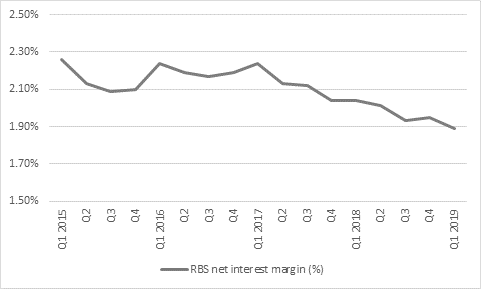

“Although (soon-to-be-ex-) chief executive Ross McEwan’s cautious comments about Brexit will grab most of the headlines it is ongoing pressure on Royal Bank of Scotland’s net interest margin that is the real reason for the share price weakness today,” says Russ Mould, AJ Bell Investment Director. “This will reflect competition for deposits and loans from established rivals, as well as challenger banks and fintech start-ups, but also the unintended consequences of central bank policy and near-record-low interest rates.

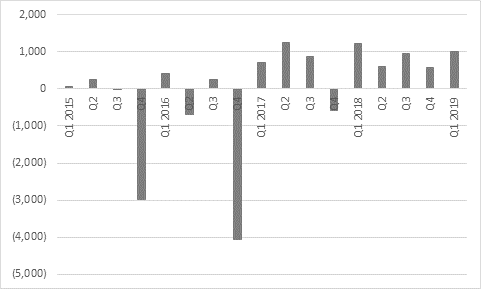

“RBS’s £1.0 billion headline pre-tax profit compared to £1.2 billion in the first three months of 2018, even though the total cost of conduct fines, loan impairments and restructuring costs fell very slightly, to £286 million from £306 million a year ago.

Source: Company accounts

“A fourth profit in the last five quarters, and seventh in the past eight, shows how far the bank has come and RBS did pass two of the three key financial tests for the quarter, since loan impairments remained limited and cost control was good. But it is the third test – net interest margin – that is really counting today.

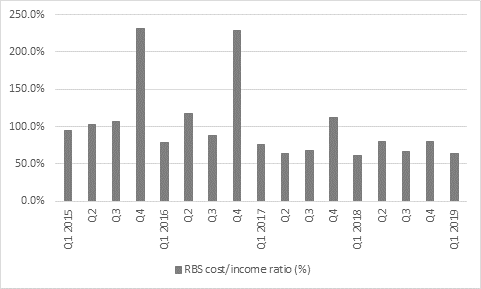

“A cost/income ratio of 63.4% (compared to 62% at Barclays yesterday) came in lower than the equivalent figure of Q1 2013, even if it represented a slight increase from 60.5% a year ago.

Source: Company accounts

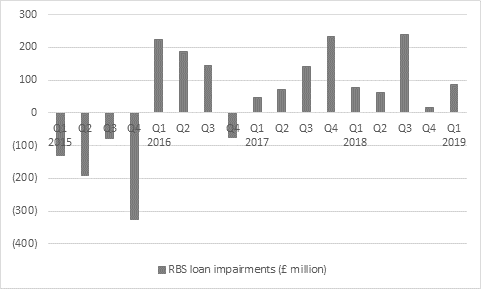

“In addition, losses on loans gone sour came to just £86 million, against £78 million a year ago, equal to just 0.11% of the customer loan book, compared to 0.10% in Q2 2018.

Source: Company accounts

“RBS is getting help here from central bank policies as low interest rates and Quantitative Easing keep borrowing costs low for consumers and corporations and make it easier for them to services their debts. But just as ZIRP (zero interest rate policies) and QE give with one hand, they are taking away with another, because the flat yield curve means banks are finding it hard to make a margin when they borrow money in the short-term and lend it out over the long term.

“RBS’ net interest margin fell again and this weighed on profits once more. Nor does this situation look likely to change, given competition and central banks’ policy U-turn this year, with a slew of monetary authorities seemingly putting interest rate increases on hold until at least 2020, including the Bank of England.

Source: Company accounts

“This is a problem for banks all over the world, not just in the UK, and there may not be much that Mr McEwan and his team can do about it, apart from continuing to lend prudently and bear down on costs, but the absence of any positive earnings surprise could make it hard for RBS’ shares to perform, even though they trade at a 17% discount to the Q1 net asset value per share figure of 288p and the company now pays a dividend for good measure.”

|

|

2019E |

2018 |

2019E |

2019E |

|

|

P/E |

Price/book |

Dividend yield |

Dividend cover |

|

HBSC |

11.3 x |

1.20 x |

6.0% |

1.47 x |

|

Lloyds |

8.5 x |

1.19 x |

5.5% |

2.15 x |

|

Royal Bank of Scotland |

8.7 x |

0.83 x |

5.0% |

2.28 x |

|

Standard Chartered |

12.7 x |

0.72 x |

2.4% |

3.26 x |

|

Barclays |

7.3 x |

0.60 x |

4.7% |

2.94 x |

Source: Sharecast, consensus analysts’ forecasts, company accounts for last stated NAV figure, Refinitiv data