AJ Bell’s first ‘Buyback Bulletin’ shows:

• Nearly £33 billion of share buybacks already announced for 2022 by members of the FTSE 100

• This leaves them on course to break 2018’s record of £34.9 billion (and we are only three months into the year)

• 29 FTSE 100 firms have already declared new buyback programmes in 2022 (compared to 30 in the whole of 2021)

• The buybacks already declared for 2022 equate to 1.6% of the FTSE’s market cap and add to a consensus forecast dividend yield for this year of 3.9%

• Financials currently the largest generator of buybacks in 2022, followed by Oils and Consumer Staples

• Sceptics will point to how buybacks disappeared when stocks were at their cheapest (2009, 2020) and proliferated near market tops (2006, 2018) when stocks were at their most expensive

• Next plc provides the clearest guidance on how its buyback strategy works

AJ Bell’s investment director Russ Mould comments:

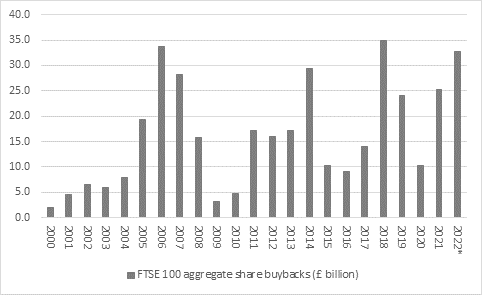

“The FTSE 100 is on course to break its record for annual cash returns to shareholders via the mechanism of share buybacks.

“So far in 2022, members of the UK’s benchmark equity index have announced plans to return £32.7 billion to their shareholders. After barely three months, this sum already exceeds the annual totals of every year since 2000 except two – 2006 (£33.6 billion) and the £34.9 billion all-time high of 2018.

Source: Company accounts. *2022 to date.

“This sum supplements the forecast £81.2 billion in dividends which analysts currently expect the FTSE 100 to pay in total in 2022. That sum equates to an expected 3.9% dividend yield and the buybacks take the total cash return yield on the index to 5.4%.

“This may tempt income-seekers and management’s willingness to purchase stock will be seen by bulls as further support for their case, alongside ongoing merger and acquisitions activity, that UK equities are cheap.

“Sceptics will point out that buyback programmes can be cancelled or halted just as quickly as they are launched, and with a lot less complaint from shareholders than if a dividend is cut. In 2020, FTSE 100 firms returned £10.2 billion to their shareholders via buybacks but scrapped plans to buy back £10.3 billion more as the pandemic spread, lockdowns were imposed and the globe plunged into a recession, to the great detriment of corporate profits cash flows and in some cases balance sheets.

“Cynics will also flag how buybacks tend to be pro-cyclical. Buyback activity reached its high in 2006-07, as animal spirits were running most strongly just before the Great Financial Crisis swept the world. Over £60 billion in buybacks across those two years did nothing to support share prices in 2007-09 and buybacks slowed to just £3 billion in 2009 by the time the crisis was passing and equity markets had collapsed and thus become much cheaper.

“Buybacks reached their next zenith in 2018 and buyback activity peaked that year, too, although it seems likely that 2022 could surpass that year’s record quite easily, all other things being equal.

“Yet management teams’ record of buying high rather than low may give some investors pause for thought as to whether buybacks are a potential contrarian indicator.

“And any investor who is researching a firm that is running a buyback programme should ask themselves two questions when they consider the merits (or otherwise) of such financial largesse:

• To what degree is this financial engineering rather than product engineering or investment in the service proposition and competitive position of the company? Ultimately, the investor is taking a stake in the firm’s ability to provide goods or a service better, or cheaper, or more effectively than its rivals (or possibly all three). Without satisfied customers, there will be no business at all, so the would-be investor must ensure that the firm is spending enough on research, product development, capital investment and marketing before it gives away any cash.

• Are company executives buying stock with their own cash rather just the company’s funds? Surely that would be a much more powerful signal still that they feel real value is there to be had?

“It may at least help to ease such concerns that the largest buyback schemes are currently being run in sectors that have been out of favour for a very long time and could therefore be potentially cheap – financials (both banks and insurance) and oils, although consumer staples are not too far behind, spearheaded by Diageo, British American Tobacco and Unilever.

|

FTSE 100 share buybacks (£ billion) |

2022* |

|

Financials |

10.5 |

|

Oil & Gas |

7.4 |

|

Consumer Staples |

6.9 |

|

Industrial goods & services |

3.2 |

|

Consumer Discretionary |

2.4 |

|

Telecoms |

1.2 |

|

Mining |

0.4 |

|

Technology |

0.3 |

|

Health Care |

0.2 |

|

Utilities |

0.2 |

|

Real estate |

0 |

|

TOTAL |

32.7 |

Source: Company accounts. *2022 to date.

