Russ Mould, investment director at AJ Bell, comments:

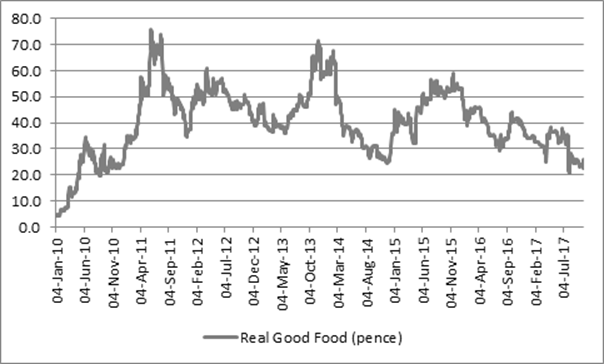

“Investors have understandably found a third trading alert pretty indigestible. Real Good Food’s abandonment of its initial guidance of £6.5 million in EBITDA (earnings before interest taxes, depreciation and amortisation) and admission that the year to March 2018 will see another pre-tax loss means that the shares opened down by around a third in early trading, to levels not seen since 2010.

“Real Good Food cited a long menu of woes when it came to explaining the warning, including currency movements, increased costs (notably butter), increased fees from corporate advisers as the company seeks to sort out its corporate governance woes (notably substantial consultancy fees paid to the previous management team), the disruption to output caused by capacity increases at its Haydens (cake decorations) and Renshaw (bakery) operations and also excessive overhead costs relating to its London headquarters.

“Executive director Chris Thomas is already taking decisive action by moving the company’s HQ from London to Liverpool to cut costs, while the company has already refinanced itself twice this year and sought to tackle its governance problems.

“This may explain why the shares began to rally after the initial hit as the June share issue and September debt facility agreement and loan notes issue do buy it welcome time to make the most of the operational improvements Thomas and team are seeking to make – first-half sales did rise 13% on a like-for-like basis so the news is by no means all bad.

“Those investors who are already stuck with the stock – or are wondering if there is some contrarian value to be had – will note that the company’s market capitalisation is barely £17 million and it generates over £100 million in sales.

“Although the firm’s debts must be taken into account as well, this suggests those sales may be going cheap providing Real Good Food can turn them into decent earnings (the chart below shows how the shares have staged dramatic rallies before).

“The worry is that the company’s operating margins have always tended to be thin.

“The company made £8 million at the operating level in 2013 but on sales of £265 million for a 3% margin – and matters have only got worse since then.

“This raises a big nagging doubt about the firm’s competitive position. The current squeeze on profits from rising commodity prices, especially butter, does raise the question of whether Real Good Food is strong enough to push through price increases of its own to compensate, in its dealings with its food retail, food wholesale and pub and restaurant customers.”

Source: Thomson Reuters Datastream