“The actual downgrades to profit forecasts flagged by both Robert Walters and PageGroup alongside their weak third-quarter trading updates are relatively minor, but their shares prices are down sharply,” says Russ Mould, AJ Bell Investment Director. “This may reflect investors’ disappointment with the cuts to earnings estimates but also concerns over the wider implications for the British and global economies.

“Economists have been fretting over weak lead indicators, such as purchasing managers’ indices, and mixed concurrent signals, such as retail sales and industrial production for quite a while now. However, they have been able to cling on to a lagging indicator in the form of strong jobs numbers and low unemployment as a sign that the UK and global economies are holding up, despite geopolitical tensions, trade disputes and the lack of visibility over what Brexit may or may not mean.

“Jobs numbers do lag – just think of how long it takes a firm to feel confident enough to add headcount (and therefore costs) before it embarks upon the lengthy process of finding the right candidate. Employment and unemployment data therefore probably reflect decisions taken by management teams some six to nine months ago.

“This is why the implications of today’s numbers from Robert Walters and PageGroup are potentially so serious.

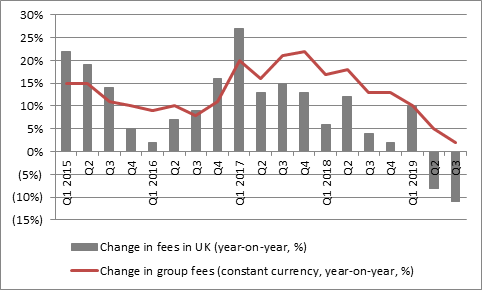

“At Robert Walters, the decline in fee growth in the UK accelerated and the overall group growth rate declined for the third quarter in a row, as Europe and Asia Pacific both slackened a little.

Source: Robert Walters’ accounts

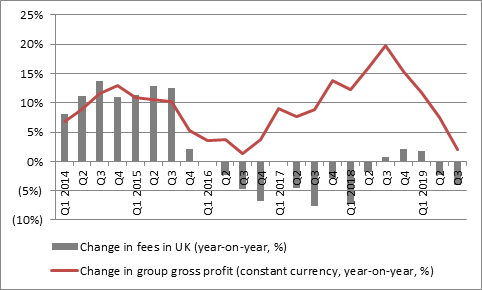

“The same trends are in evidence at PageGroup, where activity levels in Asia and the UK fell year-on-year in the third quarter. The political unrest in Hong Kong is clearly having an impact in the former and it seems logical to assume that pre-Brexit nerves are affecting the latter.

Source: Page Group accounts

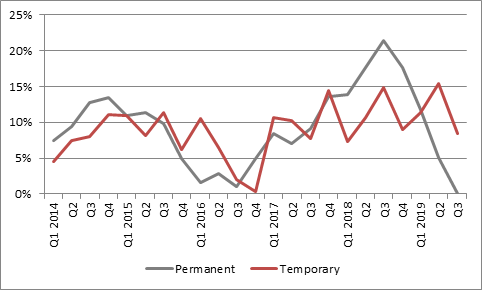

“A further trend at Page that gives grounds for concern is the slowdown in permanent hires relative to temporary ones. Generally speaking, the more confident employers are the more likely they are to take on full-time staff, while they may favour temps if the outlook is a bit less certain. A 9% increase in Page’s gross profit from temporary hires in the third quarter, relative to a flat figure for permanent positions, suggests management teams are hunkering down and playing it safe.”

Source: Page Group accounts