AJ Bell Youinvest has over 5,000 LISAs open since it launched the account 8 months ago, with an average of £2,250 invested – a healthy amount which will be boosted by a bonus of 25% from the Government. On the other side of the coin, savers have on average £1,750 of LISA allowance left (provided they haven’t maxed out their ISA allowances elsewhere), which would qualify for an average bonus of £437.50.

Tom Selby, senior analyst comments:

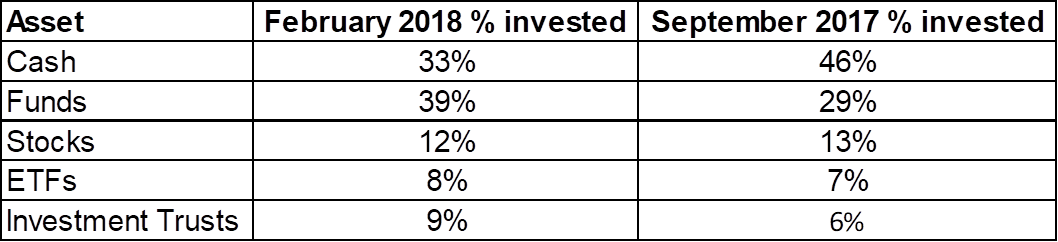

“Having cash in a stocks and shares LISA should really only be a holding pattern while people decide where to invest and that is clearly what is happening here. People may have been holding off investing due to the recent market wobble but they still want to get their savings inside a LISA wrapper so they can benefit from the Government bonus and use their allowance before the end of the tax year.

“As the market settles, investors are now turning to stock market based investments as they look to grow their funds and outstrip inflation.

“Of course, the dual purpose of the LISA – with tax-free withdrawals available from age 60 or for the purchase of your first home – means it is natural to have a significant variety of investment selections. Someone using their LISA for retirement in 30 years’ time, for example, will likely take more risk than someone wanting to buy a house by 2020.

“It’s also interesting to note that most LISA investors are over 30, with a large number of savvy 39 year-olds signing up just before they become too old to qualify for the Government bonus. With an average of £1,750 ISA allowance left to play with, savers need to act quickly if they want to make the most of their full LISA allowance before the end of the 2017/18 tax year.”

Top selling LISA investments so far in 2018 via the AJ Bell Youinvest platform:

1. Fundsmith Equity

2. Scottish Mortgage Investment Trust

3. Vanguard Lifestrategy 100% Equity

4. Vanguard Lifestrategy 80% Equity

5. Fidelity Index World

6. Vanguard FTSE All-World ETF

7. Blackrock UK Equity Tracker

8. Lindsell Train Global Equity

9. Vanguard Lifestrategy 60% Equity

10. Vanguard S&P 500 ETF