“Increases in their annual dividend of 10% at both Associated British Foods and Imperial Brands gave some support to their shares in early trading, but the benefit did not last,” says Russ Mould, AJ Bell Investment Director.

“This may seem harsh, especially as AB Foods has increased its pay-out every year since 1996 and Imperial each time since 1997, but the market is currently preoccupied with bigger issues – namely inflation, the prospect of rising interest rates and therefore higher Government bond yields.

“While there are some perfectly good stock-specific reasons why Imperial’s and AB Foods’ shares have done so badly this year – ongoing regulatory pressure and disappointment over the rate at which smokers are switching to next generation products in the case of the former and a weak performance from British Sugar at the latter – the price falls of 2018 are a continuation of a longer trend.

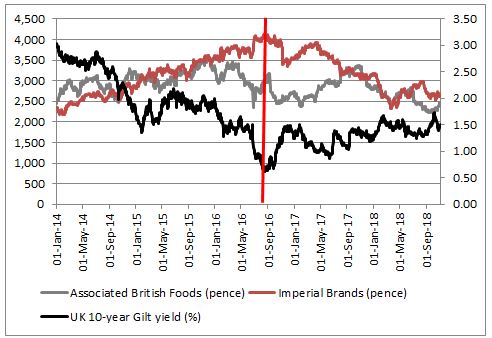

“And in the case of Imperial in particular its shares peak just as the UK 10-year Gilt yield hit bottom, in August 2016.

“ABF maintained some share price momentum until autumn 2017 before the combination of a slowdown in earnings growth and a very full valuation (a price earnings ratio of some 27 times) started to weigh on the stock.

Source: Refinitiv data

“The role of the Gilt yield cannot be underestimated in either case.

“This is because Imperial’s yield looks less attractive relative to cash and Government bonds, the higher cash and Gilt yields go – especially as the risks with shares are so much higher (in that they can go down as well as up). If investors can get better returns from lower-risk cash and bonds, they may decide that they don’t need own income-stocks such as Imperial, or that they should at least pay a lower price to access the dividend stream. This is why tobacco firms are often seen as so-called ‘bond proxies,’ stocks which do well when Government bond yields and interest rates are falling and less well when they are rising.

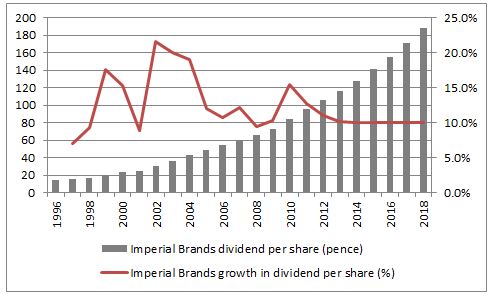

“This is all part of the natural market cycle. Investors must then decide at what stage do they think Imperial’s shares are over-sold, given that the firm has increased its annual shareholder dividend at a double-digit rate in every year but two since 1997. The shares offer a historic yield of 7% and analysts are predicting further dividend growth for the year to September 2019. Against that, sceptics will argue that the past may not be a good guide to the future as regulatory and health concerns weigh on demand for tobacco and stick volumes continue to gently decline.

Source: Company accounts, Refinitiv data. Fiscal year to September

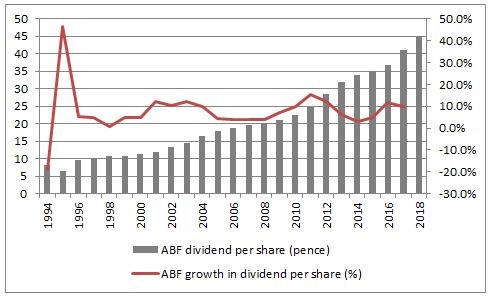

“Associated British Foods is a slightly more complicated story, since its attraction is not its yield, which is just 1.9% on the annual dividend just declared. ABF is more of a so-called ‘quality’ play, liked by investors for its consistent growth, net cash balance sheet and excellent long-term dividend growth record.

Source: Company accounts, Refinitiv data. Fiscal year to September

“Reliability has been the key to shares but the pressure on British Sugar’s profits has taken a bit of the gloss off that, and persuaded investors to de-rate the shares – so rather than paying 27 times earnings a year ago they are now content to pay just 18 times.

“British Sugar has something to do with this, but so does the Gilt yield. Quality or growth stocks tend to trade on high multiples as investors pay up to discount long-term earnings which they feel are reliable. But as Gilt yields rise, the discount rate (or interest rate) used to value those future earnings in a discounted cash flow (DCF) model rises too and the higher the discount rate, the lower the net present value (NPV) of future cash flows.

“In addition, there is a case to be a made that growth or quality names will be less favoured – or at least relatively less valuable – if economic growth is accelerating as this will help cyclical firms increase their earnings too. And if profits growth is more widely available then there is less need to pay up to access it at the select group of firms or sectors (such as tech) that are seen as capable of delivering growth whatever the economic conditions.

“This gets to the heart of the growth versus value debate. BT’s bounce last week shows a switch to value, while AB Foods’ and Imperial’s share price woes this year show how higher Gilt yields (amid expectations for higher inflation and higher interest rates) are making life harder for ‘quality/growth’ and ‘income’ styles.

“Whether this switch gets real traction or not may depend on where growth and inflation expectations – and thus the 10-year Gilt yield – all go, but in theory the higher the benchmark Government bond yield, the more it could favour cyclicals and downtrodden stocks like retailers or property, who fall into the value bucket, and work against tech, yield sectors such as utilities and highly-rated groupings such as beverages and household goods, where investors are still paying premium valuations for firms such as Diageo, Reckitt Benckiser and AB Foods.”