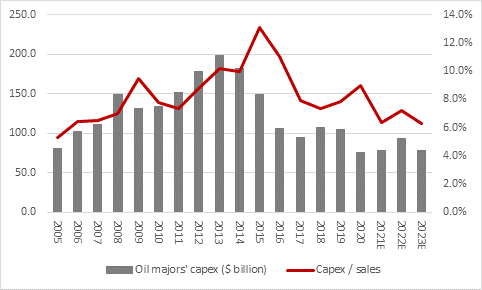

“There is the distinct possibility that neither environmental campaigners nor energy providers nor politicians nor the public will be satisfied with what emerges in terms of policy commitments from COP26, but those looking for a clear path to Net Zero by 2050 may be able to draw comfort from one statistic – the oil majors’ capital investment as a percentage of sales in 2021 looks set to come in at its lowest level since 2005,” says AJ Bell Investment Director Russ Mould. “Spending at BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Royal Dutch Shell and TotalEnergies is expected by analysts to represent just 6.3% of sales this year and is way down from the 13.1% peak of 2015.

“Moreover, that figure will feature spending on renewables and alternative sources of energy, so the percentage of sales being spent on finding more oil and gas is likely to be lower than the actual headline numbers.

Source: Company accounts for BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Royal Dutch Shell and TotalEnergies; Marketscreener; consensus analysts’ forecasts

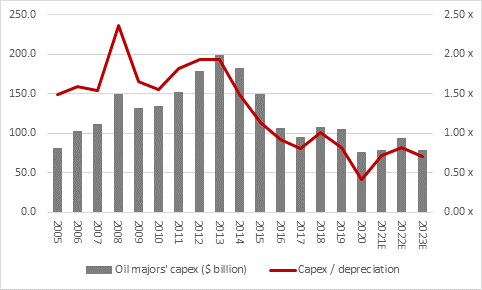

“In addition, capital investment is expected to come in below depreciation for the fourth time in five years – and stay there in 2022 and 2023 as well, according to consensus analysts’ forecasts.

“This again suggests that Big Oil is not drilling or exploring with anything like its old vigour and instead focusing on renewables and a combination of debt repayment capital returns to shareholders.

Source: Company accounts for BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Royal Dutch Shell and TotalEnergies; Marketscreener; consensus analysts’ forecasts

“In absolute dollar terms, spending across the seven majors peaked at $198 billion in 2013 and it peaked as a percentage of sales at 13.1% in 2015. This shows how public and political pressure has been building on Big Oil for some time, especially as the Paris Agreement was signed in 2015.

“However, hard-headed economics may have just as much to do with this retrenchment at Big Oil as global public and political pressure for a clear pathway to Net Zero.

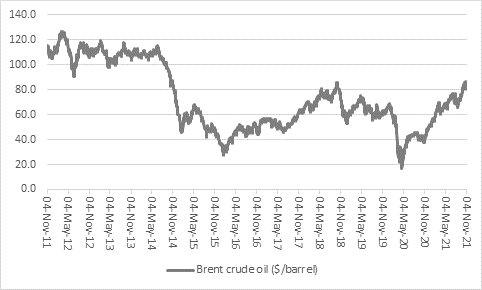

“Faced by the rise of American shale oil production and the possible loss of market share, Saudi Arabia turned on the taps in 2014 and 2015. The price of crude swiftly fell from north of $100 a barrel to barely $30. That prompted over 100 bankruptcy filings amongst US shale producers in 2015 and 2016, according to the Oil Patch Bankruptcy Monitor from Haynes Boone and also persuaded the oil majors to amend their spending and investment plans, too.

Source: Refinitiv data

“Riyadh’s move also seems to be have created the conditions for a rapprochement with Moscow. Russia and Saudi Arabia have worked in tandem over the past two year as OPEC+ first cut production in the wake of the pandemic and then slowly began to increase it again, to maintain some degree of equilibrium in the market and support oil prices.

“OPEC+’s machinations may be on reason why the oil majors are not rushing to invest in major new projects and geopolitics often has a huge say when it comes to the price of crude – were the US to drop its sanctions against Iran and Venezuela, for example, that would bring supply back into the global market, while a defrosting of relationships between Washington and Moscow might help in this respect as well.

“But there are reasons why oil executives may be careful with their companies’ cash when it comes to fresh investment in production of hydrocarbons:

• Oil executives will think back to the price collapses of 2008-09, 2014-15 and 2020 and therefore be wary of taking for granted the current resurgence in oil (and gas) prices

• Many oil firms, especially the US shale drillers, are still burdened by substantial debts and may be preferring to reduce their liabilities rather than commit to fresh capital investment. According to the last Oil Patch Bankruptcy Monitor from Haynes Boone only 12 North American oil and gas producers filed for bankruptcy in the first half of 2021, the lowest total since 2015.

• Political opposition to new drilling is becoming ever fiercer, as evidenced by reports that the UK has denied Royal Dutch Shell permission to develop the Jackdaw natural gas field in the North Sea.

• In the face of political and public opinion, banks and financing institutions are become ever-more reluctant to provide funds to oil and gas firms for the development of new fields. In October the Dutch pension giant ABP became the latest in a long list of money management institutions to announce it will sell all of its fossil-fuel related holdings.

• Oil executives are aware of public pressure, their environmental responsibilities and the opprobrium that any major new work could bring (along with the danger that making a return which compensates for the huge investment and risks involved could become more difficult, if taxes are increased or consumers and corporations are offered incentives to use alternative forms of energy).

“If analysts’ forecasts for capital investment in 2022 and 2023 prove accurate then higher oil and gas prices are not set to tempt a huge surge in fresh drilling and exploration work. That in turn means that supply may not increase even as demand is doing so, with the result that oil and gas prices remain firmly underpinned, as output from other sources such as wind or solar or hydroelectric is not quite ready to take up the slack (let alone the political hot potato that is nuclear, although that could be the biggest winner of all, if recent price action in the uranium market is any sort of yardstick).

“A sustained increase in oil and gas prices could force what environmental campaigners want – greater and more rapid action to move away from hydrocarbons and changes in behaviour and technology that reduce fossil fuel consumption. Whether the public and corporations have the desire or financial wherewithal to withstand higher heating and fuel bills and input costs will be an interesting test of their commitment to the cause (and France’s experience with the Gilets Jaunes in 2018-19 may not give environmentalists too much comfort here) and that is something which vote-hungry politicians will doubtless be watching with interest.

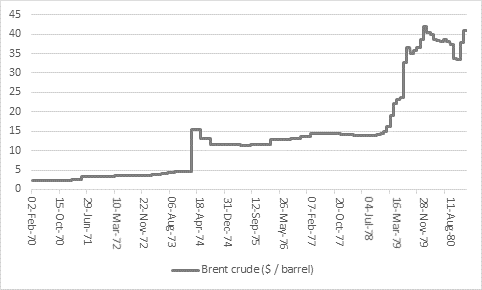

“Geopolitics helped to stoke the runaway oil price gains and inflation of the 1970s, thanks to two oil price shocks, one after the Yom Kippur war of 1973 and one after the Iranian Revolution of 1979. This time around, geopolitics could help if the US, Iran, Venezuela and Russia can strike an accord, although this does not seem unduly likely right now, especially as President Biden may not wish to give his opponents a chance to portray him as ‘soft’ on foreign policy issues.”

Source: Refinitiv data