Savers have been battered by uncertainty during 2020, with Coronavirus and the subsequent national lockdown threatening to wreak havoc with Brits’ retirement plans.

Tom Selby, senior analyst at AJ Bell, considers the implications for those building a pension pot and the challenges facing people drawing an income in retirement.

People saving for retirement in workplace defined contribution (DC) schemes

“The UK has been divided in terms of the impact Coronavirus has had on people’s financial situations. While just over a fifth (22%) of the population reported taking a financial hit during lockdown, 1-in-7 (14%) said they were financially better off.

“As a result, the savings ratio surged to a record high of 29% - although most of this money appears to be held in cash accounts at the moment, rather than being invested in pensions for the long-term.

“Those who lost their job in as a result of lockdown would have taken a hit through missing out on matched employer pension contributions and pension tax relief.

“Take someone earning the UK average salary of £30,000 a year who had previously been auto-enrolled at 8% of band earnings – the legal minimum – and lost their job or chose to opt-out at the end of March.

“Assuming they remained unemployed throughout 2020, they would miss out on £534.60 in matched employer contributions. Assuming they had not set up an alternative pension arrangement, they would also not receive £178.20 in pension tax relief on £712.80 in personal contributions.

“All-in, the lockdown hit to an average earner’s workplace pension could be over £1,400, including over £700 of ‘free money’ from employer contributions and upfront tax relief.

“While this is clearly not ideal, provided they are able to return to work and contributing to their retirement fund in 2021 any damage can be rectified by paying in a little bit more each month over time.

“For those who were furloughed on 80% of their usual pay, the impact on their automatic enrolment pension contributions will have been relatively limited.

“Someone earning the average UK salary of £30,000 furloughed on 80% of their wages from the end of March onwards and auto-enrolled at the minimum would have added £1065.60 to their retirement pot by the end of the year – around £360 less than if they had been auto-enrolled based on their full salary.”

The investment impact and the smoothing effect of ‘pound-cost averaging’

“Although 2020 has undoubtedly been a topsy-turvy year for investors, pension savers with a focus on the long-term should have been able to ride out the storm. Furthermore, those drip-feeding their contributions throughout the year will have benefitted from automatic smoothing through ‘pound-cost averaging’.

“The theory behind pound-cost averaging is relatively simple. By saving and investing little bits each month – rather than in one big lump sum – people can drastically reduce market timing risk. This is because in periods of turmoil when stockmarkets plummet, investments can subsequently be bought cheaper. The trade-off, of course, is that peaks are also smoothed out.

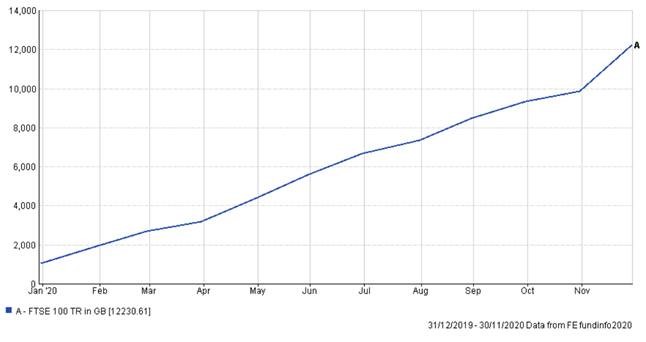

“For example, someone who invested £1,000 a month from 31st December 2019 would have a fund worth £12,231 at the end of November 2020 – meaning their fund would have grown in value by 2%.

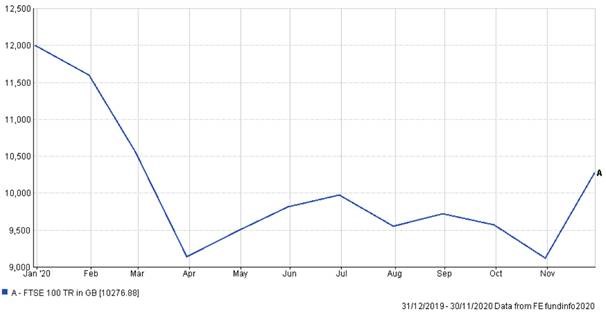

“If, on the other hand, they had chosen to invest £12,000 as a lump sum on 31st of December 2019, their fund would have been worth just £10,277 by the end of November – a 14% drop in value.”