“That trio of industries has dominated in terms of buybacks since 2000, as could be perhaps expected, given their relatively maturity and their equally hefty contribution to overall FTSE 100 profitability: they are forecast by analysts to generate 53% of the index’s aggregate pre-tax profit and pay 47% of its dividends in 2022.

|

FTSE 100 share buybacks (£ billion) |

2000-2022* |

|

Oil & Gas |

73 |

|

Financials |

64.4 |

|

Consumer Staples |

56.2 |

|

Telecoms |

44 |

|

Health Care |

39.2 |

|

Consumer Discretionary |

31 |

|

Mining |

29.9 |

|

Industrial goods & services |

23.1 |

|

Utilities |

5.8 |

|

Technology |

3 |

|

Real estate |

2.3 |

|

TOTAL |

371.9 |

Source: Company accounts. *2022 to date.

“By individual firm in 2022, Shell is currently running the most expansive buyback programme and the top ten are responsible for 75% of the cash return schemes announced so far this year.

|

Share buybacks (£ billion) |

2022* |

|

Shell |

6.3 |

|

Aviva |

3.8 |

|

Unilever |

2.5 |

|

Diageo |

2.3 |

|

British American Tobacco |

2 |

|

Lloyds |

2 |

|

NatWest Group |

2 |

|

Ferguson |

1.5 |

|

Vodafone |

1.2 |

|

BP |

1.1 |

|

TOTAL |

24.5 |

Source: Company accounts. *2022 to date.

“Yet a buyback scheme does not absolutely guarantee good share price performance.

“Ten FTSE 100 stalwarts have provided 62% of the benchmark’s buyback total since 2000. In terms of share price and capital return, five of those ten have beaten the FTSE 100 over the past 21-plus years. In terms of total return, seven have done so and three have not.

“In the cases where buybacks did seem to add value, they often came as a complement to consistent dividend growth streaks, themselves the result of a strong competitive position and pricing power – British American Tobacco, Diageo and Unilever are the prime examples.

“Rio Tinto could be seen as the exception here since by dint their very name commodities rarely come with pricing power and winners and losers are decided by the lowest marginal cost of production.

“In Rio’s case, the miner did buy back stock at the cyclical peaks of 2006 and 2011 but it has markedly picked up its pace of cash returns since 2016’s dividend cut, when management has focused on debt reduction and then shareholder distributions rather than expansive capital investment or acquisitions. Whether the world now needs more mining capex is an interesting question, especially as many metals prices are trading at or near all-time highs.

“Those where the share price has not particularly responded to buybacks include Shell, BP, GlaxoSmithKline and Vodafone.

“In fairness to GlaxoSmithKline’s current management team, the drug giant has not orchestrated a buyback since 2013 but the firm has singularly failed to grow its dividend in that period. Vodafone, Shell and BP have all cut their dividends and analysts and shareholders have had cause to ponder their long-term growth prospects. Large acquisitions at Shell (BG Group) and Vodafone (the bulk of Liberty Global’s European broadband business) also saddled those firms with debts, which stretched the balance sheet and necessitated repair and a different focus for cash flow.

|

|

|

2020-2022* |

2020-2022* |

|

Share buybacks (£ billion) |

2020-2022* |

Share price |

Total return |

|

Shell |

39.5 |

9.9% |

197.4% |

|

Vodafone |

39.1 |

(59.0%) |

77.0% |

|

BP |

33.5 |

(38.5%) |

76.3% |

|

GlaxoSmithKline |

22.3 |

(4.6%) |

168.5% |

|

Unilever |

19.2 |

244.4% |

641.3% |

|

Barclays |

18.0 |

(61.3%) |

(21.2%) |

|

Diageo |

16.3 |

679.5% |

1,476.0% |

|

AstraZeneca |

15.3 |

352.6% |

928.4% |

|

Rio Tinto |

15.3 |

589.6% |

1,958.9% |

|

British American Tobacco |

11.3 |

1,091.2% |

3,731.9% |

|

TOTAL |

229.9 |

280.4% |

923.4% |

|

|

|

|

|

|

FTSE 100 |

|

20.0% |

162.2% |

Source: Company accounts, Marketscreener, Refinitiv data

The case for and against share buybacks

“America’s Securities Exchange Act of 1934 outlawed share buybacks as it deemed large-scale share buybacks could be a form of wilful share price manipulation. That was only repealed in 1982 by the Reagan administration, with rule 10b-18, and since then buybacks have become increasingly popular. The UK has followed America’s lead to some degree here, although dividends are still the more common means for returning cash to investors.

“Back in 2019, Senators Sanders and Schumer failed to introduce legislation in the USA that would have reined in buybacks. This delighted those who argued that free markets, and not Government, were the best allocators of capital and frustrated those who worried about excessive financialisation within the economy.

