HMRC has today issued the latest statistics on withdrawals made under pension freedoms:

• In total 284,000 people withdrew over £2 billion from their pensions during the first quarter of 2019

• £25.6 billion has now been flexibly withdrawn from pension pots since the reforms were introduced in April 2015

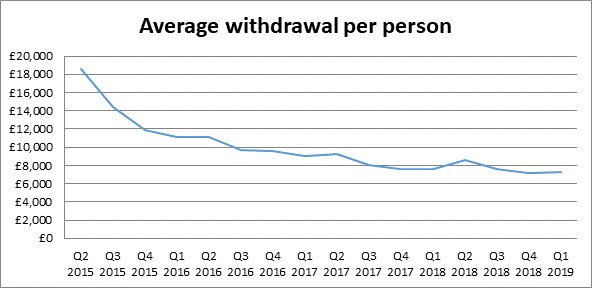

• Average pension freedoms withdrawals per person were £7,254 in Q1 2019, a slight decrease from £7,644 a year ago but a significant decrease from £11,081 in Q1 2016

• Separate AJ Bell research to mark the four-year anniversary of the freedoms in April suggested withdrawals as a proportion of total retirement savings have dropped in response to tough market conditions

Tom Selby, senior analyst at AJ Bell, comments:

“All the available evidence suggests that, in the main, savers continue to use the pension freedoms sensibly and are managing withdrawals with sustainability right at the front of their minds. The number of people using the pension freedoms continues to increase as expected but importantly the trend in the average amount per withdrawal has been consistently on a downward trajectory over the 4 years since the new rules were introduced. (see graph below)

“Most of the first four years of the new rules has also been something of a golden period for investors, with the FTSE on a flyer for the vast majority of that period, with the notable exception of the back end of 2018.

“Furthermore, the most popular funds and trusts selected by AJ Bell drawdown investors since April 2015 have performed admirably, with the top choice – Terry Smith’s Fundsmith Equity – almost doubling your money on a total return basis. (see table below)

“Those entering drawdown today however need to be realistic about the returns they might receive from the stock market.

“It would be optimistic to say the least to expect the stellar performance enjoyed in the first three years of the freedoms to be repeated. Investing in the stockmarket remains a get rich slow scheme and patience is required to reap the rewards of long-term growth.

“This is why it is so important for people keeping their money invested in retirement to review their funds and withdrawal strategy regularly and be prepared to reduce income payments where necessary.”

Returns on a £100,000 drawdown fund under pension freedoms

|

Most purchased funds by income drawdown investors since 6 April 2015 (in order of popularity) |

Total return – no withdrawals |

Total return - annual £5,000 withdrawal* |

|

Fundsmith Equity |

£192,100 |

£165,100 |

|

Scottish Mortgage (IT) |

£190,700 |

£161,110 |

|

RIT Capital (IT) |

£137,250 |

£114,520 |

|

iShares Core FTSE100 (ETF) |

£120,580 |

£97,640 |

|

City of London (IT) |

£118,740 |

£96,170 |

|

Lindsell Train Global Equity |

£187,090 |

£158,040 |

|

Finsbury Growth & Income (IT) |

£145,970 |

£120,960 |

|

Vanguard Lifestrategy 60% |

£125,690 |

£104,130 |

|

Murray International (IT) |

£136,270 |

£112,220 |

|

Personal Assets (IT) |

£119,470 |

£99,210 |

|

£100,000 portfolio split equally across the 10 funds |

£147,386 |

£122,910 |

Source: top 10 most purchased funds by income drawdown investors via AJ Bell Youinvest. Investment performance data from FE analytics 6/4/2015 – 28/3/2019. *5% of opening fund value, taken quarterly