Source: Thomson Reuters Datastream

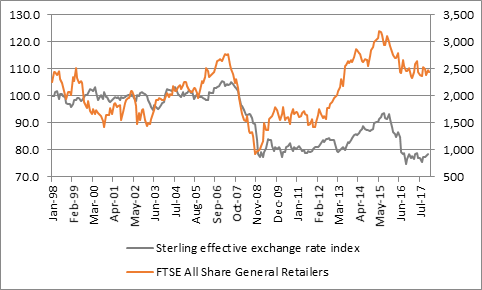

“Such sectors include Travel & Leisure, Real Estate Investment Trusts (many of which look cheap relative to their asset base) and particularly General Retailers.

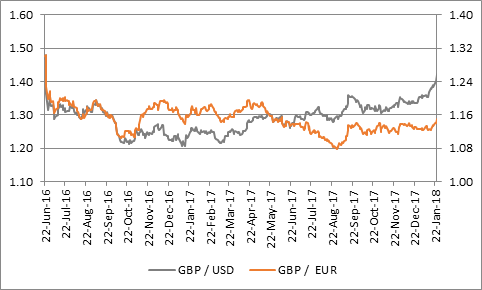

“A sustained gain in sterling would help to restrain cost pressure on restaurateurs’ and retailers’ imported goods or raw materials and also benefit consumers’ wallets and purses by keeping inflation in check and helping wage growth to catch up. A strong currency also does the Bank of England’s work for it on the inflation front and may mean that Governor Mark Carney can afford to move as slowly as usual when it comes to raising interest rates, something which could also help consumers who have hefty mortgages or credit card bills.

“While history is no guarantee for the future, the FTSE All Share General Retailers sector does look to do better when the pound is strong and less well when it is weak.

Source: Bank of England, Thomson Reuters Datastream

“A strong pound could therefore help this sector in the near term, although investors will be well aware that many retailers will still face some potent long-term challenges as they fight to convince investors (as well as customers) that they represent good value.

“These tests include competition from purely web-based rivals and the battle between ‘bricks and clicks,’ record-levels of consumer debt in the UK and the concept of ‘peak stuff,’ whereby consumers are preferring to spend on experiences rather than material goods, as they either don’t have a house of their own or already have one that’s crammed full of stuff they don’t need.”