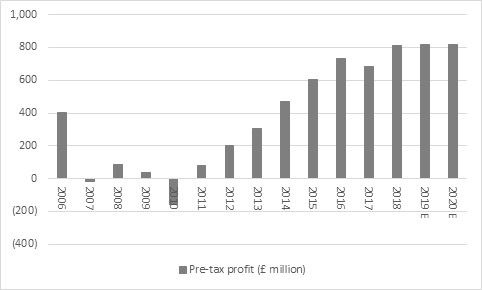

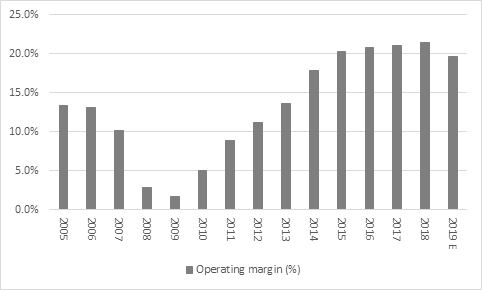

“A record order book shows that demand for housing in the UK remains strong but higher costs, the lingering effects of the freehold scandal and renewed investment in build quality mean that Taylor Wimpey expects its operating margin to fall in 2019,” says Russ Mould, AJ Bell Investment Director. “That pattern fits with the analysts’ consensus forecast of a very low single-digit percentage improvement in profits for 2019 and the market expects similarly modest progress in 2020. This may explain why the shares are barely changed in early trading, especially after a strong run in the autumn back to the 200p mark.

Source: Company accounts, Sharecast, consensus analysts’ forecasts

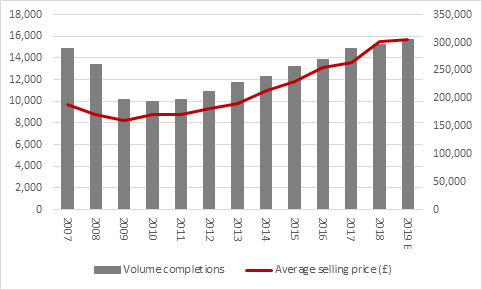

“Analysts were expecting a low single-digit increase in pre-tax profit for 2019 from Taylor Wimpey and it looks like that is what they will get, with volumes up 5%, prices up 1% and costs up by 4.5%.

Source: Company accounts

“The strong order book provides excellent visibility going forward but it does not feel as if earnings are going to suddenly soar. Price increases are flattening out and costs are ticking higher, with the result that operating margins are expected to dip from 21.4% to 19.6% in 2019. Management is working on what it calls ‘process simplification improvements’ but a renewed focus on build quality and the after-effects of the freehold scandal could conceivably restrain margins going forward.

Source: Company accounts

“At least the strong order book shows that demand for new homes in the UK remains very strong. With interest rates near historic lows and competition between the banks in the mortgage market remaining fierce, the market feels well underpinned, especially as the Help-to-Buy scheme runs until 2023.

“But very high house prices are also a potential problem.

“The Office for National Statistics says the median annual wage is £30,420, while the Halifax House Price index says the average UK house price is £238,963, or 7.8 times that sum. That makes getting on to the housing ladder very, very hard and is likely to cap house prices from here, barring further government intervention.

“Such intervention is perfectly possible, either in the form of more tinkering with Help-to-Buy, which will only be available to first-time buyers of new-build houses from 2021 to 2023, or perhaps a cut in stamp duty land tax, an idea reportedly floated by Prime Minister Boris Johnson during the general election campaign.

“Taylor Wimpey and the other builders will be looking to the March Budget with interest, since the absence of further marked house price increases in turn is likely to put some sort of lid on the their ability to markedly increase earnings. Taylor Wimpey’s ASP is up by 91% since 2009 and although volumes are up by 50% it is price that has driven the most recent gains in profit.

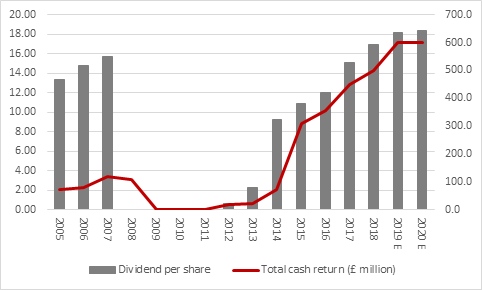

“In the absence of major profit growth, the builders will then trade off their dividend yields, which remain very generous thanks to their net cash piles and lofty profits.

“Taylor Wimpey’s plan to return over £600 million to shareholders in 2020 equates to a yield of more than 9%, assuming the firm uses dividends and not buybacks, one of the highest in the FTSE 100.

Source: Company accounts, Sharecast, consensus analysts’ forecasts

“That is likely to provide support for the shares, even if they trade at roughly two times historic book value, which has historically been the upper end of the range for most house builders.”

|

|

2020E |

2020E |

2020E |

Historic |

|

|

PE (x) |

Dividend yield (%) |

Dividend cover (x) |

Price/NAV(x) |

|

Taylor Wimpey |

9.9 x |

9.1% |

1.11 x |

1.98 x |

|

Persimmon |

10.1 x |

8.7% |

1.14 x |

3.05 x |

|

Crest Nicholson |

11.6 x |

7.7% |

1.11 x |

1.27 x |

|

Vistry |

9.6 x |

6.2% |

1.68 x |

1.62 x |

|

Barratt |

10.7 x |

6.1% |

1.54 x |

1.73 x |

|

Berkeley |

13.7 x |

4.2% |

1.73 x |

2.08 x |

|

Bellway |

9.2 x |

4.2% |

2.61 x |

1.63 x |

|

Redrow |

8.2 x |

4.2% |

2.92 x |

1.81 x |

|

Countryside Prop. |

10.9 x |

3.7% |

2.49 x |

2.63 x |

|

Average |

8.8 x |

7.1% |

1.85 x |

1.67 x |

Source: Sharecast, consensus analysts’ forecasts, company accounts for last published NAV per share figure