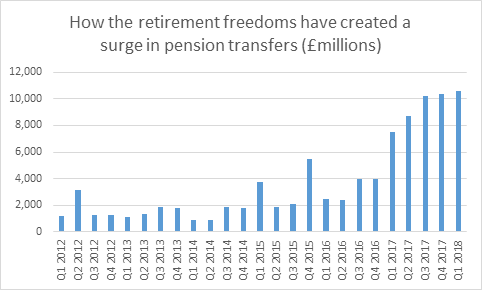

Pension transfers hit £10.6 billion in Q1 2018 – a new record

The vast majority of these likely to be people quitting guaranteed defined benefit (DB) schemes in favour of more flexible defined contribution (DC) plans

Value of pension transfers in 2017 revised up £2.5 billion to £36.8 billion

Figures confound predictions DB transfers had peaked in 2017 and could reflect significant transfers from large schemes such as British Steel

Tom Selby, senior analyst at AJ Bell, comments:

“The stampede to quit guaranteed defined benefit pension schemes shows no signs of slowing down, with the first three months of 2018 setting another record for pension transfers.

“We have witnessed a perfect storm for DB transfers in the UK, with a combination of the attractiveness of the pension freedoms, high transfer values and headlines about high-profile companies – most notably BHS and Carillion – going bust all undoubtedly influencing people’s decision to exit.

“The Q1 2018 figure also likely includes a large number of transfers away from the British Steel Pension Scheme.

“Over time pensions transfer volumes should edge downwards as the number of people with significant funds eligible for a transfer diminishes, but as things stand we remain in the eye of the storm.

“Those who have decided to move their pot away from the security of DB will now need to take a much more active role to ensure they get the retirement they want.”

Source: Office for National Statistics - Investment by insurance companies, pension funds and trusts (MQ5)

Note: Figures quoted are from section 4.3 – self-administered pension funds income and expenditure - Row 62 (‘Transfers to other pension schemes’).