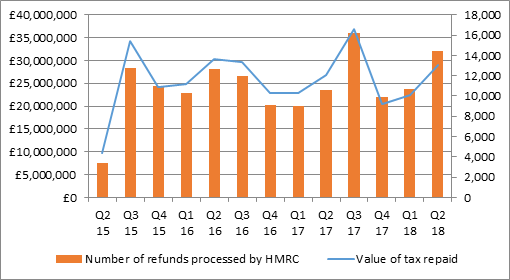

Some £334 million has been repaid to people who have accessed their pension flexibly and been overtaxed since April 2015

Figure only covers those who have filled out official tax reclaim forms – true level of over-taxation likely to be significantly higher

Over 14,000 official reclaim forms processed in the latest quarter, suggesting HMRC is working overtime to deal with requests

HMRC still refuses to review its approach despite growing industry pressure

Tom Selby, senior analyst at AJ Bell, comments:

“People who take a single pension freedoms withdrawal in a tax year continue to be punished by HMRC’s insistence on applying an emergency tax code to such payments.

“While the official figure of £334 million in tax repaid is astonishing itself, this only covers people who have filled out the official forms and is therefore likely to be the tip of the iceberg.

“Those who do not fill out a form have to rely on the Revenue to sort out their affairs and could be left waiting until the end of the tax year to be put in the right position.

“Many people who make a single withdrawal will understandably be totally unaware their fund won’t be taxed in the same way as income in the first instance, and so face a shock tax bill. In some cases individuals will be forced to make another withdrawal from their fund to bridge the gap.

“It is clear that, at the very least, HMRC needs to formally consult on its approach to pension freedoms taxation to properly consider alternatives to the current regime.”

Source: HMRC figures