“Even if GKN staves off its predator the company is due to be broken up, as the defence plan outlined by chief executive Anne Stevens sanctions the merger of the Driveline operation with America’s Dana, leaving shareholders with 47.25% of the new entity and the disposal of non-core assets ahead of a sizeable cash return.

“GKN will thus become either the 53rd founding member of the FTSE 100 to be swallowed up or the eleventh to be broken up.

“If it fails to fend off the attentions of Klepierre, Hammerson will become the 54th of the original line-up to become part of another firm. Should the real estate investment trust retain its independence it will be one of four firms that started off in the FTSE 100 in 1984 but are now in the FTSE 250, alongside Edinburgh Investment Trust, Elementis (which was known as Harrisons & Crosfield, back in the days) and Rank. Hammerson is also looking to acquire Intu in a cash-and-stock deal that could return it to the FTSE 100.

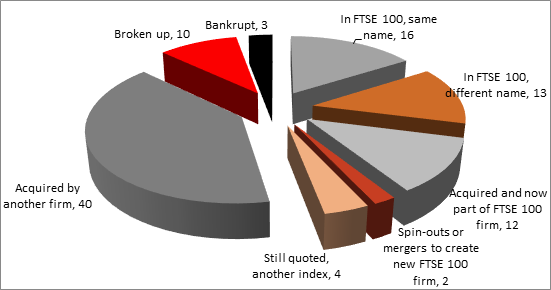

FTSE 100: what has happened to the original constituents?

See table 1 below for detail

“Only 16 of the original 100 names are still in the FTSE 100 under the same name and some of those – such as Whitbread, Pearson, Lloyds Bank and Royal Bank of Scotland – have seen dramatic changes in their business structure or even their business model over the last 34 years.

“A further 13 are still in the benchmark index but under a different name, including GKN, which in 1984 was known as Guest, Keen & Nettlefolds. Twelve more live on as part of a firm that is in the FTSE 100 now, a number Ladbrokes will swell should GVC attain promotion to the premier index, as seems likely.

“The real secret to long-term investing in stocks is to pick companies with strong competitive positions that are reinforced by investment, high barriers to entry and healthy finances and nurtured by capable management. However, the remarkable rate of turnover among the UK’s premier elite, with just 29 survivors after 34 years, shows how hard finding those sustained winners can be, especially as three founder members of the index went bust, two within a decade of its launch.”

Table 1 - FTSE 100: where the original constituents are now

New name | |||

In FTSE 100, same name | |||

1 | Associated British Foods | FTSE 100 | |

2 | Barclays | FTSE 100 | |

3 | Barratt Development | FTSE 100 | |

4 | Johnson Matthey | FTSE 100 | |

5 | Land Securities | FTSE 100 | |

6 | Legal & General | FTSE 100 | |

7 | Lloyds Bank | FTSE 100 | |

8 | Marks & Spencer | FTSE 100 | |

9 | Pearson | FTSE 100 | |

10 | Royal Bank of Scotland | FTSE 100 | |

11 | Sainsbury | FTSE 100 | |

12 | Smith & Nephew | FTSE 100 | |

13 | Standard Chartered | FTSE 100 | |

14 | Tesco | FTSE 100 | |

15 | Unilever | FTSE 100 | |

16 | Whitbread | FTSE 100 | |

In FTSE 100, different name | |||

1 | BAT Industries | BAT (BATS) | FTSE 100 |

2 | British Aerospace | BAE Systems (BA.) | FTSE 100 |

3 | British Petroleum | BP (BP.) | FTSE 100 |

4 | Commercial Union | Aviva (AV.) | FTSE 100 |

5 | Glaxo | GlaxoSmithKline (GSK) | FTSE 100 |

6 | Guest, Keen & Nettlefolds | GKN (GKN) | FTSE 100 |

7 | Imperial | Imperial Brands (IMB) | FTSE 100 |

8 | Prudential Assurance | Prudential (PRU) | FTSE 100 |

9 | Reckitt & Colman | Reckitt Benckiser (RB.) | FTSE 100 |

10 | Reed International | RELX (REL) | FTSE 100 |

11 | Rio Tinto-Zinc | Rio Tinto (RIO) | FTSE 100 |

12 | Royal Insurance | RSA (RSA) | FTSE 100 |

13 | Shell Transport & Trading | Royal Dutch Shell (RDSB) | FTSE 100 |

Acquired and now part of FTSE 100 firm | |||

1 | Allied Lyons | Merged with Pedro Domecq (1994). Acquired and broken up by Pernod Ricard, Fortune and Diageo | Acquired |

