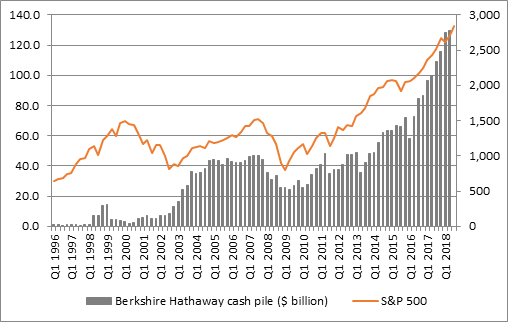

Source: Berkshire Hathaway accounts, Thomson Reuters Datastream

“This is something that investors should consider, as key indices such as the S&P 500 and FTSE 100 make heavy weather of getting back to, and breaking away from, the all-time highs they set earlier in the year.

“Company executives should also perhaps pause for thought. After all, in his annual letter to shareholders in his Berkshire Hathaway investment vehicle back in February, Warren Buffett warned of the difficulty that he and Berkshire Hathaway business partner Charlie Munger were having in finding good acquisitions at sensible prices.

“Yet research from Moody’s Analytics shows that the value of global merger and acquisition (M&A) transactions reached $2.6 trillion in the first half of 2018, only just below the $2.65 trillion record of 2007 – yet Buffett and Munger have done nothing.

“Instead, they seem to be patiently building up their cash pile, waiting for what they feel are more sensible prices and it is easy to understand why.

“M&A tends to peak when animal spirits are running high and often when executives feel their own shares are expensive enough to make them a valuable acquisition currency (not that this is necessarily a good thing for the sellers and the recipients of those shares, namely investors).

“The last M&A boom was a perfect example of this, since 2007 heralded the peak in the economic, stock market and global M&A cycles just ahead of the global financial crisis.

“It is noticeable how Berkshire Hathaway’s cash pile grew in 1998-1999, just ahead of the 200 tech bubble and stock market bust, and again in 2005 to 2007, as markets again became frothy.

“Buffett and Munger than applied that cash, buying assets at much lower valuations, in 2000 to 2003 and 2007 to 2009 as markets melted down and to great effect, judging by the subsequent returns and renewed growth in the cash position.

“Investors may therefore perhaps like to take note of how the ultimate contrarians are once more sitting on the sidelines as stock markets rise.”