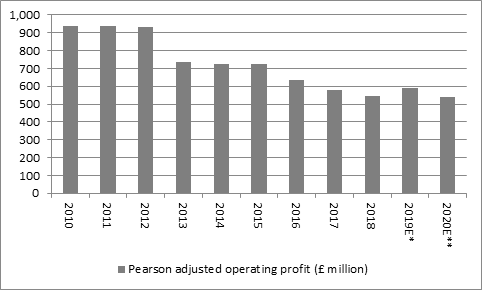

“Pearson will get a new boss in 2020 when John Fallon steps down, but it is starting the new year by going back to old bad habits by issuing a profit warning in January, just as it did in 2013, 2016 and 2017,” says Russ Mould, AJ Bell Investment Director. “The latest alert leaves the shares languishing at their lowest level since July 2009 and shareholders could be forgiven for wondering whether both Mr Fallon and chief financial officer Coram Williams are getting out before things get even worse.

“For all of the restructuring, asset disposals and financial engineering through share buybacks, Mr Fallon, who took over in 2013, and Mr Williams have proved unable to fully defend Pearson’s profits from the rise of Open Education Resources (OER), whereby universities make best-of-breed lecturing and educational materials freely available.

“Students and lecturers can therefore copy, use, append and even modify the documents, and cut down on the expense of buying or renting the sort of textbooks provided by Pearson.

“The new management team, once appointed, will still have to address the issue of how to recondition Pearson’s business model for the digital age, as even a shift to generating two-thirds of US higher education sales from digital products is not proving enough to support earnings.

Source: Company accounts. *Based on company guidance given 16 January. ** Based on mid-point of company guidance given 16 January.

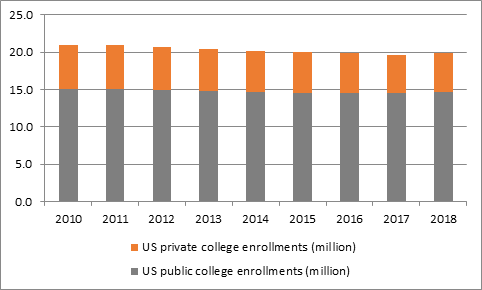

“US higher educational courseware is now only a quarter of group sales, but US college student numbers were flat or down in every year from 2011 to 2017 and lofty fees appear to be deterring some Americans for taking the step up to higher education.

Source: Statista

“The prevailing two-tier system helps, as students who live in the state pay less and also have the option of living at home, while grants and bursaries can help students too.

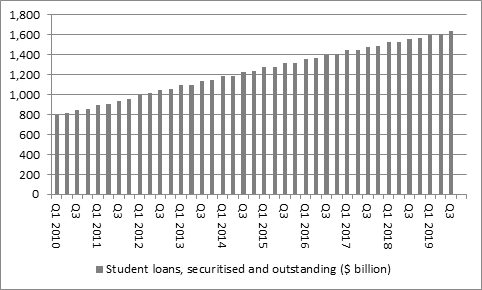

“Nevertheless, the affordability of higher education in the US is an issue. Ballooning aggregate student debt numbers suggest that paying for the top—level of education is a burden for many that can only be bridged by borrowing and those loans will have to be serviced in the future.

“Data from the St. Louis Federal Reserve database shows that total US student debt has doubled this decade to reach a new high of $1.6 trillion.

Source: FRED – St. Louis Federal Reserve database

“Faced with the prospect of taking on substantial debts, it is no surprise that student numbers have been dropping and there may be little or no defence against that for Pearson, should the trend continue. The stabilisation in US student numbers in 2018 offers some hope but it does not seem to be helping Pearson that much, judging by the earnings drop of 2018 and the decline forecast today by management for 2020.

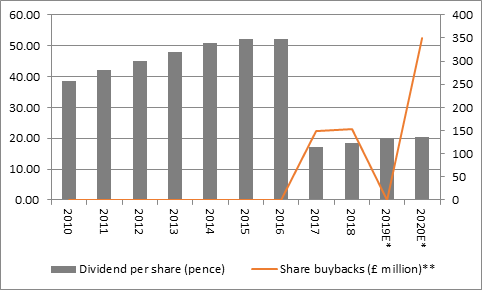

“The plan to launch a £350 million share buyback may offer some support to the shares, while the dividend yield of around 3% is more than twice covered by earnings per share – for now.

Source: Company accounts, Sharecast. * Consensus analysts' forecasts for dividends. **2020E company buybacks figure based on trading statement of 16 January 2020

“However, further pressure on profits – and therefore cash flow – could lead to questions being asked about the dividend, last cut in 2017, or at least the wisdom of the share buyback programme. Ultimately, the buyback programmes of 2017 and 2018 provided only fleeting support to the share price and if the underlying performance of the business does not improve then there is a risk that the 2020 buyback proves equally ineffective at convincing investors that all is well.”