“There are four clear arguments in favour of share buybacks.

• If a company is generating surplus cash it can return it to shareholders and let them decide what to do with it, rather than splurge it on an unnecessary acquisition or capacity increases. This is a particularly acute issue at a time when interest rates remain low, even after some recent increases, and as a result firms are not gaining a decent return on any cash holdings.

• Buybacks can work for individuals depending on their tax situation, and whether they prefer to be taxed on a capital gain (buyback) or dividend (income).

• Anyone who elects to retain their shares when a firm buys back stock will have an enhanced stake in the company and thus be entitled to a bigger share of future dividends (assuming there are any).

• They can also suggest that a management team feels a company’s shares are undervalued, so any move to buy back stock can be seen as a vote of confidence in the firm’s near and long-term trading prospects.

“Equally, there are four reasons to treat share buybacks with some degree of caution and not blindly welcome them all as a good thing.

• History shows companies have a habit of buying stock back during bull markets (when their stocks tend to be more expensive) and not doing so during bear ones (when their stock tends to be much cheaper). For example, buybacks in the US topped out in 2007 and collapsed in 2008 and 2009 only to reach new highs in 2018 as stock prices reached new peaks. A similar pattern can be seen in the UK and the higher share prices have gone, the more buybacks there seem to have been in 2021 and 2022 on both sides of the Atlantic.

• This in turn exposes investors to the risk management teams are buying high rather than low and could therefore question whether executives are sufficiently objective when they sanction a buyback to show the market they feel their stock is undervalued.

• A buyback could be used to massage earnings per share figures by reducing the share count at limited cost. This could be used to trigger management bonuses or stock options.

• There is also the risk that firms buy back stock using debt, potentially weakening their balance sheets and competitive position in the long term (although the same danger lurks with dividends). General Electric, which spent more than $40 billion on share buybacks in the decade after the Great Financial Crisis, is a horrible example of this. The debt taken on board to fund buybacks, as well as acquisitions, weakened the company and left it struggling to invest in its competitive proposition to customers. As profits have turned down the borrowings have become a crushing burden that has forced new management to sell assets and prompted the shares to collapse.

“When it comes to buybacks, it may therefore be worth heeding the words of master investor Warren Buffett from his 2012 letter to shareholders in his Berkshire Hathaway investment vehicle.

“Charlie [Munger] and I favour repurchases when two conditions are met: first, a company has ample funds to take care of the operational liquidity and needs of its business; second, its stock is selling at a material discount to the company's intrinsic business value, conservatively calculated.”

“Bearing this in mind, investors must therefore look at how a company buys back its stock.

• If it does so in a disciplined manner, clearly setting a maximum price that it is prepared to pay (and explaining why) then the buyback could help to create shareholder value through the efficient deployment of cash.

• But if a company buys shares at any price – something that could get a professional fund manager the sack for poor performance and do damage to any private investor’s portfolio, since the price and valuation paid for a stock are the ultimate arbiter of the long-term return they make from an investment – then its buyback programme should be treated with scepticism. Such indiscipline would raise suspicions that management is simply trying to massage the share price or earnings targets or both, especially in managers are using cheap debt as a source of funding rather than internally generated cash.

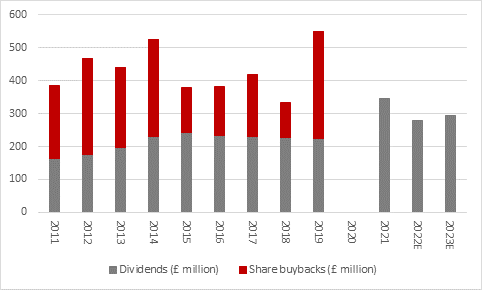

“Next is a rare – and shining – example on how to run a disciplined share buyback.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, management guidance for 2022E on 6 January 2022. Financial year to January.

“The multi-channel retailer does not buy back stock willy-nilly at any price, like so many of its FTSE 100 peers. It buys back stock when the purchase brings it an equivalent rate of return (or ERR) of 8% and it calculates ERR by dividing pre-tax profit by the market cap.

“At the time of writing, Lord Wolfson’s guidance for the year to January 2023 of pre-tax profit of £860 million compares to a market capitalisation of £7.8 billion. That implies a buyback would bring an ERR of 11% so the firm may look to supplement its regular dividends with a stock repurchase programme.

“Next paid out £2.3 billion in dividends and £1.9 billion in buybacks over the past decade. Those buybacks have taken the share count down from 181 million to around 127 million, increasing the stake of anyone who chose not to sell by almost a third.”

Notes to editors:

The produce the Buyback Bulletin, AJ Bell takes the data for the FTSE 100 companies from their regulatory news releases and aggregates them to provide the buyback outlook for the entire FTSE 100 index. The data above relates to the outlook for 2022. Data correct as of 29 March 2022.