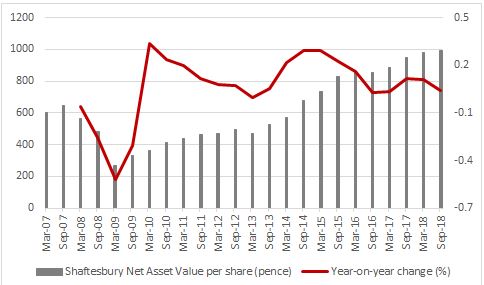

“Even as investors continue to fret over the possible implications of Brexit and what it may or may not mean for the UK’s economy, Chinatown-owner Shaftesbury continues to defy the doubters with a 4% increase in its net asset value per share and a 5% increase in its full-year dividend,” says Russ Mould, AJ Bell investment director.

“The net asset value (NAV) per share figure of 991p is way in excess of the 646p peak seen just before the financial crisis hit home in 2007, helped by lettings, lease renewals and rent reviews which came in at an average of 2.4% above their estimated September 2017 valuation.

Source: Company accounts

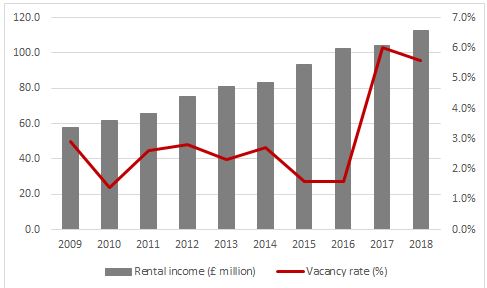

“Bulls of the company, whose £3 billion portfolio is spread across the Carnaby, Covent Garden, Chinatown, Soho and Fitzrovia areas of central London, will also point to a decline in the vacancy rate across Shaftesbury’s properties, as take-up at its three new developments in Broadwick Street, Seven Dials and Central Cross continues to improve. The vacancy rate fell to 4.6%, down from 6% a year ago, with a further 2.6% of the portfolio under offer.

“That healthy demand and the steady rise in rental income both help to reaffirm the prime nature of Shaftesbury’s assets, which is helping the company to weather concerns over trading on the High Street and the financial well-being of many restaurant chains.

Source: Company accounts

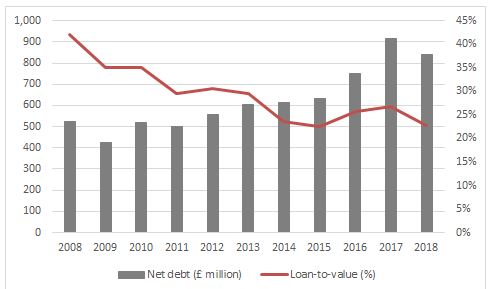

“In addition, last December’s £260 million rights issue has helped to buffer the balance sheet. Debt has come down and the loan-to-value ratio remains low at barely 23%, even after £168 million of site acquisitions during the year.

Source: Company accounts

“However, not everyone will be satisfied. The 991p net asset value per share figure undershot consensus estimates which were looking for a figure north of £10 a share, while NAV growth has slowed again. Chief executive Brian Bickell does also acknowledge a trend toward longer lettings periods for larger spaces, to suggest some greater degree of caution among some tenants, even if he does note, doubtless with some satisfaction, that internet-based retailers are starting to take space in Shaftesbury’s properties as a means of further promoting their brands.

“Shaftesbury’s increase in net asset value per share still compares favourably with the flat-to-slightly-down trend seen from FTSE 100 and FTSE 250 real estate investment trusts (REITs) such as British Land, Land Securities, INTU and Hammerson during the year.

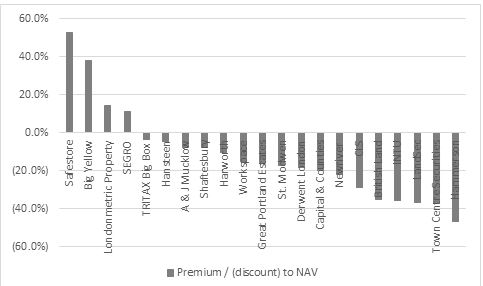

“That helps to underpin Shaftesbury’s valuation. Its shares trade at just a 7.6% discount to net asset value per share, much lower than the hefty discounts seen at retail and leisure-exposed REITs such as Hammerson, Intu or Town Centre Securities.

Source: Company accounts, Refintiv data. Based on last published, historic net asset value per share figure

“Besides its strong results and the quality of its assets, Shaftesbury’s shares may also be drawing support from a third issue – the persistent rumours, as yet unconfirmed, of a potential bid from Hong Kong billionaire and 20% stakeholder Samuel Tak Lee.

“Admittedly, talk of a bid from the same source in 2014-15 came to naught and perhaps Mr Tak Lee is waiting to see how the Brexit talks play out. Any further drop the pound could make an approach cheaper to launch.”