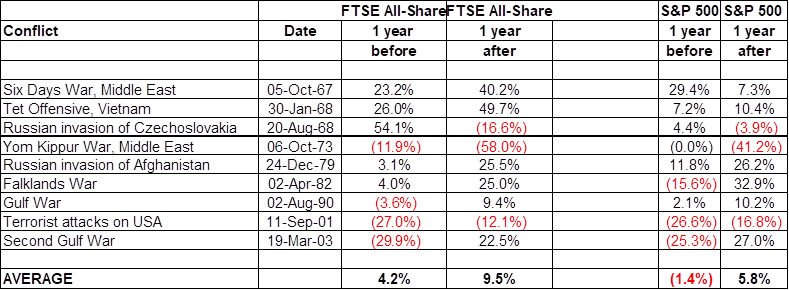

“The maxim that investors should ‘buy to the sound of cannons, sell to the sound of trumpets’ is always attributed to banking giant Nathan Meyer Rothschild (though he denied saying it) and portfolio builders could be forgiven for worrying about which may come next as Russian troops remain active on the borders of Ukraine – even if movements in share prices would be a pretty small concern in the greater scheme of things should any shooting begin,” says AJ Bell Investment Director Russ Mould. “That said, a brief look at the globe’s major conflicts involving either the US or the UK since the institution of the UK’s FTSE All-Share in 1962 shows any negative impact upon equity markets tends to be relatively short-lived, even allowing for the effect of other events, such as shifts in monetary or fiscal policy, economic momentum and corporate profits.

“These stretch from General Moshe Dayan’s pre-emptive Six Days War of 1967 to America’s second invasion of Iraq in 2003 under General Tommy Franks and President George W. Bush.

“Awful and frightening as all of those events were, American and British share prices tended to show remarkable resilience on most occasions (even if, again, that was understandably far from anyone’s primary concern).

Source: Refinitiv data

“The mild exceptions to the rule are 1968's Russian invasion of Czechoslovakia, as it was then, to bring Alexander Dubček to heel and 2001’s terrorist attacks, but the globe was already in the grip of a bear market then anyway as the tech, media and telecoms bubble began to burst.

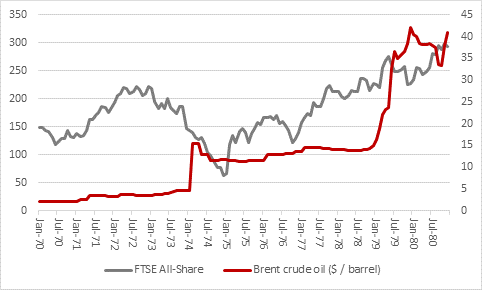

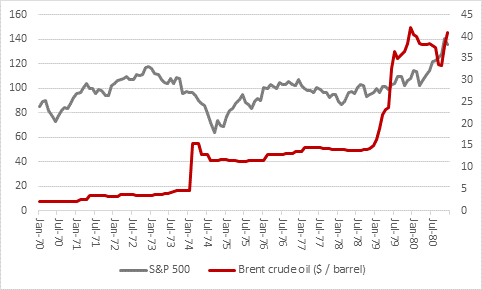

“The real outlier is the 1973 Yom Kippur war when Israel fought off a joint attack launched by Egypt and Syria. While the long-term effect of the war was a chain of events which led to the 1978 Camp David accords and 1979 peace settlement between Cairo and Jerusalem, the immediate consequence was OPEC’s oil embargo, imposed in anger at America’s support for Israel. Oil shot up from $4.50 to $14.50 a barrel and inflation spiked in the West. The nasty recession that followed hammered markets in nominal terms for the next 15 months and inflation hurt returns in real, post-inflation terms for most of the next ten years.

Source: Refinitiv data

Source: Refinitiv data

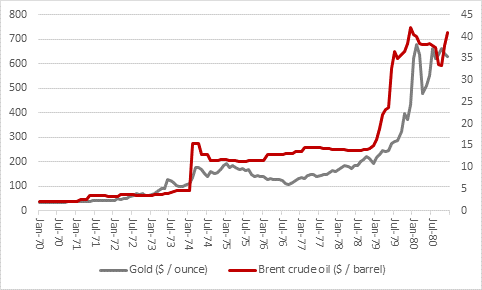

“All asset classes – bar gold – took a pasting between late 1973 and early 1975 as a result and inflation was only finally conquered by the hefty interest rate increases sanctioned by Paul Volcker at the US Federal Reserve and Margaret Thatcher and Nigel Lawson in 10 and 11 Downing Street in late 1970s and early 1980s.

Source: Refinitiv data

“It could also be argued that the conflict which had truly long-term effects was Vietnam, not least because it lasted the longest of any of them. The 20-year war only came to an end when North Vietnam overran Saigon in 1975 and by then America had suffered dreadful casualties, pounding blows to its reputation as a global superpower and also great damage to its balance sheet.

“One of the reasons behind President Richard M. Nixon’s decision to take America off the gold standard in 1971 was its soaring debt burden, largely incurred owing to its military efforts in South-East Asia. The dollar lost around a third of its value across the rest of the decade and gold surged as the shift away from the Bretton Woods mechanism and toward floating currencies was swiftly followed by the oil shock of 1973 (and another in 1979 after the fall of the Shah in Iran), weak growth and uncomfortably high inflation.

“Inflation is already a key preoccupation of financial markets and anything that jeopardises energy supplies and further hikes in oil and gas prices are likely go down as badly with investors as they would with consumers, owing to memories of the 1973 and 1979 oil price shocks and the economic damage they did. This may explain why the US is reportedly in talks with key geopolitical partners so it can help to provide them with the energy they need, in the event of any disruption to supply from Eastern Europe.”