“The prospect of fresh sanctions on Russia, and moves to ban the purchase of commodities supplied by that country, is driving up prices of oil, gas, wheat, nickel, copper and others, in some cases to new all-time highs, not least because supply of many of these precious raw materials was already tight,” says AJ Bell Investment Director Russ Mould. “In response to a collapse in commodity prices, and some spectacularly overpriced and failed acquisitions, miners have cut back on capital investment and spending. They have focused instead on reducing debt and then returning any surplus cash to shareholders. As a result, it could take a long time for supply to catch up with demand, especially if Russian supply is excluded from markets for a long time, at least providing the global economy remains on track.

“Russia is a top-five producer of palladium, diamonds, gas, oil platinum, potash, aluminium, gold, nickel and steel so any company or consumer reliant on those will be looking on nervously, while Ukraine and Russia between them account for about a third of the world’s wheat.

“Any move to spurn Russian supply for any lengthy period of time could have severe ramifications for prices, especially as Western miners and oil and gas producers have not invested in a lot of fresh supply for several years.

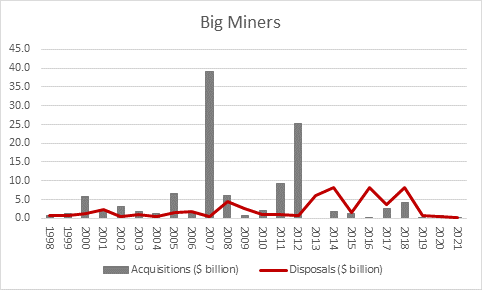

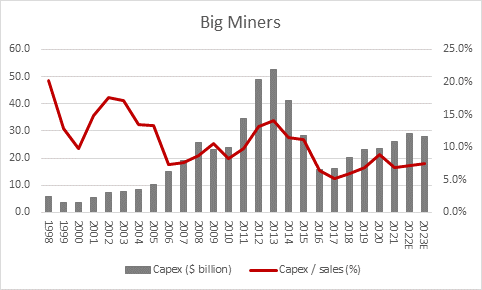

“This is partly due to the fallow years of the mid-2010s when raw material prices collapsed after an investment splurge between 2010-2013 and the impact on balance sheets of some poorly timed and overpriced acquisitions.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Data for Anglo American, Antofagasta, BHP, Endeavour Mining (since 2001), Glencore (since 2006) and Rio Tinto.

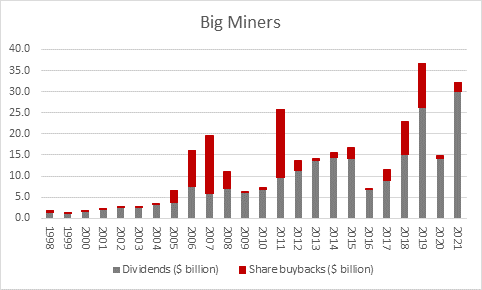

“It is also due to calls from shareholders for greater financial prudence and the cash generated from lower investment, asset disposals and an upturn in profits has gone into their pockets rather than a slew of spending on big new exploration and excavation projects.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Data for Anglo American, Antofagasta, BHP, Endeavour Mining (since 2001), Glencore (since 2006) and Rio Tinto.

“Capex-to-sales ratios at the Big Five miners in the FTSE 100 – Antofagasta, Anglo American, new-entrant Endeavour Mining, Glencore and Rio Tinto – plus former member BHP are only just rising from two-decade lows. Even if they pressed the pedal to the metal now it would take time for mines to go into production and output to come onstream.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Data for Anglo American, Antofagasta, BHP, Endeavour Mining (since 2001), Glencore (since 2006) and Rio Tinto.

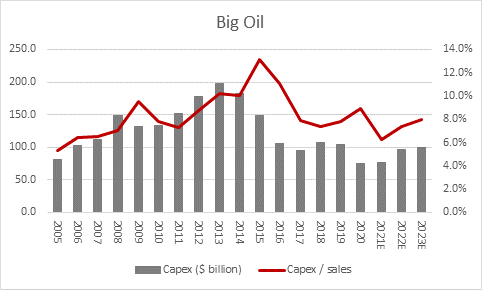

“This is very similar to the trend that can be seen at Big Oil, in the form of the world’s supermajors, BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Shell and TotalEnergies.

Source: Company accounts, Marketscreener, consensus analysts' forecasts for BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Shell and TotalEnergies

“President Biden is trying to unlock some supply via talks with Venezuela, Iran and Saudi Arabia but he may also have to revisit his administration’s own policies, since the White House’s record is one of fairly consistent opposition to requests for the approval of new pipelines and fresh oil exploration. At a time when energy security is once more a key issue, the President, and other world leaders, may be faced with an awkward choice between their commitment to the environment and their green principles and keeping a lid on energy prices and inflation by sanctioning more projects.

“There is the possibility that high prices will prove to be the best cure for high prices, just as they were in 2007-08 when $147 oil and soaring prices for copper, nickel and other commodities helped to tip with world into recession.

“However, that is a not a scenario that the world’s leaders will welcome either, and those investors with longer memories may hark back to 1973 when an oil price shock in the wake of the 1973 Arab-Israeli Yom Kippur war helped to stoke the inflation (and in some cases) stagflation that bedevilled the global economy for the rest of the decade and hurt investors’ real-terms returns so badly. The ultimate solution then were the double-digit percentage interest rates imposed by the Federal Reserve under Paul Volcker in the US and the Thatcher-Lawson government in 10 and 11 Downing Street in the UK, a treatment which the highly-indebted global economy is ill-equipped to swallow this time around.”