The lump sum investing experience in 2020 (£12,000 invested on 31st December 2019)

The monthly investing experience (£1,000 a month invested from 31st December 2019)

Investors closing in on their chosen retirement date

“The impact of the volatility we have seen in 2020 on those approaching retirement will depend on the investments they hold and how they plan to draw an income in retirement.

“Those planning to take a regular income while staying invested (‘drawdown’) should have been able ride out the storm in March and April.

“Someone who is 64 and planning to take an income from their 65th birthday, for example, might still have an investment time horizon of 30 years or more to recover any losses.

“The same would not be true for those planning to buy an annuity, however. Those planning to buy an annuity should be in low risk assets or cash as they approach retirement, otherwise they risk facing a moving target.

“Someone who took a 20% hit to their fund in March who planned to retire in April, for example, would be forced to either take a 20% lower retirement income for life or delay retirement and hope their fund recovers.

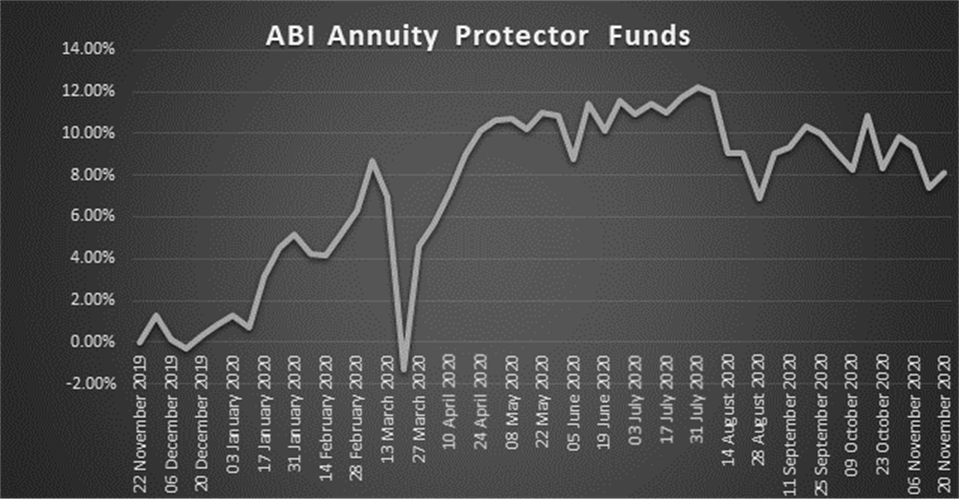

“This is why the performance of funds tailored specifically for those planning to buy an annuity was concerning during 2020. ‘Annuity Protector’ funds have been highly volatile throughout the year, with some suffering double-digit drops as markets tanked in March.

“This is because, rather than investing in cash, these funds hold things like gilts and corporate bonds which are deemed to be ‘safe’.

“The experience of 2020 has proven they are anything but, and while their value has bounced back the funds have provided a painful lesson in the importance of understanding what you are invested in.”

People taking a retirement income while staying invested

“2020 saw the first ‘bear market’ – where share prices fall by more than 20% - since the pension freedoms were introduced in April 2015, presenting a significant challenge for those in drawdown.

“Of course the impact will have depended on the extent to which people were exposed to stocks hit hardest by Coronavirus.

“As the year wore on, extra pain was loaded on drawdown investors in the form of widespread dividend cuts – the lifeblood of most retirement income strategies.

“The biggest danger in such an environment is faced by those in the early stages of drawdown and is often referred to as ‘pound-cost ravaging’. This works in the opposite direction to pound-cost averaging and, if ignored, can swiftly turn a sensible retirement strategy into an unsustainable one.

