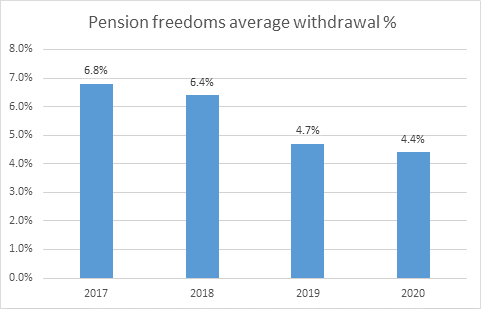

• New survey* suggests, on average, pension freedoms withdrawals are 4.4% of all private retirement pots – down from 4.7% a year ago and 6.6% in 2017

• Pension freedoms withdrawals represent around a third (32%) of total income on average, with over two-thirds (70%) of respondents saying they represent half their income or less

• Nevertheless, the coronavirus sell-off will require hundreds of thousands of investors to review their retirement income strategies to ensure they remain sustainable

• Savers have withdrawn almost £33 billion in total since the pension freedoms launched in April 2015

Tom Selby, senior analyst at AJ Bell, comments:

“As the 5th anniversary of the pension freedoms reforms approaches this weekend, roughly 150,000 people a year who choose to stay invested while taking an income through drawdown face their biggest retirement challenge yet.

“Our research suggests, on average, annual withdrawals represent 4.4% of all private pension pots – a figure which has decreased every year we have carried out the survey.

“Although it is difficult to judge the sustainability of withdrawals without knowing people’s individual circumstances and overall wealth, a market characterised by people taking an income of between 4 and 5% who tend to have multiple sources of income may appear of little concern – particularly during a period where markets have risen at a healthy rate.

“However, the coronavirus sell-off has changed everything, ripping a double-digit hole in millions of savers pension plans. While those who are building a retirement pot should have decades for their funds to (hopefully) recover value, people drawing an income already will likely have to adjust their spending expectations.

“This will particularly be the case for people in the early years of retirement who took significant withdrawals from their fund just as the current crisis hit. This combination of big withdrawals and negative investment performance – often referred to as ‘pound-cost ravaging’ – can wreak havoc with people’s retirement plans.

“While it may be tempting for some to plough on regardless, such an approach will leave you at significant risk of running out of money.”

AJ Bell’s pension freedoms survey – 5 key findings

1. Average total value of private pensions: £152,000

2. Average annual withdrawal: £6,694

3. Average proportion of income coming from pension freedoms withdrawals: 32%

4. Proportion who have other sources of income: 74%

5. Proportion concerned about running out of money in retirement: 50%

*Independent survey of 500 people who entered drawdown since April 2015 and are taking a regular income. Research carried out online during February and March 2020.