“Shares in the London Stock Exchange may be down 6% today, but the news that another overseas bid for the FTSE 100 firm has failed hardly qualifies as ‘human bites dog.’ Rather it is much more along the lines of ‘small earthquake in Chile, no-one injured,’” says Russ Mould, AJ Bell Investment Director.

“There have been several failed attempts to acquire the LSEG over the past two decades, including ones from NASDAQ and Intercontinental Exchange of the USA, Australia’s Macquarie Bank and Deutsche Boerse, so another unsuccessful approach merely adds to a long list.

“The HKEx approach was likely to prove particularly problematic, given the potential for political involvement. The UK Government, and the authorities in the City, may well have looked askance at the prospect of Chinese influence over the LSEG, given China’s influence over HKEx, since the Hong Kong government appoints more than half of HKEx’s board. The latest round of pro-democracy, pro-reform protests in Hong Kong raised the stakes even further.

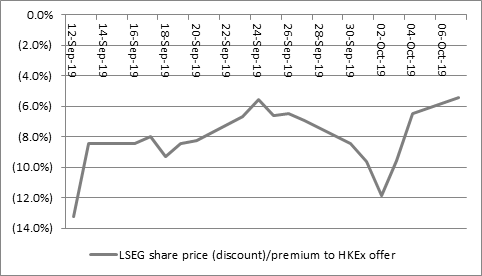

“As a result, the LSEG share price never really got close to the offer price implied by HK’s cash-and-shares proposal. The plan of 2.495 HKEx shares plus £20.45 in cash for every LSE share initially equated to a bid of £83.61 a share.

“But HKEx’s shares weakened as its own investors questioned the logic of the deal and by the close on Monday the value of the offer had ebbed to £78.79 a share.

|

HKEx offer: 13 Sept |

|

|

|

|

|

|

|

Cash |

£20.45 |

£20.45 |

|

HKEx shares |

2.495 |

£63.16 |

|

|

|

|

|

TOTAL |

|

£83.61 |

|

LSE share price |

|

£72.52 |

|

Discount/premium |

|

(13.3%) |

|

|

|

|

|

HKEx offer: 7 Oct |

|

|

|

|

|

|

|

Cash |

£20.45 |

£20.45 |

|

HKEx shares |

2.495 |

£58.34 |

|

|

|

|

|

TOTAL |

|

£78.79 |

|

LSE share price |

|

£74.52 |

|

Discount/premium |

|

(5.4%) |

Source: Refinitiv data

“That at least meant that the discount to the offer price at which the LSE had consistently traded had at least begun to close. Perhaps some investors had even been hoping for an improved offer, with the sweetener of extra cash, but the increase in HKEx’s share price following its announcement that the bid is off suggests the company would have had a difficult task to persuade its own shareholders of the merits of such an increase.”

Source: Refinitiv data