“The best strategies use acquisitions to supplement existing momentum in the business rather than create it. A slowdown in the rate of acquisitions at RPC means that investors now have a better feel for the underlying growth rate of which the company is capable – and they do not seem to be overly impressed.

“Headline sales grew 5.8% year-on-year in the first quarter, boosted by the single acquisition made in the company’s fiscal year to March 2018.

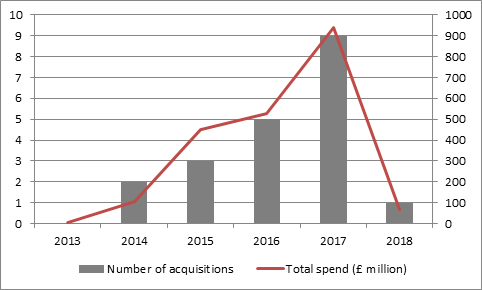

“But underlying sales growth was just 2%.Chart 1 -

“That is even lower than the 2.8% rate of advance generated across the whole of its last fiscal year.

Source: Company accounts. Year to March.

“This explains why chief executive Pim Vervaat seems to want to get back onto the acquisition trail – yet he spends a portion of today’s trading statement saying that his shareholders seem less keen on this plan than they were previously.

“He rails against both the firm’s low stock market valuation – which means RPC’s shares are less useful as an acquisition currency – and shareholders’ reluctance to let him take on too much debt to fund deals either.

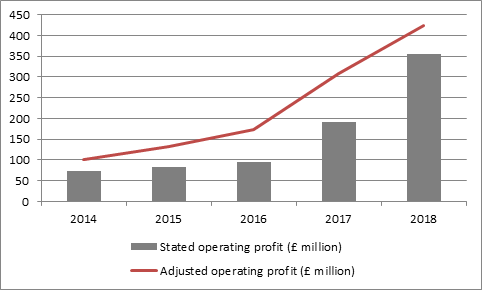

“This implies that his shareholders now focusing on the quality of RPC’s earnings and not just the quantity. In the long run this has to be a good thing, however, given the dangers associated with debt-funded merger and acquisitions activity and RPC’s unfortunate (though regrettably by no means unique habit) of focusing on ‘adjusted’ earnings rather than statutory ones.

Source: Company accounts. Year to March.

“The quality of RPC’s earnings is better judged via cash flow, a figure where ‘adjustments’ to the statutory reported numbers are not really possible – cash is a matter of fact.

“And in RPC’s case, cash flow growth has remained volatile, especially relative to sales and profits growth. In addition, operating free cash flow as a percentage of sales is no higher now than it was in fiscal 2013-14, despite the acquisition spree, to suggest that RPC may be a bigger company but not necessarily a better one.

£ million | 2014 | 2015 | 2016 | 2017 | 2018 |

|

|

|

|

|

|

Sales | 1,047 | 1,222 | 1,642 | 2,747 | 3,748 |

EBIT | 73 | 83 | 95 | 192 | 356 |

Depreciation | 43 | 54 | 74 | 130 | 162 |

Amortisation | 8 | 7 | 3 | 3 | 4 |

Impairment losses | 7 | 4 | 12 | 1 | 0 |

NWC | 12 | 0 | 0 | 29 | (22) |

Capex | (70) | (92) | (101) | (175) | (241) |

OpFcF | 73 | 57 | 83 | 180 | 258 |

|

|

|

|

|

|

Year-on-year change | |||||

Sales | 7% | 17% | 34% | 67% | 36% |

EBIT | 18% | 14% | 14% | 102% | 85% |

OpFcF | 21% | (22%) | 47% | 116% | 43% |

|

|

|

|

|

|

As % sales | |||||

EBIT | 7.0% | 6.8% | 5.8% | 7.0% | 9.5% |

OpFcF | 6.9% | 4.6% | 5.1% | 6.5% | 6.9% |

Source: Company accounts. Year to March.

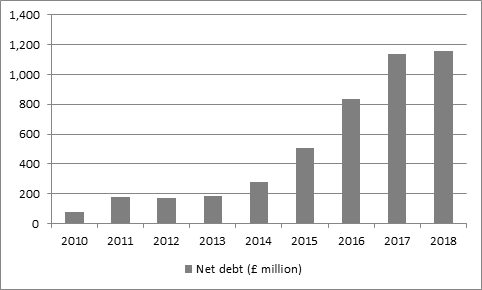

“The dangers associated with RPC’s acquisitive strategy can then be seen in its balance sheet. Net debt was £80 million in March 2010, before the company began to do deals. That figure had reached £1.2 billion by March 2018.

Source: Company accounts. Year to March.

“None of this is to say that RPC is in financial trouble. Stated operating profit of £356 million covers net interest costs of £36 million nearly ten times over, so interest cover is excellent and would remain strong even if interest rates began to rise.

“But it does help to explain why RPC’s shares peaked at £10.65 in January 2017 and have since slipped to 735p.

“Investors have not just looked at the stated growth numbers (boosted as they were by deals) but how that growth is being generated, what the underlying picture looks like and the risks associated with the growth strategy.

“As a result, RPC’s shares have suffered a sharp de-rating. At £10.65 they were effectively trading on a forward price/earnings multiple of 17 times with a dividend yield of 2.2%.

“Today they are trading on 10 times forward earnings with a dividend yield of 4% as investors feel less inclined to pay up – and demand a higher yield – to compensate themselves for the risks involved.

“It is therefore possible that RPC’s valuation is now more realistic. And if Mr Vervaat can resist the temptation to do further deals (as he nearly did in the year to March 2018) and focus on cash flow and debt reduction, then the multiple attributed to RPC’s stock could rise again as debt – and thus risk – comes down.”