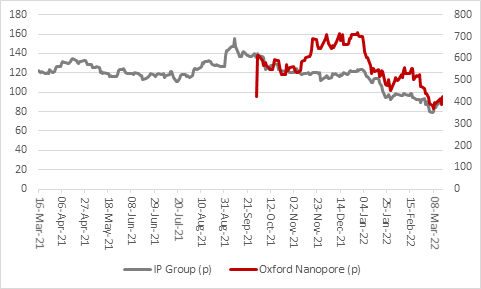

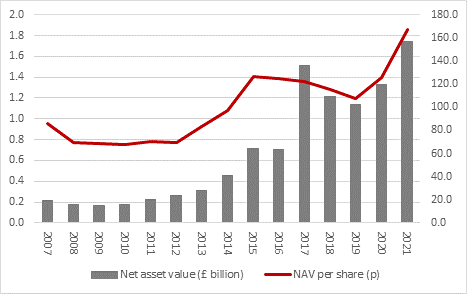

“The departure of long-time chief executive Alan Aubrey and chief investment officer Mike Townend and a slide in the share price of Oxford Nanopore have weighed on sentiment toward intellectual property incubator IP Group, but new boss Greg Smith will be pleased to see how record full-year results from the FTSE 250 firm are drawing a positive response from investors,” says AJ Bell Investment Director Russ Mould. “A 40% drop in Oxford Nanopore’s shares since the end of 2021 has shaved £233 million, or nearly 22p a share, off the net asset value (NAV) of IP Group’s portfolio but all other things being equal that still leaves NAV at 145p. At 95p, the shares trade at a 35% discount to that, so some investors may be taking the view that IP Group now looks attractively valued.

Source: Refinitiv data

“Oxford Nanopore is the third unicorn with a $1-billion-plus valuation to emerge from IP Group’s investment portfolio and IP Group still owns a 10% stake in the genetic sequencing specialist.

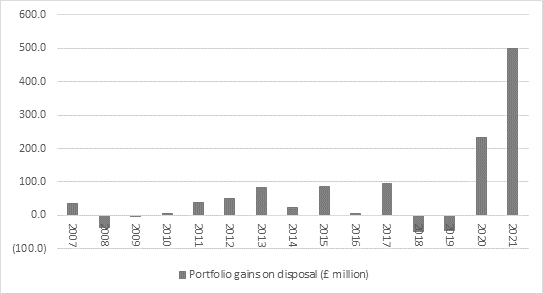

“The £84 million profit on the sale of Oxford Nanopore shares helped IP Group to book an all-time high £497 million in gains on disposal from its investments, profits which helped to fund a £35 million share buyback programme and an increase in the dividend.

Source: Company accounts

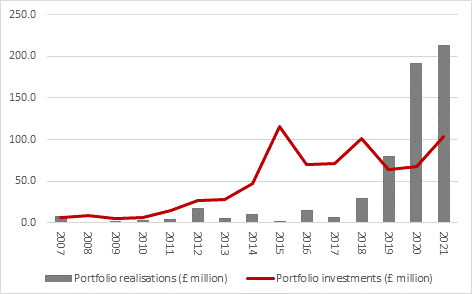

“Last year was also the third in a row when IP Group realised more in cash from its portfolio than it put in, to show how positive momentum has continued to build, helped by the sale of Inviata, WaveOptics and Kuur Therapeutics.

Source: Company accounts

“Further growth in net asset value is therefore possible, especially if the other portfolio holdings developed as planned and there is definitely more to IP Group than just its investment in Oxford Nanopore. It owns stakes in 100 companies, predominantly in the UK but also in Australia and New Zealand, thanks in part to the acquisition over time of Fusion IP, ParkWalk Advisers and Touchstone Innovations. All those deals added further breadth and depth to the portfolio.

Source: Company accounts

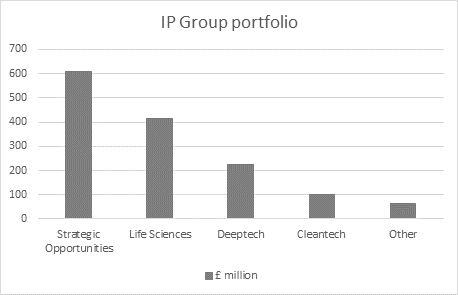

“The portfolio is spread across life sciences, technology, clean technology and what management terms strategic opportunities, of which Oxford Nanopore is the biggest.

Source: Company accounts

“In some ways this mean leave IP Group’s shares bound at the hip with those of Oxford Nanopore, for all of the potential of the other 99 holdings, which include stakes in other firms that are already listed, including Diurnal, Oxford Sciences Innovation and Mirriad Advertising.

“The slide in Oxford Nanopore means IP Group has gone from trading at a premium to NAV last autumn to a hefty discount, as investors have stopped enthusing about the potential upside in Oxford Nanopore and started worrying about the possible downside.

“The discount is not as big as the 50%-plus gap which prevailed when Neil Woodford’s woes compelled his funds to dump 13% of IP Group’s shares so they could raise cash in late 2019 but it may prompt some investors to consider whether there is now some value to be had.

“However, the influence of Oxford Nanopore will remain considerable, and investors may also ask questions about the valuations of some of the other portfolio holdings, especially if they are not quoted or listed on a stock market. This is not to question the auditing process but to reflect the role played by interest rates in how these positions can be valued.

“One way in which long-term growth plays can be valued, especially if they are in loss now but are expected to make a profit some way down the line, is a discounted cashflow model (DCF). Here, future cashflows are discounted back using a pre-set interest rate to determine the net present value (NPV) of those cashflows in ‘today’s money.’ This figure is then adjusted by debt and cash to arrive at a theoretical value for the equity and a theoretical ‘fair value’ share price.

“The last ten years have seen interest rates, bond yields (and thus implied discount rates for DCF calculations) go only one way, and that was lower. As result, the valuation of long-term growth stocks generally only went one way, and that was higher.

“If central banks are forced by inflation to raise rates whether they like or not, discount rates could rise too and reverse the trend, so that the perceived fair value of long-term growth and early-stage companies, such as the ones in which IP Group invests, starts to fall.”