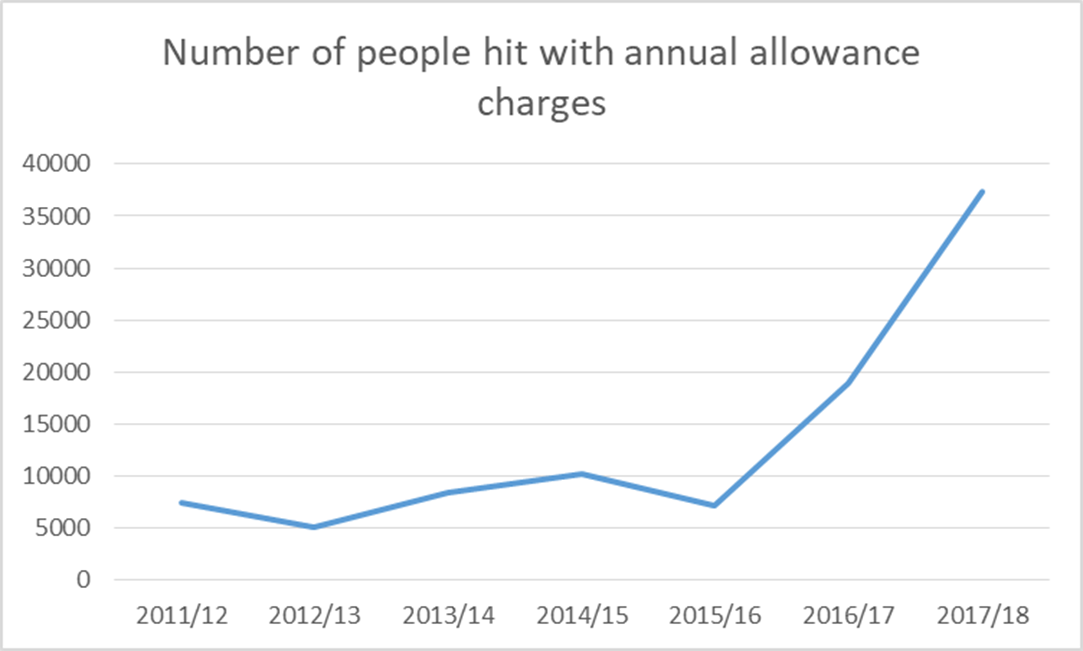

• More than 37,000 people hit with annual allowance charges in 2017/18, double the number recorded in the previous year

• Some £173 million has already been paid by over 10,000 savers in annual allowance charges in 2017/18

• A further 26,550 people have reported contributions worth £812 million over the annual allowance through self-assessment which will be subject to a tax charge

• In addition, 4,550 people paid £185million in lifetime allowance charges in 2017/18, up from £144million the previous year

Full data available here - https://www.gov.uk/government/collections/personal-pensions-statistics

Tom Selby, senior analyst at AJ Bell, comments:

“The staggering impact of the Treasury’s pension tax grab have been laid bare by today’s figures.

“Twice as many people were clobbered with an annual allowance charge in 2017/18 compared with the previous tax year, with hundreds of millions snatched from the grasp of hard-working savers.

“The culprits behind this spike in pension tax are almost certainly the taper, which lowers the annual allowance for high earners, and the money purchase annual allowance (MPAA), which penalises those who take taxable income from their retirement pot.

“The lifetime allowance also continues to hit ever larger swathes of people, with 4,550 individuals coughing up £185million in lifetime allowance charges in 2017/18.

“As we approach an inevitable general election, political parties of all persuasions need to reflect on the anti-savings message being given to the British public by these measures.

“With the taper in particular placing huge strain on the NHS, scrapping this measure should be a priority for the Government.

“The MPAA and the lifetime allowance just add to this complexity, while constant tinkering gives the impression of a moving feast which many struggle to have confidence in.

“We continue to bang the drum for an independent review of the entire pension tax framework, with a focus on simplifying and encouraging more people to save for retirement. Hopefully once the unholy mess that is Brexit has been resolved the Government can get on with important domestic issues such as this.”

Source: HMRC statistics