“The current preferred narrative clearly seems to be that the US economy is strong enough to withstand a gradual tightening of policy – and that even if it isn’t, the Fed will chicken out and quickly ease it again. Yet this could be complacent, for two reasons.

“First, the Powell-led Fed is apparently paying little heed to financial market or other concerns, beyond its twin mandates of inflation and employment. Pleas from the central bank governors of India and Indonesia to take emerging markets into account when setting policy have fallen on deaf ears. In addition, Mr Powell is on record as saying – more than once – than it is not the central bank’s job ‘to stop people losing money’.

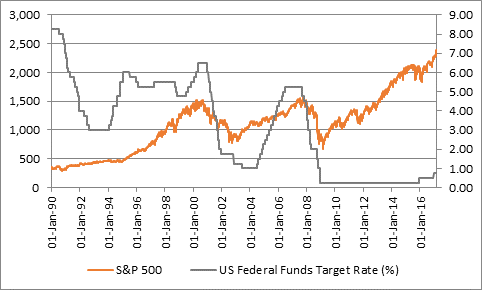

“Second, history suggests that even if the US economy can withstand a higher cost of money, financial markets may not, as improved returns on risk-free cash (at least in nominal, pre-inflation terms) suck money out of financial assets such as bonds and shares, where the risks are higher. The current scenario of lofty valuations, near-record low volatility and rising interest rates looks like the perfect set-up for a market stumble, based on the experiences of 2007 and 2000, as well as other historical market upsets.

Source: Thomson Reuters Datastream

“Just consider this tale of market woe, across the Fed’s last seven rate hike cycles

Rate hike cycle | Event |

1971-74 | 1973-74 stock and bond bear market |

1977-81 | Latin American debt crisis (and double-dip US recession) |

1983-84 | Biggest US banking failure to date (Commercial & Illinois) |

1986-89 | 1987 Black Monday Crash, US Savings & Loan crisis (c. 750 banks closed or resolved) |

1994-95 | Bond market rout, Mexican Tequila sunset crisis and China devalues |

1999-2000 | Tech bubble collapses |

2004-06 | US housing market collapses and Global Financial crisis begins |

2015-? | Emerging market currencies start to wobble again …. |

“Higher US interest rates may already be affecting some riskier areas of the markets – such as emerging market currencies, junk bonds and cryptocurrencies, all of which have found the going a lot tougher in 2018.

“None of this is to say that stock or bond markets are about to suddenly keel over but we are reaching what looks like the next big test for investors. The last eight peaks in the S&P 500 were preceded by an average interest rate increase of 2.18 percentage points – and it has needed more than that on just two occasions to bring a bull market to a halt.

“The Fed has now increased rates by 1.75 percentage points to 2.00%, with a plan to push through two further hikes of 0.25% in 2018 and three more in 2019. They would take the total to 12 increases this cycle and 3.25% for the headline rate respectively.

“Even if that 3.25% figure is below the 7.59% average which has called the top for US stocks after the last eight bull markets, you do have to wonder whether the US economy will prove more susceptible to even a modest tightening in policy this time around, given that there is so much more debt in the system, at the Government, corporate and consumer level.”

Changes in US interest rates before the last eight peaks in the S&P 500

Date | S&P 500 | Fed funds rate | Change in Fed |

| peak level | at S&P peak | Funds before peak |

11-Jan-73 | 120 | 5.50% | 2.00% |

21-Sep-76 | 1,008 | 5.50% | 0.75% |

28-Nov-80 | 141 | 15.00% | 10.25% |

10-Oct-83 | 173 | 9.38% | 0.88% |

25-Aug-87 | 337 | 6.63% | 0.88% |

16-Jul-90 | 369 | 8.00% | (1.81%) |

24-Mar-00 | 1,527 | 6.00% | 1.25% |

09-Oct-07 | 1,565 | 4.75% | 3.25% |

Average |

| 7.59% | 2.18% |

Source: Thomson Reuters Datastream