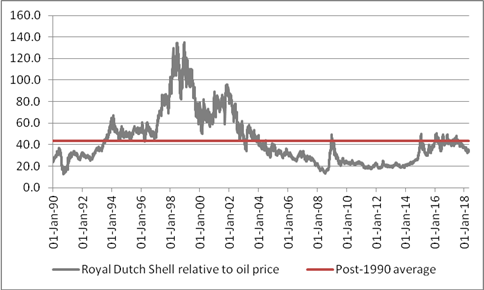

“As a result, it can be argued that Shell’s shares still look cheap relative to the oil price, trading at 35 times the price of crude compared to the post-1990 average of just over 43 times.

Source: Thomson Reuters Datastream

“This gap to the historic discount could close by Shell’s shares making fresh ground although it could close if oil falls sharply, so investors will have to keep tabs on OPEC’s output plans, US oil inventories, global rig activity, global economic growth and the impact of geopolitics in the Middle East, Russia and beyond, at least it comes to near-term movements in the price of crude.”