“Most investors would not expect to see a 6% rise in the share price of a firm after it has just forecast a fourth consecutive drop in annual profits, but that is what they are getting with Next today,” says Russ Mould, AJ Bell Investment Director.

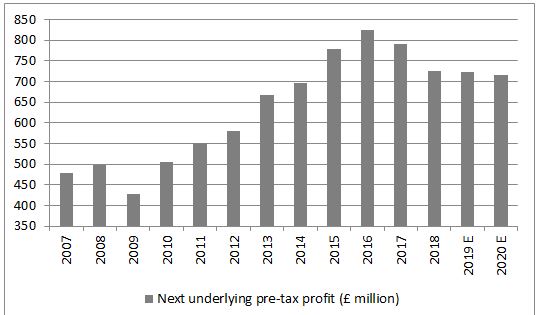

“Shareholders are shrugging off guidance from the retailer’s boss, Lord Simon Wolfson, that profits will drop very slightly in the years to January 2019 and January 2020, to £723 million and then £715 million, from the £726 million made in 2018.

Source: Company accounts, management guidance for fiscal 2019 and fiscal 2020. Company financial year to January.

“They are doing so because Next has provided no nasty surprises regarding Christmas trading, despite the downbeat news flow which has coloured so much of the commentary issues on the festive season so far (notably HMV’s return to administration, weak foot fall numbers on the High Street and the often alarming level of discounting visible in shop windows).

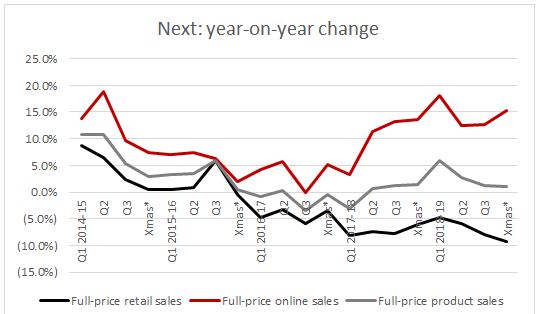

“The retailer met expectations with a 1% increase in like-for-like full-price product sales and a 1.5% like-for-like increase overall, a rate of growth which matched that of the Christmas period in 2017 and exceeded those seen in 2016 and 2015.

“Retail sales fell 9.2% year-on-year but online growth accelerated to 15.2% to take up the slack

Source: Company accounts. *Xmas does not cover the whole of the final quarter of the year which runs to the end of January.

“This again serves to remind investors that Next is no mere bricks-and-mortar retailer, as over half of its profits come online, with the shops serving as a useful destination for click-and-collect customers.

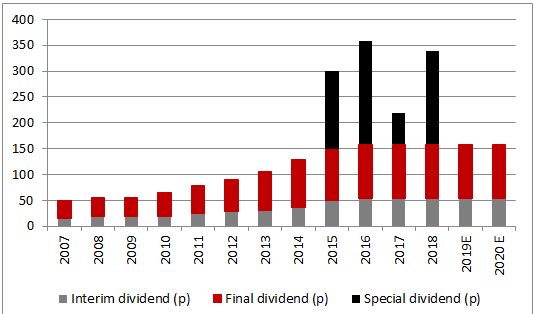

“Such strong online business, coupled with careful management of the shop estate and good cost control, helps to underpin Next’s robust cash flow, which in turn funds the company’s dividend payments.

“Management’s forecast that it expects to generate some £300 million in surplus cash in 2019-20, once all bills have been paid, investments in the core product and service proposition made and dividends paid, will reassure shareholders and this probably explains the warm reception given to the trading statement.

“Next’s 158p-a-year dividend seems well underpinned and that equates to a 3.6% dividend yield, some way ahead of anything that investors can get from cash in the bank or Government bond yields.

Source: Company accounts, analysts’ consensus forecasts for company years to January 2019 and January 2020.

“That said, investors will continue to watch the company’s profit margins, given the very slight downward steer in earnings guidance for the year, due to a seasonal slant in sales toward lower-margin beauty gifts but also the costs that come with the online business – dealing with returned products will be a particular burden here and one that investors should not forget when they assess other retailers, especially online plays such as ASOS, Boohoo and Quiz.