“The admission of ongoing disruption to the underlying business will be of perhaps the greatest concern – and probably explains today’s share price dive - but Kingfisher is only two years into a five-year turnaround and this year could be crucial when it comes to persuading investors whether the plan is fitting together or coming unglued.

“One problem for Kingfisher is the unhelpful economic backdrop. Like-for-like group sales on a constant currency basis did crawl back in to positive territory in the fourth quarter, with a 0.3% increase. However, fresh weakness in the UK, at both B&Q and Screwfix is a source of concern.

“Kingfisher may be able to do little about UK consumer confidence but it can certainly manage its own stock levels and investors will be hoping to see less disruption in the underlying business in fiscal 2018-19 as the company works on its buying and sourcing, online offering and price points. A £528 million increase in inventories soaked up cash and reduced free cash flow to just £6 million from £459 million a year ago.

“One clear sign that management is making the ONE Kingfisher programme work will, therefore, be a reduction in stock and working capital this year and investors will be pleased to see that cash released, not least as that will fund the dividend and the share buyback scheme and enable the company to make the cash returns to investors that are one key target of the turnaround plan.”

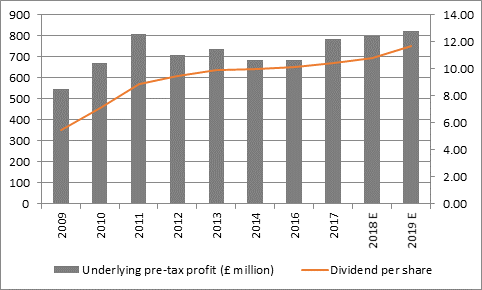

Source: Company accounts, Digital Look, consensus analysts’ forecasts. Year to January.