“The Bank of England will publish the results of its latest annual stress tests of the country’s leading banks on Monday 16 December (having delayed their release by a week owing to the General Election). All seven passed in 2018 and Barclays, HSBC, Lloyds, RBS and Standard Chartered, as well as Santander and the Nationwide Building Society, will be looking to prove their resilience again this year – not that it has done the share prices of the quoted banks much good in the past 12 months,” says Russ Mould, AJ Bell Investment Director.

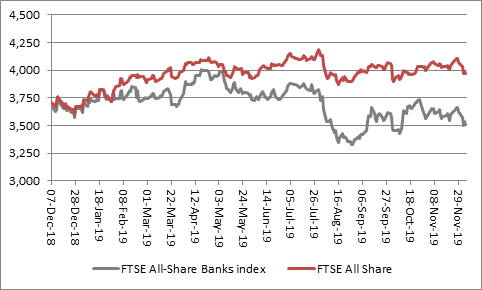

“Over the past 12 months, the FTSE All-Share Banks index is down 4.5% against a 7% gain in the FTSE All-Share benchmark and it can be argued that the Bank of England is measuring the strength of the lenders while at the same time imposing policies which, unintentionally, weaken their earnings power.

Source: Refinitiv data

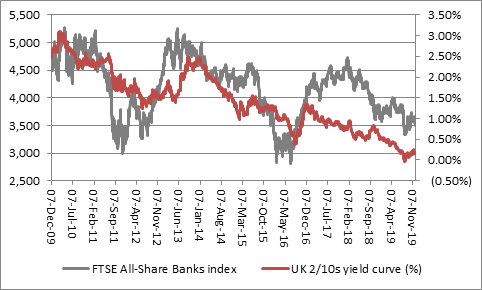

“The Bank of England continues to keep interest rates at near record-lows and suppress bond yields by maintaining its £435 billion stock of UK Government Gilts, acquired through its Quantitative Easing (QE) programme.

“Yet banks need positive interest rates, a steep yield curve and decent credit spreads to make money and zero-interest-rate-policies (ZIRP) and QE go a long way to depriving the lenders of all three, even if advocates of these supposedly emergency measures will argue that they are still helping to keep the UK economy on track.

Source: Refinitiv data

“Throw in competition from challenger banks, and a battle between the major lenders themselves in the mortgage market as they look to do something with the capital they are obliged to keen as part of their ring-fenced, retail operations, and regulators’ and central bank policies are making life tough for the big lenders. This can be seen in how their net interest margins are coming under seemingly constant pressure and it is this which largely explains the share price weakness in absolute terms, let alone relative to the market.

|

|

2015 |

2016 |

2017 |

2018 |

Q3 2019 |

|

HSBC |

1.88% |

1.73% |

1.63% |

1.66% |

1.59% |

|

Standard Chartered |

2.08% |

2.00% |

1.55% |

1.58% |

1.56% |

|

RBS* |

2.12% |

2.18% |

2.13% |

1.98% |

1.83% |

|

Lloyds |

2.63% |

2.71% |

2.86% |

2.93% |

2.88% |

|

Barclays UK |

3.56% |

3.62% |

3.49% |

3.23% |

3.10% |

Source: Company accounts. RBS restated to exclude NatWest Markets Q3 2019

“None of these seems likely to prevent any of the seven from passing the tests, which assume three severe challenges hit the banks at the same time:

• A UK and global macroeconomic stress that runs for five years to the end of 2023. This includes a 4.7% drop in UK (a declines of 3.7% in the USA and 4% in the EU); a 33% plunge in UK residential property prices and a 41% collapse in commercial buildings’ value (and drops Hong Kong and Chinese) property prices too); a surge in UK unemployment to 9.2%; a 30% drop in sterling against the dollar, a surge in inflation and a hike in interest rates to 4%

• A financial market stress that hits trading and investment banking operations, including a 41% drop in UK share prices, a huge jump in corporate bond spreads (and therefore defaults)

• A misconduct costs stress test.

