Almost £17.5 billion flexibly withdrawn from pensions since freedoms launched in April 2015 (latest HMRC statistics)

500,000 flexible payments made to 222,000 people in Q1 2018

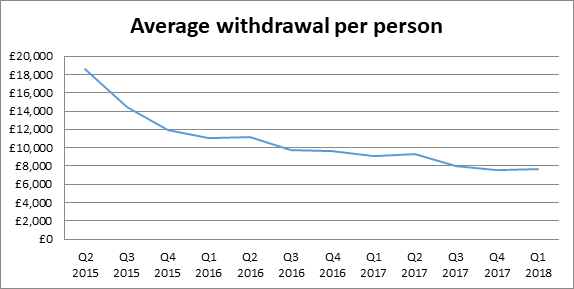

Average withdrawal per person was £7,644, up slightly versus the previous quarter

Upcoming FCA Retirement Outcomes Review likely to focus on sustainability of withdrawals and consumer engagement

Tom Selby, senior analyst at AJ Bell, comments:

“Three years on from the launch of the pension freedoms we are beginning to get a clearer picture of how savers are using the flexibilities. The popularity of the reforms is obvious, with half a million flexible payments made to over 200,000 people in the first three months of 2018.

“Average withdrawals per quarter ticked up slightly but remain well below the levels seen in the first 12 months. While there are signs some people may be taking too much too soon from their retirement pots, there is no clear evidence this is a widespread problem. Indeed, many remain concerned that ‘reckless conservatism’ – where people take too little from their funds and struggle to make ends meet – could prove to be just as significant a problem.

“All eyes now turn to the FCA Retirement Outcomes Review, which is set to deliver its verdict on the drawdown market and any remedies it deems necessary to protect consumers. This is likely to pay particular attention to the sustainability of withdrawals and the extent to which people entering drawdown are engaging with their pension.

“Our own research suggests many savers lack knowledge about the decisions they are taking at retirement. This must now become the central focus for both policymakers and the wider retirement income sector.”

Source: HMRC