2 | Beecham | Now part of GlaxoSmithKline | Acquired |

3 | Britoil | Acquired by BP (1988) | Acquired |

4 | Distillers | Now part of Diageo | Acquired |

5 | General Accident | Part of Aviva | Acquired |

6 | Great Universal Stores | Experian (EXPN) + Home Retail (HOME) - Home Retail acquired by Sainsbury in 2016. Homebase sold to Wesfarmers for £340m, Argos retained. | FTSE 100 / Acquired |

7 | Midland Bank | Now part of HSBC | Acquired |

8 | National Westminster Bank | Now part of RBS | Acquired |

9 | Plessey | Acquired by GEC and Siemens (1989) and then merged to form BAE Systems (1999) | Acquired |

10 | Sun Alliance & London Insurance | Part of RSA | Acquired |

11 | Tarmac | Acquired by Anglo American (1999), part-sold 2013 and now part of JV with Lafarge | Acquired |

12 | Wimpey (George) | Now part of Taylor Wimpey | FTSE 250 |

Spin-outs or mergers to create new FTSE 100 firm | |||

1 | Grand Metropolitan | Diageo (DGE) | FTSE 100 |

2 | Racal | Vodafone (VOD) | Acquired |

Still quoted, another index | |||

1 | Edinburgh Investment Trust | FTSE 250 | |

2 | Harrisons & Crosfield | Elementis (ELM) | FTSE 250 |

3 | Rank | FTSE 250 | |

4 | Hammerson | FTSE 250 | |

Acquired by another firm | |||

1 | Associated Dairies | Acquired | |

2 | BICC | Acquired | |

3 | BOC | Acquired | |

4 | BPB Industries | Acquired | |

5 | BTR | Acquired | |

6 | Berisford | Acquired | |

7 | Blue Circle | Acquired | |

8 | Boots | Acquired | |

9 | Bowater | Acquired | |

10 | British Electric Traction | Acquired | |

11 | British Home Stores | Acquired | |

12 | Burton | Acquired | |

13 | Cable & Wireless | Acquired | |

14 | Consolidated Gold Fields | Acquired | |

15 | English China Clays | Acquired | |

16 | Exco International | Acquired | |

17 | Fisons | Acquired | |

18 | Globe Investment Trust | Acquired | |

19 | Guardian Royal Exchange | Acquired | |

20 | Hambro Life | Acquired | |

21 | Hawker Siddeley | Acquired | |

22 | House of Fraser | Acquired | |

23 | Ladbrokes | Acquired | |

24 | MEPC | Acquired | |

25 | Northern Foods | Acquired | |

26 | Peninsular & Oriental Steam | Acquired | |

27 | Pilkington | Acquired | |

28 | Magnet & Southerns | Acquired | |

29 | RMC | Acquired | |

30 | Redland | Acquired | |

31 | Rowntree Mackintosh | Acquired | |

32 | Scottish & Newcastle | Acquired | |

33 | Sears | Acquired | |

34 | Sedgwick | Acquired | |

35 | Standard Telephone & Cables | Acquired | |

36 | Sun Life Assurance | Acquired | |

37 | Trafalgar House | Acquired | |

38 | Trusthouse Forte | Acquired | |

39 | Ultramar | Acquired | |

40 | United Biscuits | Acquired | |

Broken up | |||

1 | Bass | Broken up | |

2 | Cadbury Schweppes | Broken up | |

3 | Charterhouse J. Rothschild | Broken up | |

4 | Courtaulds | Broken up | |

5 | Dalgety | Broken up | |

6 | General Electric Company (GEC) | Broken up | |

7 | Hanson Trust | Broken up | |

8 | ICI | Broken up | |

9 | Imperial Continental Gas | Broken up | |

10 | Thorn EMI | Broken up | |

Bankrupt | |||

1 | British & Commonwealth Shipping | Bankrupt | |

2 | Ferranti | Bankrupt | |

3 | MFI Furniture | Bankrupt | |

Source: London Stock Exchange, Company accounts, FTSE Russell. Assumes Ladbrokes Coral acquired by GVC, but does not assume GVC is promoted to the FTSE 100. Treats GKN as a FTSE 100 member but under a new name and Hammerson as a FTSE 250 member.