“A 6% month-on-month jump in mortgage approvals in UK, according to today’s Bank of England statistics, will be welcomed by Governor Mark Carney and Chancellor Philip Hammond and should also put a smile on the face of shareholders in the UK house builders, whose shares have yet to return to the levels reached before the UK voted to leave the EU,” comments Russ Mould, investment director at AJ Bell.

“Barratt Developments and Persimmon jumped to the top of the FTSE 100 leader board with gains of around 2% in response to the data, even as the UK’s elite index languished in negative territory.

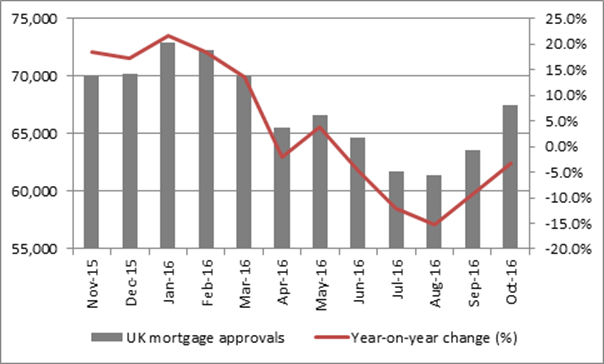

“The total approvals figure of 67,518 compared to 63,594 a month ago and easily exceeded the consensus forecast of 66,000.

“Even though that total still represented the fifth straight year-on-year decline in approvals, the rate of decline is improving and approvals have risen for two straight months after a lengthy pre- and post-Brexit lull. Changes to Stamp Duty Land tax added to property market fears, despite the ongoing Help to Buy scheme and the creation of the Help to Buy ISA and Lifetime ISA, all of which are designed to help first-time buyers.

Source: Bank of England

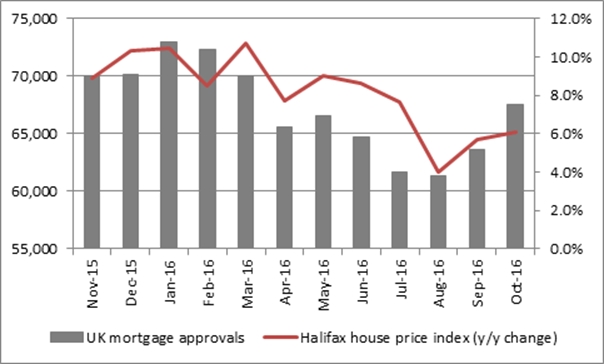

“This rebound could have further positive implications, as house prices look to track mortgage approvals, given the logical mechanics of supply and demand:

Source: Bank of England, Halifax, Thomson Reuters Datastream

“A sustained uptick in mortgage approval rates, possibly helped by the Bank of England’s interest rate cut and renewed QE and bank funding schemes from the summer, could thus provide support to house prices and house builder share prices, given that the latter remain depressed relative to where they were earlier in the year.”