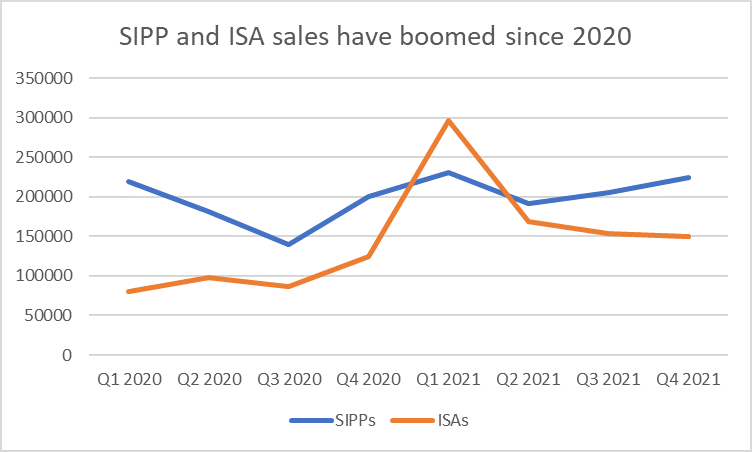

• ISA sales almost doubled in 2021, from 389,674 to 769,247, as ‘accidental’ lockdown savers shifted money into tax efficient vehicles, new FCA data shows (Retail Investments Product Sales Data dashboard | FCA)

• SIPP sales also surged by 15% year-on year, from 740,418 in 2020 to 851,963 in 2021

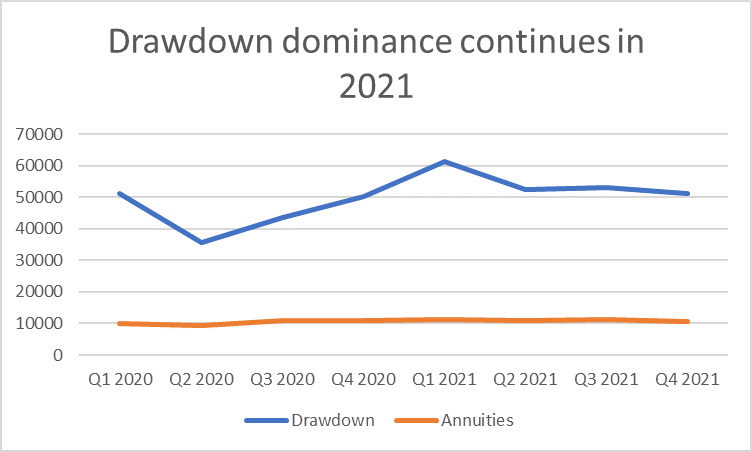

• Drawdown continues to dominate the retirement income market, with 218,100 people entering drawdown in 2021, up 21% from 180,654 in 2020

• Annuity sales also nudged up by 7% year-on-year, from 41,293 to 44,161

Tom Selby, head of retirement policy at AJ Bell, comments:

“During the peak of the pandemic and subsequent national lockdowns, millions of ‘accidental savers’ fortunate enough to remain in employment saw their bank balances bolstered as spending on things like going out and holidays plummeted.

“These accidental savers were undoubtedly one of the key driving forces behind a near-doubling of ISA sales from 2020 to 2021. The first quarter of 2021 was particularly eye-catching, with almost 300,000 ISAs bought during that three-month period alone.

“The world has of course moved on significantly since the turn of the year, with millions of Brits now facing up to a cost-of-living crisis which is squeezing their ability to spend and save for the future.”

Source: AJ Bell analysis of FCA data

Drawdown dominance continues

“In the retirement market SIPPs continue to lead the way, a trend spurred in no small part by the introduction of pension freedoms just over seven years ago.

“SIPP sales surged 15% year-on-year, from 740,418 in 2020 to 851,963 in 2021, making them comfortably the most popular product among retail retirement savers. The rising popularity of SIPPs is reflected in the retirement income market, with drawdown now firmly established as the dominant option.

“The number of people entering drawdown rose 21% from 2020 to 2021, reflecting a return to confidence among savers taking a retirement income while staying invested in markets. That confidence faces an arguably even sterner test at the moment, with economies around the world struggling to combat rapidly rising prices and the continuing uncertainty caused by Russia’s war in Ukraine.”

Source: AJ Bell analysis of FCA data

Annuities remain viable but sales are low

“While rumours of the death of the annuity market were perhaps premature, sales remain much lower than before 2015, with just over 44,000 new plans sold in 2021, up 7% compared to 2020.

“Rising interest rates could help boost the attractiveness of a guaranteed income for life marginally, although other factors – namely the inflexible nature of the product – mean many will prefer not to go down this road.

“For lots of people a combination of annuity and drawdown will likely be the right solution. For example, annuities tend to become better value as we get older, while some will adopt a mix-and-match approach, using an annuity to cover fixed costs and opting for flexibility with the rest.”