“Investors have clearly been spooked by the resurgence of resource nationalism in the DR Congo, where President Kabila is looking to increase the royalty payments owed by miners to the Government under legislation that dates back over a decade.

“In sterling terms, Randgold’s London-listed shares are down by nearly 17% over the past 12 months while the (dollar-denominated) price of gold is up by nearly 5% and the precious metal is down by only 5% when priced in pounds.

“Over the same time frame, two leading gold mining exchange-traded funds listed in London, Van Eck Vectors Gold Miners and Van Eck Vectors Junior Gold Miners are both up, even when priced in pounds.

| Price change, past year (%) |

Evolution (A$) | 50.4% |

Buenaventura ($) | 29.9% |

Newmont Mining ($) | 14.3% |

Van Eck Vectors Junior Gold Miners ETF (£) | 11.6% |

Kinross Gold ($) | 11.3% |

Van Eck Vectors Gold Miners ETF (£) | 5.7% |

Gold ($) | 4.6% |

Newcrest Mining (A$) | 4.0% |

Agnico-Eagle ($) | (4.0%) |

Goldcorp ($) | (11.9%) |

Gold (£) | (4.6%) |

AngloGold Ashanti (ZAR) | (12.4%) |

Randgold Resources (£) | (16.5%) |

Barrick Gold ($) | (34.2%) |

Source: Thomson Reuters Datastream

“That may mean that Randgold has priced in at least some of the potential negative impact, depending upon the terms of the final legislation in Kinshasa, but investors will be hoping the law is not too punitive, as the DR Congo is a substantial contributor to Randgold’s mining operations.

| Equity ownership | 2016 gold production (ounces) |

Loulo-Gounkoto, Mali | 80% | 707,116 |

Kibali, DRC | 45% | 585,946 |

Tongon, Cote d'Ivoire | 89% | 260,556 |

Morila, Mali | 40% | 54,022 |

Massawa, Senegal | 83% | 0 |

Source: Randgold Resources 2016 report and accounts

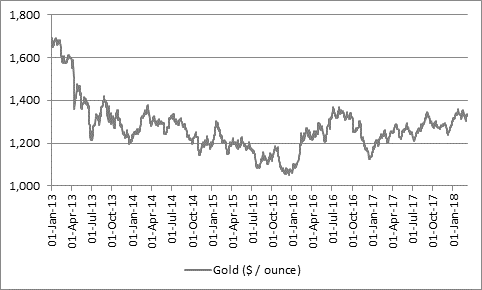

“Amidst the recent (short) burst of market volatility, gold held relatively firm and the precious metal is trading within a whisker of the 2014 and 2016 year highs – and any break-out above $1,340 to $1,350 an ounce could lead to further upside, if chart-watchers are to be believed.

Source: Thomson Reuters Datastream

“If inflation really does take a grip then this is possible as gold can do well during periods of inflation, owing to its perceived status as a store of value and a protector of wealth, owing to its limited availability and the very modest annual rate of increases in supply.

“If investors do feel that gold is an option as part of a balanced portfolio, they can then choose to own the metal directly or indirectly (via tracker such as an exchange-traded fund) or via gold miners.

“The experiences of Randgold and the wide divergence in miners’ share price performance over the last 12 months shows that picking the ‘right’ miner is not as easy as it looks. Investors need to assess where the miners operate and the risks posed by resource nationalism or weather, their financial strength, costs of production (as inflation here is becoming an issue), their operational currencies, financial strength and management acumen.

“However, during a genuine upturn in gold is it reasonable to expect gold mining stocks to rise faster than gold, given how geared their profits (and dividend payments) are to the metal’s price.”