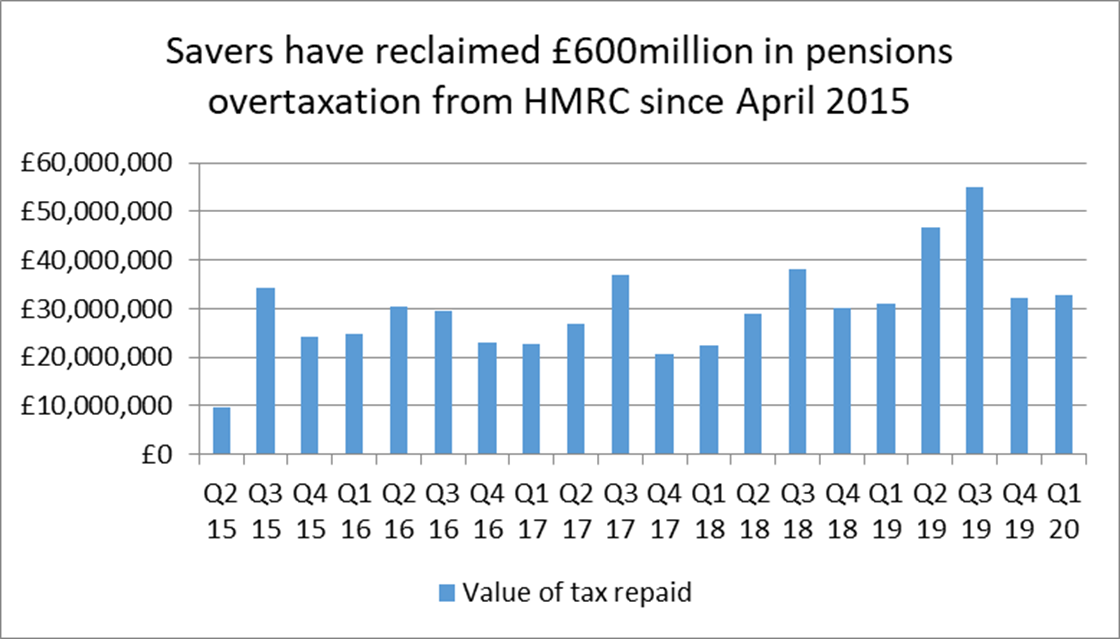

• Pensioners overtaxed on their first pension freedoms withdrawal of the tax year have now reclaimed £600 million from HMRC, official figures reveal (https://www.gov.uk/government/publications/pension-schemes-newsletter-116-january-20/pension-schemes-newsletter-116-january-2020)

• Over 10,000 official reclaim forms were processed by HMRC in Q1 2020, with the average person getting a refund of £3,141

• People dipping into their pensions for the first time as a result of COVID-19 risk getting thousands of pounds less than expected due to HMRC’s emergency ‘Month 1’ taxation policy on single withdrawals

Tom Selby, senior analyst at AJ Bell, comments:

“While the freedom and flexibility pensions now offer has been welcomed by millions, HMRC’s insistence on applying a ‘Month 1’ emergency tax code to the first withdrawal of the tax year has now seen savers reclaim £600 million in overpaid tax.

“It’s worth remembering this only covers those who have made a reclaim using the official forms, and so doesn’t include any people refunded via HMRC’s systems at the end of the tax year.

“Anyone planning to access their pension in the new tax year – including those looking to use their retirement pot to plug an income gap resulting from COVID-19 – needs to be aware of the impact Month 1 taxation will have on the amount of money they receive initially.

“For those taking a regular stream of income, HMRC should automatically adjust your tax code so you receive the right amount in subsequent months.

“However, where you are making a single withdrawal in the tax year you will either have to fill out one of three forms or wait for the Revenue to sort out your tax position.”

How Month 1 works – an example

If someone makes a pension withdrawal of £12,500 (the same level as the personal allowance) and has no other taxable income, they might expect to be taxed at 0%.

However, because Month 1 is applied all their usual tax allowances are divided by 12. This means only £1,042 of the withdrawal is taxed at 0% (1/12th of £12,500), with the next £3,125 taxed at 20% (1/12th of £37,500).

The remaining part of the withdrawal is taxed at 40%, giving a total tax bill of almost £4,000.

Source: HMRC Pension Schemes Newsletters