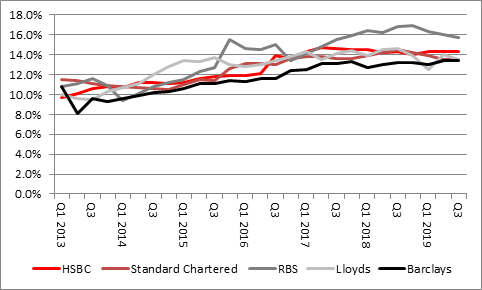

“All of the quoted lenders have built up their capital buffers, as defined by their common equity tier 1 (CET 1) ratio, which measures how much of its total risk-weighted assets are covered by its highest-quality capital (such as cash and equity).

Source: Company accounts. Shows CET1 ratio

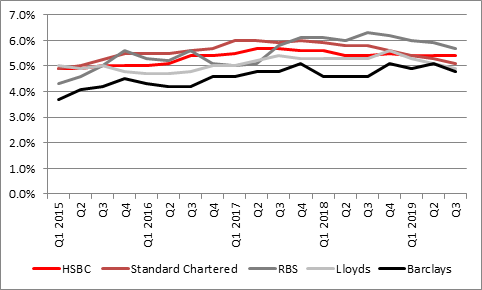

“They have also cut their leverage ratios, as calculated by dividing the value of their Tier 1 capital by their average total assets. This, in effect, measures by the degree to which the banks’ assets could fall in value, on average, before their equity is wiped out and the lenders are rendered insolvent.

Source: Company accounts. Shows leverage ratio

“The aim of the exercise will, therefore, be to give depositors and borrowers comfort that their bank or building society of choice is safe, ten years after the end of the financial crisis.

“Whether that makes them good investments is a separate issue. Valuations may be tempting on an earnings, yield or book value basis (or in some cases all three), but if we remain stuck in this period of low growth, low inflation and low interest rates, with QE thrown in for good measure, the banks could struggle to provide the profits-surprise catalyst that would make investors want to revisit them. Japan’s banks are down 90% from the high they reached in 1989, just as that country’s own debt-fuelled property and stock market came to a crashing end, after all.”

|

|

2020E |

Q3 2019 |

2020E |

2020E |

|

|

P/E |

Price/book |

Dividend yield |

Dividend cover |

|

Lloyds |

8.6 x |

1.17 x |

5.8% |

2.00 x |

|

HBSC |

10.3 x |

1.00 x |

7.0% |

1.38 x |

|

Royal Bank of Scotland |

9.2 x |

0.83 x |

5.6% |

1.93 x |

|

Standard Chartered |

10.0 x |

0.69 x |

3.6% |

2.75 x |

|

Barclays |

7.2 x |

0.61 x |

5.7% |

2.44 x |

Source: Company accounts, Sharecast, consensus analysts’ forecasts

|

|

Q3 2019 |

||||||

|

|

Net interest |

Cost/income |

Impairment |

Loan/deposit |

2019 |

CET1 |

Leverage |

|

|

margin (%) |

ratio (%) |

ratio (%) |

ratio (%) |

RoTE |

ratio |

ratio |

|

HBSC |

1.61% |

56.7% |

0.23% |

74% |

11.2% |

14.2% |

5.4% |

|

Lloyds |

2.89% |

46.5% |

0.33% |

107% |

6.8% |

13.5% |

4.9% |

|

RBS |

2.02% |

67.5% |

0.26% |

86% |

6.8% |

15.7% |

5.7% |

|

Standard Chartered |

1.56% |

64.8% |

0.23% |

66% |

7.5% |

13.5% |

5.1% |

|

Barclays |

3.10% |

62.0% |

0.53% |

82% |

5.1% |

13.4% |

4.8% |

Source: Company accounts