Pound-cost ravaging – an example

“After taking his tax-free cash, Paul was left with a fund worth £100,000. He needs £5,000 a year to support his lifestyle in retirement and wants his spending to keep in line with inflation, so plans to increase his withdrawals by 2% a year (in line with the Bank of England CPI inflation target).

“After making his initial £5,000 withdrawal his fund was hit by COVID-19, reducing the value at the end of year 1 by a further 20% to £76,000.

“If Paul continues to make withdrawals as planned and his investments deliver 4% returns post-charges, his fund could run out by the time of his 84th birthday.

“If instead of Year 1 of retirement the 20% fall had occurred in Year 10 (with 4% returns otherwise), his fund could have lasted until his 87th birthday. In other words, bad timing has cost Paul £15,000 of retirement income (in 2020 terms).

How have drawdown investors reacted to market uncertainty?

“The positive news is that, when faced with severe market turmoil, people responded in exactly the way you would hope.

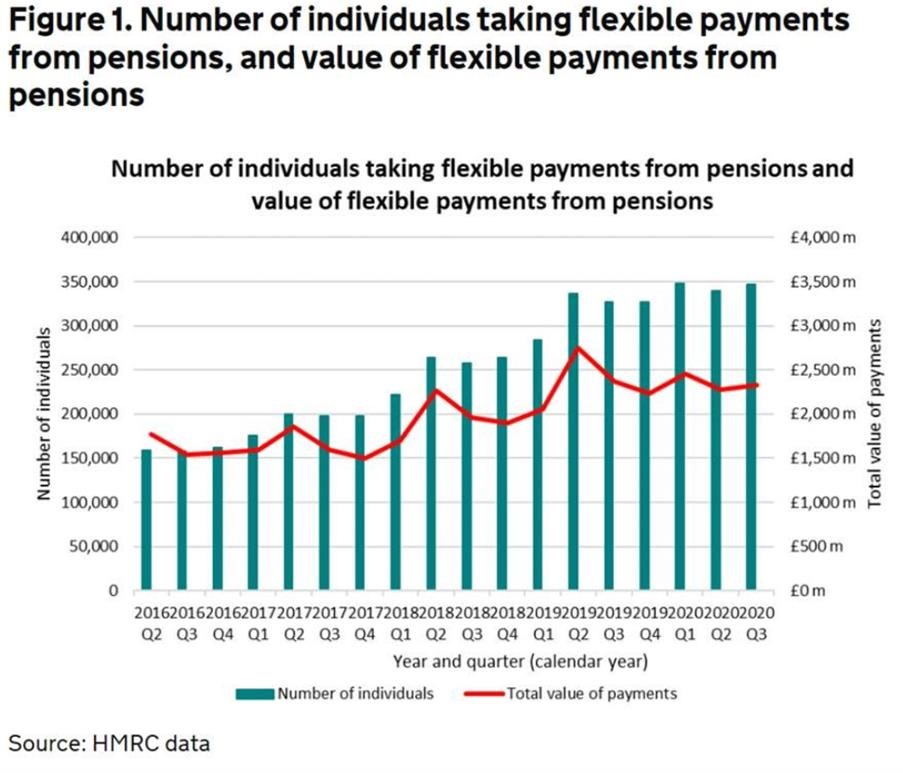

“Some £2.3 billion was withdrawn flexibly from pensions between April and July as COVID-19 took its grip on the UK, according to quarterly data published earlier this year by HMRC.

“This figure was down 17% compared to Q2 2019 when £2.8 billion was withdrawn flexibly from retirement pots, suggesting many people chose to either pause access or reduce their income as markets plummeted.

“This was particularly notable as Q2 is normally peak pension freedoms season, with withdrawals peaking as people take advantage of a new set of tax allowances in April.

“While the number of people accessing their pension year-on-year increased marginally to 340,000, this number was down from 348,000 versus Q1 2020 – contrary to patterns seen since the pension freedoms launched in 2015. The average amount withdrawn per individual in Q2 2020 was £6,700, down 18% from £8,200 in Q2 2019.

“Withdrawals have since picked up a little, which further suggests people held back on accessing their retirement pot during the market dip and are now returning to their original income plans.”