• New HMRC data reveals £30.7 billion has been flexibly withdrawn from pensions since April 2015

• Savers withdrew £2.4 billion in the third quarter of 2019, up 21% compared with Q3 2018

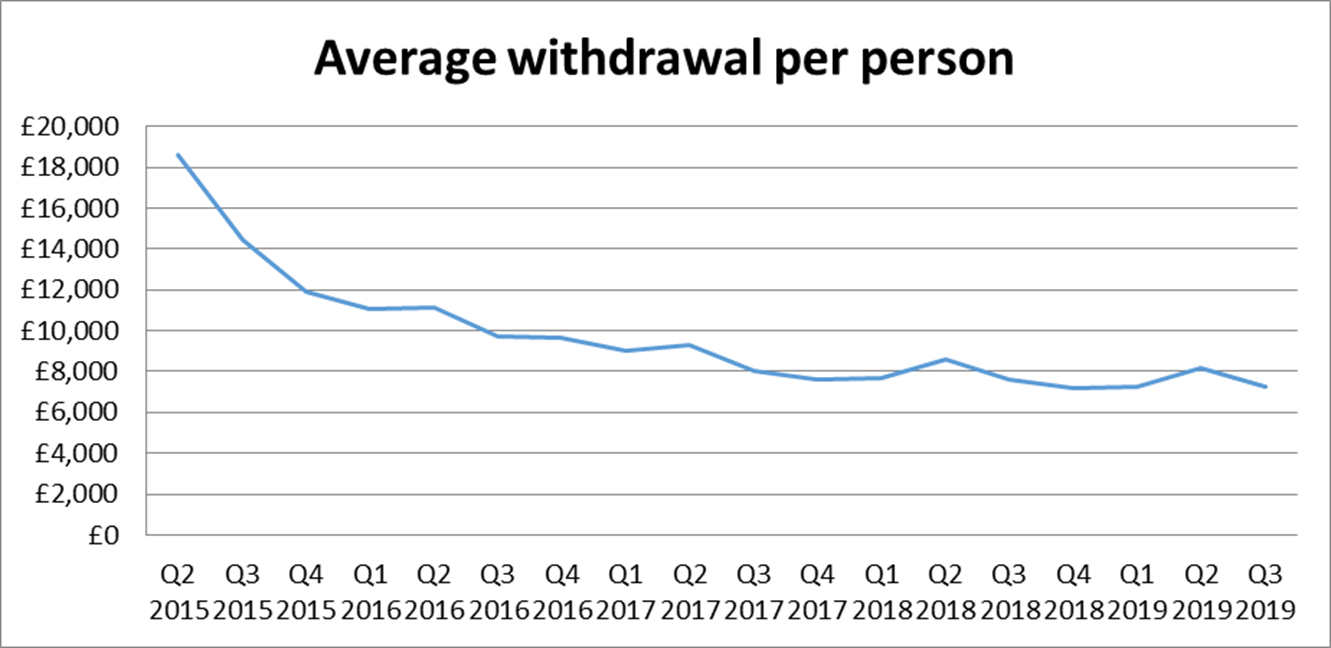

• However, the average withdrawal per person has actually fallen, from £7,600 in Q3 last year to £7,250 in Q3 2019

Tom Selby, senior analyst at AJ Bell, comments:

“The pension freedoms are now firmly embedded in the UK retirement landscape, with 327,000 people flexibly accessing their retirement pot in the third quarter of 2019.

“Encouragingly, the average withdrawal per person continues to fall steadily, suggesting people are thinking carefully about how to spend their hard-earned pension rather than risking retirement ruin with an ill-advised binge.

“Although savers have embraced pension freedoms there remain problems with the overall retirement system which demand attention.

“The taxation of pension freedoms withdrawals is a confusing mess which can leave people facing shock emergency tax bills running into thousands of pounds, while the money purchase annual allowance (MPAA) is a brutal punishment for those who take taxable income from their fund.

“Fixing these holes so the tax system works with the retirement flexibilities should be a priority for the next Government.

“Scams also continue to be an ever-present threat despite greater regulatory attention and measures to ban cold-calling. It is absolutely vital that the next administration, whoever it may be, continues to focus on this area to create an environment where savers feel secure and fraudsters live in fear.”