“Netflix shareholders won’t enjoy looking at their trading screens this morning and neither will those of ASOS for precisely the same reason – there are few worse investments than a growth stock that disappoints,” says Russ Mould, AJ Bell Investment Director. “Fast-fashion specialist ASOS trades on a very high valuation – before today’s upset it was trading on a price/earnings ratio of more than 50 for the year to August 2019 and more than 30 for the year to August 2020 - because investors expect rapid future earnings growth. This is all well and good if that growth arrives but it leaves investors with little or no downside protection if it does not and ASOS does not pay a dividend so there is no yield to underpin the shares, either.

“This is the latest in a series of disappointments from the firm, following lower-than-expected sales figures, forecasts of additional spending on capacity and technology or earnings that failed to meet analysts’ forecasts in each of March, April, July and December 2018 and March 2019.

“As a result, ASOS shares have plunged from £76 to barely £20 and the company is no longer the biggest firm on AIM, as ranked by market capitalisation. It is not even the biggest fashion retailer on AIM either, having been overtaken by Boohoo.com, on a market value basis. The days when ASOS’ market cap could have even propelled it into the FTSE 100, had management chosen to switch from the junior AIM platform to the Main Market, are also long gone.

|

Stock |

Market cap (£ billion) |

|

FTSE 100: smallest stock by market cap |

|

|

Marks & Spencer* |

4.1 |

|

|

|

|

AIM: Largest stocks by market cap |

|

|

Burford Capital |

3.3 |

|

Hutchison China Meditech |

3.0 |

|

Fever-Tree Drinks |

2.7 |

|

Boohoo.com |

2.5 |

|

ASOS |

2.1 |

|

RWS |

1.8 |

|

Clinigen |

1.3 |

|

Secure Income REIT |

1.3 |

|

Dart |

1.2 |

Source: Refinitiv data, Sharecast, Sharepad.

“However, we have been here before. A series of mis-steps and a warehouse fire in Barnsley took ASOS’ shares from more than £60 to £20 in the space of six months in 2014 and 2011 saw another slump, that time from £23 to £13. Yet sales and profits momentum were swiftly re-established and the share price roared back.

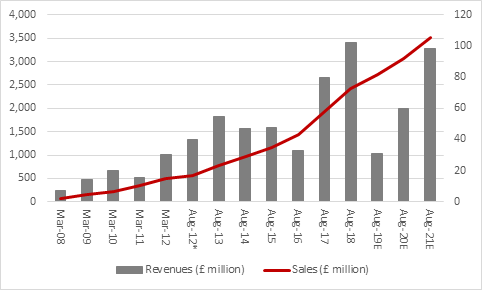

“It would therefore be unwise to say that ASOS has had its day and analysts are still forecasting that profits will double in the year to August 2020 and then rise by another 50% in the year to August 2021. If such expectations are met then investors, who are still growth-starved in a world of low interest rates and economic uncertainty, could still come back to ASOS and give management a chance to prove that the company’s profit woes are just a temporary blip, rather than a more worrying sign that its customer base thinks it is no longer the height of fashion to shop there.

“That said, the company will need to get a wiggle on if it is to keep both its customers and investors happy. Customers are not short of options when it comes to online retailers and investors will note that even if profits do treble by the year to August 2021 they will still be coming in below the levels reached in the 12-month period to August 2018. That sort of hiatus in profit momentum will start to eat into ASOS’ perceived growth stock status – and therefore the valuation afforded to the shares – if management is not careful.”

Source: Company accounts, Sharecast, consensus analysts’ forecasts