• Higher and top-rate income tax bands to be frozen in Scotland in 2020/21, SNP minister for public finance Kate Forbes confirms (https://www.gov.scot/binaries/content/documents/govscot/publications/publication/2020/02/scottish-budget-2020-21/documents/scottish-budget-2020-21/scottish-budget-2020-21/govscot%3Adocument/scottish-budget-2020-21.pdf)

• Starter and basic-rate tax bands will increase in line with inflation

• Decision to hold income tax rates for higher earners expected to raise £51million in 2020/21

• Anyone dragged into a higher tax band will have greater incentive to save in a pension

Tom Selby, senior analyst at AJ Bell, comments:

“The Scottish Budget itself was something of a sideshow following finance minister Derek Mackay’s dramatic resignation earlier today. This is on top of existing uncertainty created both by the UK Government’s decision to delay its Budget until 11th March and the possible impacts of trade negotiations with the EU.

“For Scottish taxpayers the Budget itself hasn’t presented any major horrors, although there have been some tweaks to income tax bands which will impact people’s finances.

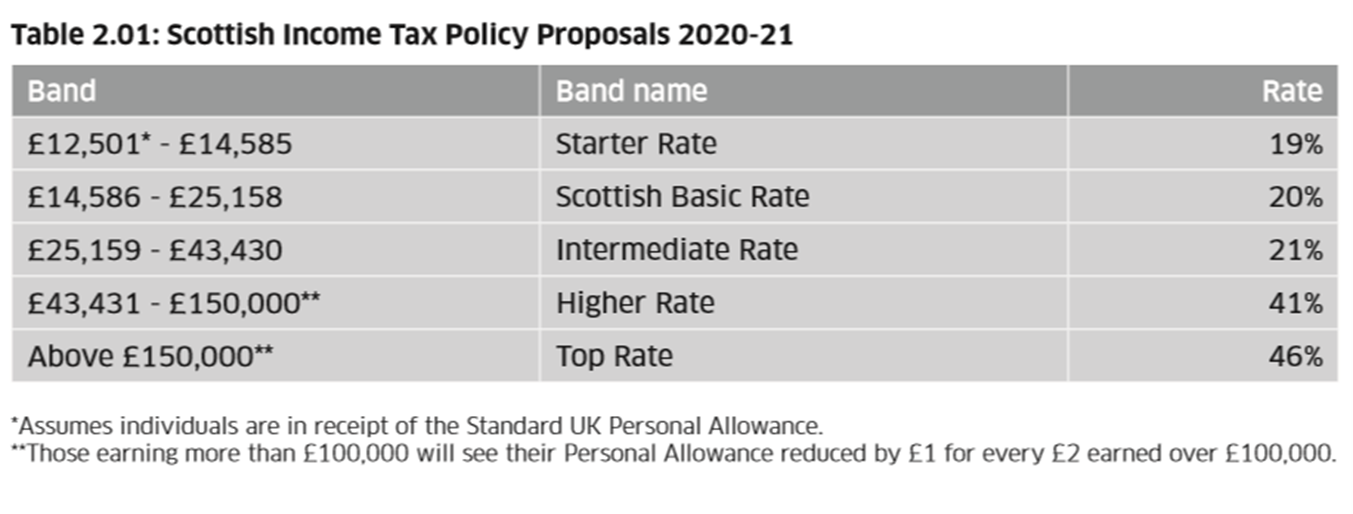

“While the personal allowance has been held at £12,500 – keeping it in line with the rest of the UK – the starter and basic-rate bands have risen in line with inflation, allowing low earners to keep a little more of their hard-earned cash from the taxman.

“However, the decision to freeze both the higher and additional-rate bands at a time when earnings growth in Scotland is over 2% means more people will be sucked into paying more tax.

“Those who find themselves in this position will have an extra incentive to save in a pension, with the tax relief for higher and top-rate taxpayers set at 41% and 46% respectively, 1 percentage point higher than the rest of the UK.”