|

|

| Performance in S&P 500 index | ||||||

|

|

|

| BEFORE |

|

| AFTER |

|

|

| President | Days | 6 months | 3 months | 1 month | 1 month | 3 months | 6 months | 12 months |

Oct’90 | GHW Bush | 2 | -8.4% | -13.1% | -2.8% | -1.9% | 0.5% | 20.8% | 21.4% |

Nov’95 | Clinton | 5 | 12.1% | 5.3% | 0.8% | 2.0% | 8.0% | 11.5% | 23.7% |

Dec-Jan’96 | Clinton | 21 | 14.2% | 5.7% | 3.2% | 4.8% | 6.3% | 6.6% | 21.2% |

Oct’13 | Obama | 15 | 8.5% | 5.0% | 3.8% | 4.5% | 7.2% | 8.2% | 8.2% |

Jan’18 | Trump | ? | 13.6% | 9.1% | 4.9% |

|

|

|

|

AVERAGE | 10.8 | 8.0% | 2.4% | 2.0% | 2.3% | 5.5% | 11.8% | 18.6% | |

Source: US Congress, US Government Printing Office, Thomson Reuters Datastream

“However, the US government bond market seems more nervous, since the yield on the benchmark US Treasury paper has reached a three-year high.

“Whether this reflects concern over inflation, fiscal incontinence, the Federal Reserve’s withdrawal of Quantitative Easing or a combination of all three remains to be seen.

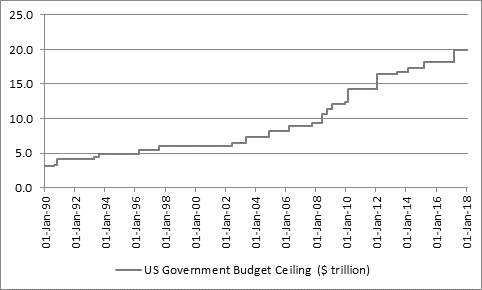

“But it does seem odd in some ways that US government bond yields should still be a lot closer to their record lows (and prices thus near record highs) than the other way round, when supply of this paper has never been greater, judging by the inexorable rise in the US federal deficit and thus the debt ceiling.

Source: US Congress, US Government Printing Office

“Many have tried and failed to call the top in the bond bull market over the last 35 years and the long-term deceleration in economic growth rates and inflation has thwarted them, so yet another session of political haggling over how much Capitol Hill is prepared to let the US Government borrow may not be enough this time either, but the latest sell-off and ceiling negotiations may focus attention on America’s addiction to debt – and not just at Government level.

“In 2017, new all-time highs were reached for Federal debt (over $20 trillion) , mortgage debt (over $14.5 trillion), consumer loans and credit card ($3.8 trillion) student debt (over $1.5 trillion), car loans (over $1 trillion) with only state and local government debt stabilising at around $3 trillion – but even that figure excludes pension liabilities.

“America is drowning in debt and such liabilities are only really manageable for many because interest rates are so low. At least the Government can issue more debt although it remains to be seen whether bond vigilantes will rebel one day.

“With the Trump tax cuts expected to add to the deficit by 2027, not lower it, the bull market in bonds is potentially facing its biggest challenge for some time and in the event a sell-off does take yields higher it will be interesting to see if say a 3% yield on 10-year Treasuries starts to suck money out of stocks and back towards fixed income.”