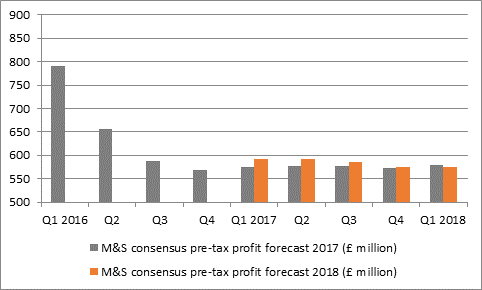

“However, chief executive Steve Rowe will be able to draw some crumbs of comfort from how he has been able to leave profit forecasts unchanged, which may give some grounds for hope that he is finally stopping the rot. Pre-tax income forecasts for 2017 and 2018 have had a bad habit of seeping lower over the past two years, dragging the share price with them.

Source: Digital Look, consensus analysts’ forecasts

“Whether this is due to better management of expectations or better management of the business will remain a debate between bulls and bears of the company - and there are plenty of the latter around, as it is the seventh most shorted stock, according to data from shorttracker.co.uk, with 12 funds declaring a combined short position of 10.9% of the outstanding shares in issue.

“But it could suggest that Mr Rowe’s turnaround plan is having some effect, even if profits are still way below their past peak, despite the difficult environment in which the company is operating. Moreover, success stories such as Joules, boohoo.com and Ted Baker on the clothing side show that it is still possible to grow sales and profits if you get the product and your route to market right, with the result that you do not have to discount excessively to stay out of trouble.

“As such, M&S is far from a lost cause and by getting things right Mr Rowe and team can still bring the FTSE 100 firm back into full favour with shoppers and investors alike:

“Get the fashion basics right. M&S is still a leading provider in areas such as lingerie and denim. By doing these areas, and others such as school-wear, well, M&S can still attract customers who may then buy elsewhere in the stores when they arrive.

“Go for style rather than fashion. M&S should avoid trying to go for bold, statement ranges. A more classical approach suits the company’s demographic so much better. A return of the company’s former knack of coming up with the ‘Piece of the Season’ that appealed to customers of all generations would also be a big step in the right direction. Former triumphs such as velvet shirts for women and killer cashmere cardigans show it can be done. Better still, successes such as these will create a buzz that is sorely lacking about the brand and ranges, keep stock turnover high and markdown low, to benefit of both the top line and margins.

“Focus on quality not price. M&S should avoid the temptation to get dragged down on price and ensure it stands out on quality. The result could be a hit to margin, but that may be the price of returning to top-line growth. The Rosie Huntington Whiteley lingerie range is proving a great success and while it may not be big enough to change M&S’ fortunes on its own, it shows what can be achieved by providing quality, stylish products which last and don’t fall apart within a season of having bought them. M&S must however do this through its own branded products or ranges such as Rosie rather than using external brands as previous attempts to use third-party names have never worked.

“Cut down on store space.

“Get IT, online and click and collect right. This is the company’s chance to attract a more youthful customer and keep existing fans happy. M&S.com has had its teething problems but this is the best venue for offering a wide range of product rather than its bricks and mortar outlets. The company needs to offer free delivery and returns and click and collect to provide as many channels to market as possible.”