• The Pensions and Lifetime Savings Association (PLSA) ‘Retirement Living Standards’ have been updated to reflect lifestyle changes during lockdown

• More money for eating out, higher personal grooming budget and Netflix subscription among changes to the Living Standards

• Around half of single employees expected to achieve between ‘minimum’ and ‘moderate’ Retirement Living Standard

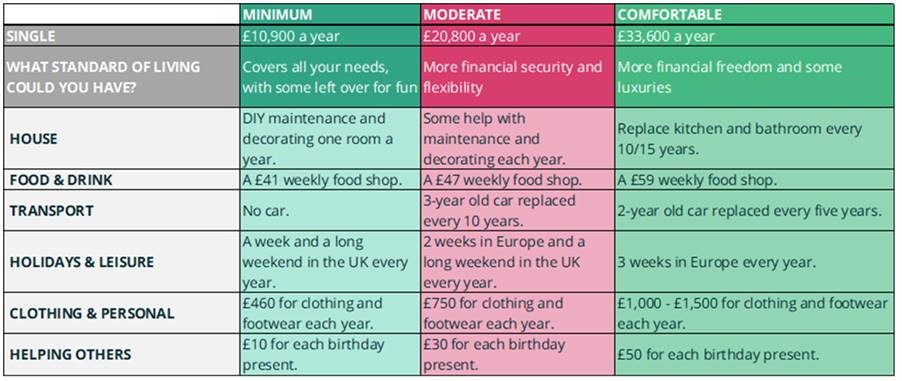

• For a single person, the new estimated income levels are (see end of press release for details):

o Minimum - £11,000 per year

o Moderate - £21,000 per year

o Comfortable - £34,000 per year

• New research suggests the pandemic has prompted more people to think about their preparedness for retirement

Tom Selby, head of retirement policy at AJ Bell, comments:

“The pandemic has exposed gaping holes in the finances of millions of people, with many having little or nothing saved for an emergency.

“What’s more, contribution levels into pension schemes remain low, particularly among self-employed workers who don’t benefit from automatic enrolment.

“As the UK economy slowly recovers from lockdown, it is vital financial resilience becomes a key focus for policymakers, both in the short and long-term.

“This must include encouraging more people to think about how they will fund their lifestyle in retirement, with pensions likely to be central for most savers.

“The PLSA’s ‘Retirement Living Standards’ provide a valuable benchmark against which people can think about their pension planning, and it makes sense to update those Standards in line with what retirees spend their cash on.

“This is exactly how inflation works and should help ensure the Standards remain relevant to people’s experiences.”

Half of single employees heading for ‘minimum’ to ‘moderate’ retirement

“Around half of single employees are estimated to be on track for a minimum to moderate retirement, with those in couples expected to be closer to the top of this range.

“While for many people a total retirement income of between £11,000 and £21,000 per year might be enough to fund their planned lifestyles, a minimum to moderate living standard will inevitably be far below the expectations of others.

“For those aspiring to more, higher levels of voluntary saving above the automatic enrolment minimum of 8% will almost certainly be necessary.

“Higher contributions, particularly in the early years of saving for retirement, can benefit from extra compound growth over the long-term, with an additional boost provided by tax relief and in some cases matched employer contributions.

“Alternatively, retiring later or working part-time to supplement your pension could help boost your income.

“But whatever your retirement aspirations, it is worth reviewing how much you save and where you save it.

“If having a moderate or comfortable standard of living in retirement is a key goal, you might need to think about saving a bit more in your pension if you can afford to.”

Source: PLSA