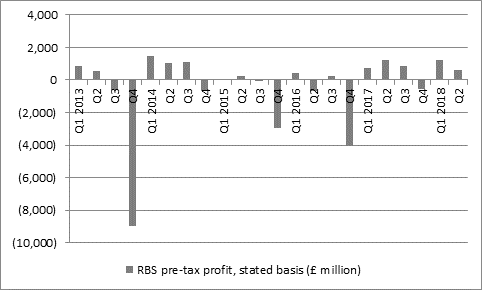

“That just means the bank needs to start churning out consistent profits – and a fifth quarter in the black out of the last six is now giving Mr McEwan the confidence to signal a 2p per share interim dividend.

Source: RBS accounts

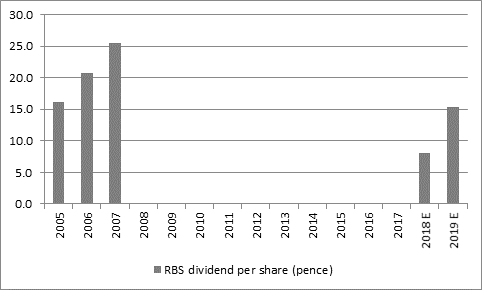

“Analysts now expect the bank to pay out 8p a share in total for 2018 and 15.4p in 2019, enough for a 3.2% dividend yield this year and 6% next year – both figures which easily beat anything that can be earned from cash in the bank or UK Government bonds.

Source: RBS accounts. 2005-2007 payments adjusted for current share count.

Actual payments at the time were 20.2p. 25.8p and 32.2p per share

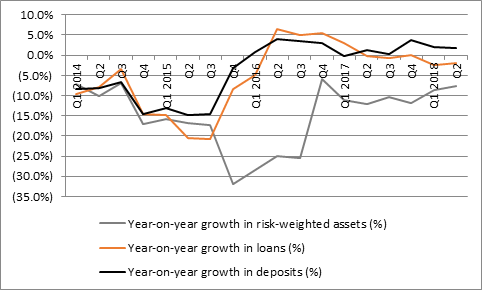

“Equally, investors are probably right to demand such a high yield to compensate themselves for both the residual risks associated with the company and its lack of real underlying growth – the bank is still shrinking itself, as shown by ongoing year-on-year declines in risk-weighted assets and loans (even if deposits did please by growing slightly).

Source: RBS accounts

“The bulk of the improvement in profits is therefore still coming from lower litigation costs, lower loan impairments and lower restructuring charges, so the quality of earnings may not be great, even if the quantity pleases.

“As with Lloyds and Barclays, investors will therefore be hoping that RBS can stay out of trouble and the regulators’ sights, lend sensibly and keep costs in check, to help fund those precious future dividend payments.

“Any downturn in the global economy – no matter how unlikely that seems at the moment – would be an unwelcome development as it could put pressure on the loan book and expose the bank to fresh loan impairments if customers get into financial difficulty.

“This may be why central banks are raising interest rates only slowly – and in fact history suggests that banks shares tend to do well when headline borrowing costs are rising, as this helps their lending margins and presumably also signals that the underlying economy is running pretty hot anyway.

“What is odd, therefore, is the poor performance from the UK banking sector in 2018 to date. It is down some 6% for the year, against a broadly flat showing from the FTSE All-Share, and that ranks it just thirty-second by performance out of the 39 industrial groupings which make up the All-Share benchmark.

“Banking stocks have been similarly uninspiring performers in the US, Europe and Japan this year. This implies that someone, somewhere is either worried about the global economy or the state of the globe’s financial plumbing or ongoing increases in global indebtedness (or something else), so it will be interesting to see if today’s dividend announcement from RBS helps to soothe these concerns on a sustained basis, even if the shares are trading nicely higher at the opening in London today.”

|

| 2018E |

|

|

| P/E | Price/book | Dividend yield | Dividend cover |

Lloyds | 8.7 x | 1.20 x | 5.4% | 2.1 x |

HBSC | 12.7 x | 1.35 x | 5.5% | 1.4 x |

Barclays | 9.4 x | 0.72 x | 3.5% | 3.0 x |

Royal Bank of Scotland | 9.7 x | 0.87 x | 3.2% | 3.2 x |

Standard Chartered | 12.5 x | 0.73 x | 2.6% | 3.1 x |

Source: Thomson Reuters Datastream, Digital Look, consensus analysts’ forecasts