Conservative manifesto pledge to scrap triple-lock in 2020 absent from Queen’s Speech

Future state pension age rises also not mentioned - set to be key battleground with Labour

Finance Bill urgently needed to fill gaping hole in pension tax legislation

Tom Selby, senior analyst at AJ Bell, comments:

“While Brexit is clearly sucking up huge amounts of policy time and resource, there remains a significant domestic reform agenda for the minority Government to be getting on with. Unfortunately we have a hung Parliament and a Prime Minister staggering on following a disastrous general election campaign.

“The result of this is a delayed Queen’s Speech which gives no clarity on either the major structural strains on the UK’s pensions system, or the outstanding legislative issues that were sidelined by the snap election.”

Ageing society – raising the state pension age and reforming social care

“The ageing society remains arguably the key challenge facing policymakers today. As average life expectancies in the UK continue to rise, the cost of providing the state pension will mount.

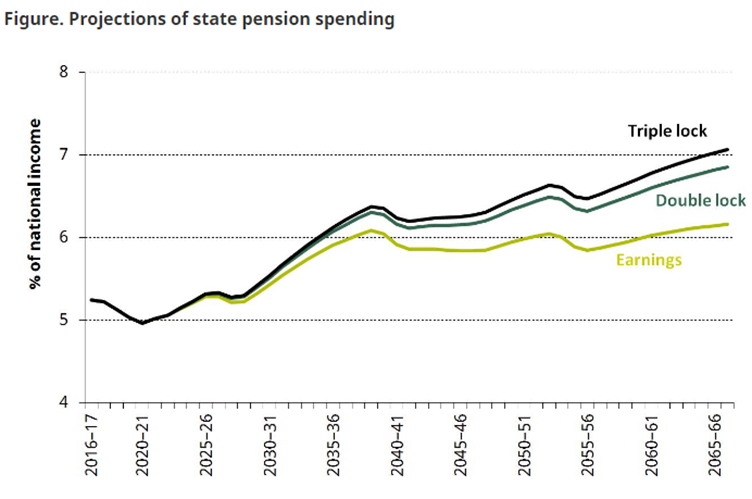

“The IFS estimates the state pension will cost an extra £30bn in today’s terms in 50 years’ time – and even moving to a double-lock would do little to alleviate these cost pressures (see graph below).

“Reports suggest the Government has decided to retain the triple-lock, which randomly ratchets up the payment in years when earnings and inflation are below 2.5%. While this may be politically necessary to woo the DUP, it remains illogical and is an obvious manifestation of short-term deal-making overriding long-term thinking.

“This state pension system is patently unsustainable over the long-term and at some point, someone will need to either reduce the amount people get or increase the age at which they get it. Unfortunately Prime Minister Theresa May has a wafer thin majority and as a result bold, necessary reforms to increase the state pension age faster risk being kicked into the long grass.

“The UK’s social care system is also urgently in need of reform and the Government has promised a consultation later this year setting out possible ways forward. The Queen’s Speech confirmed a consultation will put forward reform proposals but given the hostile reception given to the Tories so-called ‘Dementia Tax’, it would be no surprise to see this confined to the dustbin.”

Domestic reform agenda – MPAA, pension scams clampdown and boosting automatic enrolment

“With all the noise surrounding Brexit negotiations it’s easy to forget vital domestic personal finance reforms need addressing. In particular, we now need urgent clarity on how the Money Purchase Annual Allowance cut will be applied and whether the proposed dividend allowance reduction will still be introduced in April next year. This legislation is likely to be swept up in a new Finance Bill this year.

“We are also still waiting for the Government to implement a crucial clampdown on pension scammers, including a ban on cold-calling. These are incredibly important consumer protection measures that must not be further delayed.

“Automatic enrolment remains the central plinth of the UK’s private pension policy agenda and an important review looking at expanding the reforms is due to report by the end of this year. However, the election has placed serious time pressure on this work and so it would be no surprise to see the review slip into 2018.

“When it does eventually report, we are likely to see consideration of a range of changes, including potentially removing the earnings bands and trigger; expanding the reforms to the self-employed; and escalating contributions beyond 8%.

“This will be something of a high-wire balancing act for the Government, which needs to balance off the long-term risk of society not saving enough for retirement with the short-term risk of mass opt-outs if contributions go up and wages remain stagnant.”