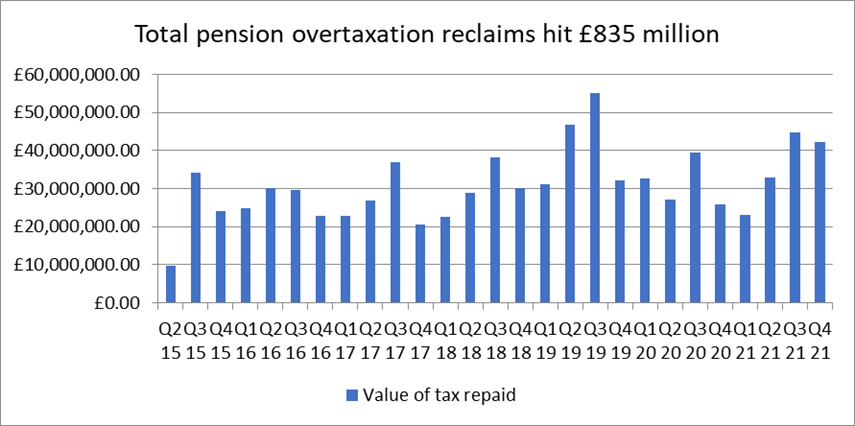

• Savers have reclaimed over £835 million in overtaxation on pension freedoms withdrawals since the reforms were introduced, AJ Bell analysis of the latest HMRC data reveals (Pension schemes newsletter 136 ― January 2022 - GOV.UK (www.gov.uk))

• Overtaxation occurs because HMRC usually requires a ‘Month 1’ emergency tax code to be applied to the first flexible withdrawal of the tax year

• Where Month 1 is used the normal tax allowances are divided by 12 and applied to the first withdrawal – leaving some nursing shock tax bills of thousands of pounds

• Savers who take a regular income should be refunded automatically, but those who only make one withdrawal will need to fill out one of three official forms to get their money back

• In the three months to December 2021, over £42 million was refunded to savers who had paid emergency tax on their first flexible withdrawals

• The average amount reclaimed between October and December 2021 was £3,107

Tom Selby, head of retirement policy at AJ Bell, comments: “Savers continue to be hit in the pocket by HMRC simply for accessing their retirement pot.

“In fact, since April 2015 a jaw-dropping £835 million has been repaid to people clobbered with an emergency tax bill on their first withdrawal of the tax year.

“In the final quarter of 2021 alone over £42 million was refunded to savers who had been overtaxed, with the average repayment sitting at £3,107.

“What’s more, the true figure is likely to be significantly higher as this only covers people who fill out one of three official reclaim forms. HMRC says those who don’t go through this process will be refunded at the end of the tax year.

“It is beyond belief as the 7th anniversary of the pension freedoms reforms approaches that the tax system continues to operate in this way. Having introduced flexibility over pension access from age 55, an upgrade of the tax system is now long overdue.”

Source: HMRC

How ‘Month 1’ emergency taxation works for pension withdrawals

HMRC usually requires a ‘Month 1’ emergency tax code to be applied to the first flexible pension withdrawal of the tax year.

This applies to drawdown and ad-hoc lump sum withdrawals, and only to the taxable portion – so your tax-free cash should not be affected.

When you are taxed on a Month 1 basis, your usual tax allowances are divided by 12 and then applied to that withdrawal. So rather than receiving your usual £12,570 personal allowance, for example, you only get £1,047.50.

This can result in savers being overtaxed by thousands of pounds on their first withdrawal.

If someone takes a regular income, HMRC should sort out their tax position automatically. However, for those who only take a single withdrawal during the tax year, they will need to reclaim using one of three official forms:

• If you’ve emptied your pot by flexibly accessing your pension and are still working or receiving benefits, you should fill out form P53Z;

• If you’ve emptied your pot by flexibly accessing your pension and aren’t working or receiving benefits, you should fill out form P50Z;

• If you’ve only flexibly accessed part of your pension pot then use form P55.

Provided you fill out the correct form HMRC says you should receive a refund of any overpaid tax within 30 days.