“Although the Bank of England’s £435 billion Quantitative Easing (QE) scheme has been deployed to depress Gilt yields, the yield on the benchmark 10-year UK Government loan has been inching slowly higher since early 2016, as if to suggest the only way is up for headline interest rates from here onwards.

“The Gilt market’s response to the decision by the Monetary Policy Committee to increase the base rate by 0.25% to 0.75% could therefore be crucial in shaping how the stock market responds, as certain sectors (and therefore by implication certain stocks) seem to perform well or badly, depending on how the 10-year Gilt yield is doing.

“While the past is by no means a guarantee for the future, history suggests that sectors such as banks and general retailers may do better if the benchmark 10-year Gilt yield – and by implication Bank of England base rates – continue to move higher.

“This makes sense in terms of the banks, as the theory is higher interest rates will allow the lenders to increase their net interest margins, although it may seem less intuitive in terms of the retailers. After all, higher borrowing costs could in theory crimps consumers’ ability to spend freely, if mortgage and credit card interest payments go higher.

“The historic relationship is not as obvious as it is with the banks, but perhaps the theory here is that the Bank of England is raising rates because inflation – and wages – are rising and that the economy is strong, an environment which could be helpful for the nation’s shopkeepers.

“Both retailers and banks have underperformed the broader UK stock market in 2018 and both have been long-term laggards for good measure. Each sector could therefore fall into the long-neglected ‘value’ category, which has been trampled down by the rush to buy growth and momentum plays, a trend that could reverse if rates start to rise consistently, if steadily, for two reasons:

First, if the Bank of England is tightening policy because the economy is doing well and inflation is accelerating, then in theory corporate profits growth should be robust. There is therefore less reason to pay very high valuations to get access to the secular growth offered by sectors such as tech and biotech if a rapid cyclical upturn in company earnings is underway.

Second, many momentum and growth stocks are priced off the earnings that they are expected to generate some way off into the future. These profits are often valued according to a discounted cash flow model, or DCF, which applies a discount (or interest) rate to those earnings and discounts them back to get a value for them in today’s money. The higher interest rates go, the higher the discount rate and the lower the value of those future earnings today – something which could affect tech stock valuations, for example.

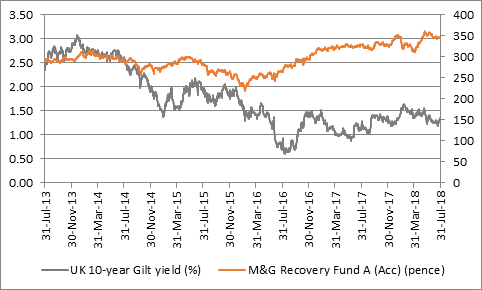

“In this context it is interesting to see how M&G Recovery Fund, the long-time charge of Tom Dobell, has tended to do best of late when the 10-year Gilt yield has been rising (and investors have been expecting better cyclical growth, higher inflation and – by extension – higher interest rates.

Source: M&G, Thomson Reuters Datastream

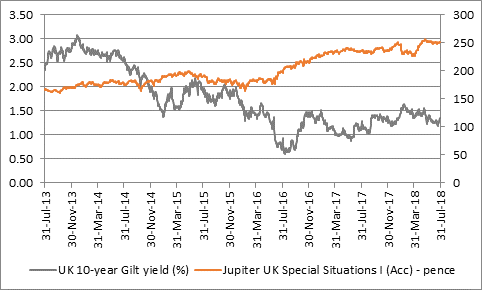

“A similar potential trend can be seen at another value fund, Jupiter UK Special Situations, even if again we must accept that the past offers no guarantee for future returns.

Source: Thomson Reuters Datastream

“By contrast, sectors which could struggle in the event of a sustained – if steady – string of rate rises include the so-called ‘bond proxies’, notably utilities, where lower Gilt yields tend to mean better share price performance and higher yields mean worse performance.

“These are stocks whose prime attraction is their dividend yield, owing to the lack of earnings growth, and thus capital appreciation potential, on offer.

“If bond yields rise – thanks to base rate rises – then investors will eventually be able to get improved coupons on bonds, where the capital risk is in theory lower, and may feel less inclined to seek out dividend yields from shares where the capital risk is higher.

“This could weigh on sectors such as Electricity and Gas, Water and Multi-Utilities, as well as perhaps Tobacco and the telecoms sectors.

Source: Thomson Reuters Datastream