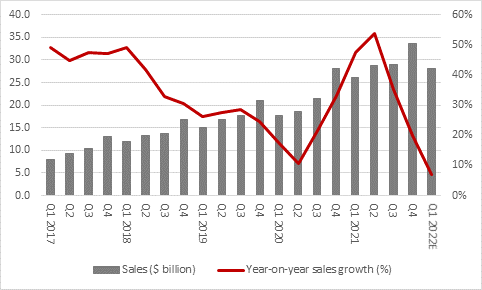

“It’s tough for any firm to stay at the top: either customers get bored of you, the competition catches up or the regulator sticks in their nose and at Facebook it may just be a case of all three, as growth in daily average user stalls and revenue increases begin to slow,” says AJ Bell Investment Director Russ Mould. “Facebook may also be yet another firm whose business model is perfectly-adapted to helping people cope with the pandemic and lockdowns but may see fresh interest wane as commuters return to offices and consumers look to get out and about again.

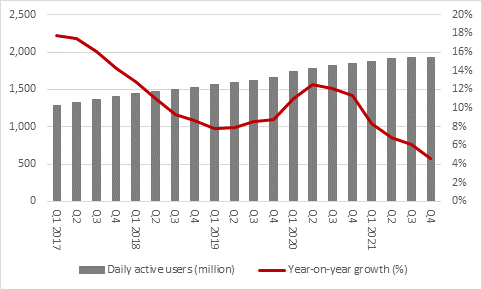

“The one-fifth plunge in parent company Meta Platform’s shares, and loss of $180 billion of total stock market value, may seem extreme in response to the loss of one million average daily users when Facebook still has more than 1.9 billion of them and the company still expects sales to grow by 7% year-on-year in the first quarter of 2022.

Source: Company accounts, midpoint of management guidance for Q1 2022

“But a near-$1 trillion price tag for the company leaves little room for disappointment, especially as that figure represents more than 20 times forecast profits for this year. That lofty valuation could look even more exposed if these fourth-quarter numbers suggest that demand for Facebook may be reaching saturation point.

“After all, the platform has 1.9 billion daily average users and 2.9 billion monthly active users.

“The globe’s population is eight billion and around five billion of those have reliable internet access. Facebook already reaches 2.9 billion of them and of the other two billion more than half are Chinese, where the platform is still banned after 2009’s initial embargo.

“That means the Facebook platform already addresses three-quarters of its available market, so there isn’t a lot more to go for – and competition such as TikTok, or video streaming services, or even getting off the sofa and taking some exercise, going to work or meeting friends in person could all yet catch up with it.

Source: Company accounts

“User numbers in the US and Canada and Europe have already stalled and neither Asia nor Latin America showed any growth in the last quarter, either.

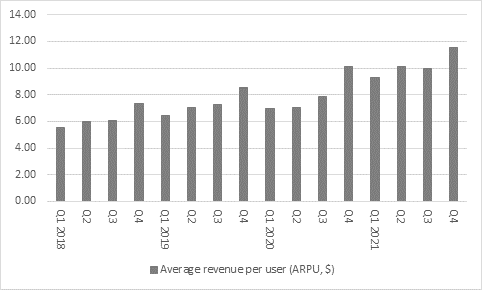

“The company may therefore look to increase average revenue per user (ARPU) and it is doing a good job here. In the fourth quarter ARPU rose 14% year-on-year to $11.57 but if advertisers see any shrinkage in the platform’s user base that could prove hard to sustain, especially as the change to privacy settings to Apple’s iOS platform make it harder for digital advertisers to harvest customer data and target them effectively.

|

|

Q1 2020 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

|

USA & Canada |

195 |

198 |

196 |

195 |

195 |

195 |

196 |

195 |

|

Europe |

305 |

305 |

305 |

308 |

309 |

307 |

308 |

309 |

|

Asia-Pacific |

678 |

699 |

727 |

744 |

760 |

788 |

805 |

806 |

|

Rest of World |

556 |

583 |

593 |

598 |

613 |

618 |

822 |

819 |

|

Daily active users (million) |

1,734 |

1,785 |

1,820 |

1,845 |

1,878 |

1,908 |

1,930 |

1,929 |

|

|

|

|

|

|

|

|

|

|

|

Year-on-year change |

|

|

|

|

|

|

|

|

|

USA & Canada |

4.80% |

5.90% |

3.70% |

2.60% |

0.00% |

-1.50% |

0.00% |

0.00% |

|

Europe |

6.60% |

6.60% |

5.90% |

4.80% |

1.30% |

0.70% |

1.00% |

0.30% |

|

Asia-Pacific |

13.00% |

13.70% |

15.90% |

16.10% |

12.10% |

12.70% |

10.70% |

8.30% |

|

Rest of World |

13.50% |

16.80% |

14.30% |

12.40% |

10.30% |

6.00% |

38.60% |

37.00% |

|

Daily active users (million) |

11.00% |

12.50% |

12.10% |

11.30% |

8.30% |

6.90% |

6.00% |

4.60% |

Source: Company accounts

“Meta Platforms is looking to develop new revenue streams and the Reality Labs arm, which covers augmented and virtual reality (AR and VR) hardware and software generated $2.3 billion in revenues in 2021. However, that is less than 2% of group sales and the unit’s operating loss ballooned to $10.2 billion, up from $6.6 billion in 2020, so it looks like a return on that investment is some way off.

Source: Company accounts

“Meta Platforms’ earnings disappointment adds to a list of shocks from firms whose profits, cashflow and share prices thrived as their earnings models helped keep businesses or consumers connected and entertained during the early stages and the pandemic and lockdowns, including Netflix, Peloton and Spotify.

“That may help to further drive investors away from highly-rated technology and social media stocks which offer the promise of long-term secular growth and toward cheaper, cyclical stocks which could generate rapid near-term earnings increases if the economy keeps on recovering in the wake of the pandemic.

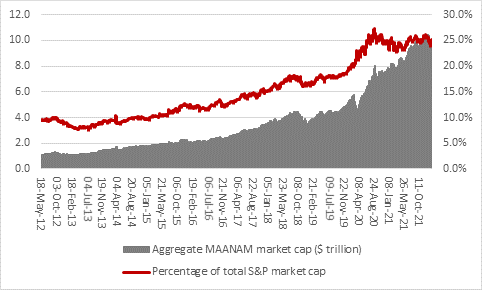

“The share price plunge at Mark Zuckerberg’s charge may have wider implications for the US stock market.

“The sextet of Meta Platforms, Amazon, Apple, Netflix, Alphabet and Microsoft (MAANAM, or FAANGM as they began life) has done so much to lift headline US stock indices, thanks to their meteoric share price rises.

“But Netflix and Meta Platforms have now both disappointed. That raises the stakes at the other four given how many investors are relying on them to keep delivering.

“Before Meta’s accident on Wednesday, the MAANAM sextet had a combined market capitalisation of $9.8 trillion, or 25% of the entire S&P 500 benchmark index.

“And over the past 12 months, the MAANAM’s combined value had risen by $1.6 trillion, one quarter of the S&P 500’s $6.6 valuation gain.

Source: Refinitiv data

“If this sextet starts losing value and altitude they could shift from support for America’s headline index to deadweight, something that will affect not just direct shareholders but those who glean their access to the power of corporate America through tracker funds or actively-run collectives.

“It does not necessarily mean US headline indices are primed for a plunge, although it does increase the risk of a substantial reverse and it also suggests that new market leadership may be required if the S&P500 is to keep forging higher.”