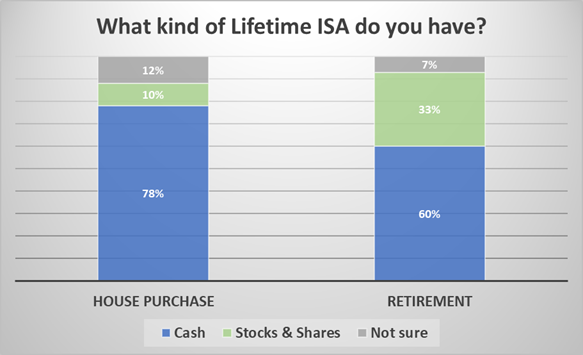

• 60% of consumers using a Lifetime ISA to save for retirement are in cash*

• That’s despite many being in their 20s and 30s and having decades until retirement

• They face high inflation risk, and having a lower retirement pot than those who opt for shares

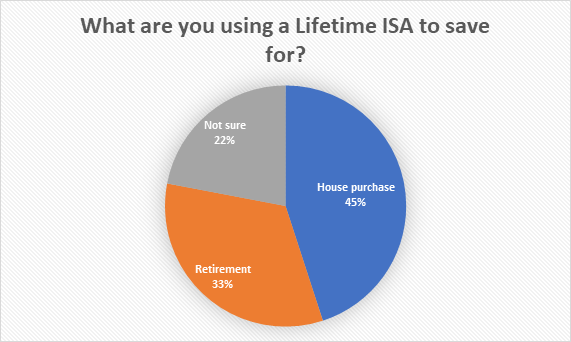

• Overall 45% of Lifetime ISA holders are saving for a house purchase, and 33% for retirement*

*Figures from a survey of 1,106 Lifetime ISA holders conducted by findoutnow on behalf of AJ Bell

Laith Khalaf, head of investment analysis at AJ Bell, comments:

“A third of Lifetime ISAs are using the tax shelter to save for retirement, but most of those are opting for cash rather than stocks, despite the fact they are decades away from drawing on their money. That opens them up to the threat of inflation eating away at their savings, while also missing out on the longer term expected returns of stock market investment. Our survey showed the average age of those using a cash Lifetime ISA to save for retirement was just 36, so they have many years ahead of them to ride out the ups and downs of the stock market in search of inflation-busting returns.

“The Lifetime ISA is actually a pretty good way for basic rate taxpayers to save for retirement, but those who opt for cash will likely end up with much smaller pots than those who invest in shares. Seeing as money in a Lifetime ISA is actually locked away until you’re 60, if you’re saving for retirement, it definitely makes sense to consider shares over cash for such a long-time frame. Those who are saving regularly into a Lifetime ISA will also find that their monthly contributions will help to smooth the stock market journey

“We don’t know what returns are going to look like over the next twenty or thirty years, but the Barclays Equity Gilt Study shows that since 1899, UK shares have returned 5% above inflation, and cash 0.7% above inflation. Based on these figures, a 30 year old paying the maximum £4k in each year (plus £1k tax relief) until age 50, would have a pot worth £174,706 at age 60 if held in cash, or a pot worth £404,874 if invested in stocks (assuming 2% inflation and 0.3% in annual investment charges for an index tracker fund).

“Worse still, cash rates are currently much lower than historical averages. The Barclays Equity Gilt study shows that over the last 10 years, UK shares have returned 4.9% above inflation, and cash has returned 2.5% below inflation, so it’s lost a significant chunk of its buying power. Right now, inflation is on the rise, but cash rates don’t look like they’re going anywhere. So, it’s a particularly inauspicious time to be holding cash for long term savings purposes.

“Broadly speaking, lots of consumers do seem unwilling to move out of cash, even for long term savings. Indeed this prompted the FCA to conclude, in a report issued last December, that many consumers are missing out on making their money work better for them in the long term by holding cash rather than investing. Of course, if you potentially need access to your savings at the drop of a hat, holding cash makes sense. So, the 78% of people using a cash Lifetime ISA to save for a house deposit are likely thinking of buying relatively soon, while the remainder who have opted for stocks are probably playing a longer game. But Lifetime ISA savers in who have so far plumped for cash to save for retirement should give serious thought to switching across into stocks. Their future selves will probably thank them heartily.”

Lifetime ISA Survey results

The survey of 1,106 Lifetime ISA holders was conducted by findoutnow on behalf of AJ Bell.