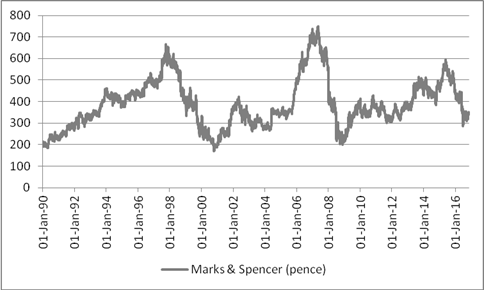

A 20% slide in the shares during his first six months in office is a clear sign to Rowe that investors want to see more than gimmicks like buybacks and special dividends if they are to show interest in a stock which is trading at May 1992 levels, when Sir Richard Greenbury was still in charge.

Source: Thomson Reuters Datastream

In share price terms that is the worst start to a tenure in office of any of M&S’s last six bosses, so Rowe still has his work cut out.

|

| First 6 months | First 12 months | Term of office |

Steve Rowe | 02-Apr-16 | -21.2% |

|

|

Marc Bolland | 01-May-10 | 16.5% | 5.9% | 11.1% |

Stuart Rose | 01-Jun-04 | -8.3% | -8.6% | 0.3% |

Roger Holmes | 01-Sep-02 | -10.4% | -10.2% | 5.4% |

Luc Vandevelde | 01-Feb-00 | -12.4% | -11.7% | 34.7% |

Peter Salsbury | 01-Feb-99 | 5.5% | -24.3% | -24.3% |

AVERAGE |

| -5.1% | -9.8% | 5.5% |

Source: Thomson Reuters Datastream

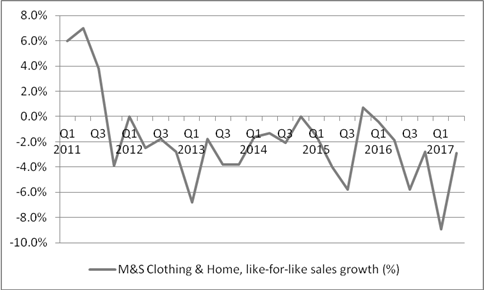

Operational performance still is not good enough. The rate of decline in like-for-like sales at Clothing & Home improved a 2.9% year-on-year drop was still the sixth in a row and the eighteenth in the past twenty-two quarters.. A 0.9% drop in Food and meagre 0.4% increase at M&s.com show there is much to do.

Source: Thomson Reuters Datastream

However, Rowe is clearly aware of this. Although M&S shaved its gross margin guidance lower, this is largely currency related and improvements in buying and stock availability are helping. In addition, the new boss has outlined a vigorous restructuring plan:

The International business will be run on a franchise basis, which lowers cost and risk, in a bid to eliminate £45 million in annual losses. This shift, which brings M&S into line with chains that trade well overseas, like TopShop, reduces staff costs, brings in local managers who know their markets better, helps volumes and reduces markdown, all helping returns so long as brand control is maintained.

On the domestic front a quarter of Clothing & Home space will be repositioned, presumably toward food, albeit at a three-year cost of £150 million over three years. M&S is also cutting both capital investment and marketing expense.

Cost-cutting will help to support earnings forecasts but this will only take M&S so far – to truly revive profits (which according to consensus forecasts for 2017-18 pre-tax profit will come in below where they were a decade earlier) the company must get Clothing & Home right and it is currently hard to argue that M&S has truly found its fashion handwriting.

Alternatively, Rowe might get lucky and be able to ride a stronger economy higher. This looks unlikely at the moment but as the chart below shows an improvement in consumer confidence could at least provide him with valuable breathing space while the new boss implements his turnaround plan.