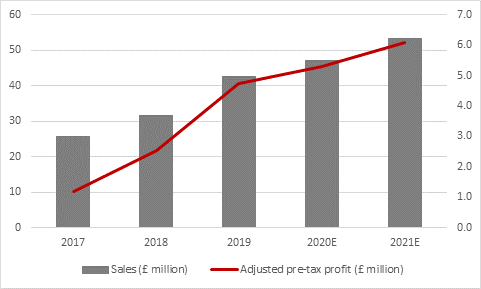

“It is the character of Dick the Butcher who utters the immortal words ‘The first thing we do, let’s kill all the lawyers’ in Shakespeare’s Henry VI, Part II but judging by its second set of full-year results as a public company it is Keystone Law that is cutting a swathe through the legal industry,” says Russ Mould, AJ Bell Investment Director. “The company bills itself as a challenger law firm and its platform-based model seems to be working, as sales rose 35% and profits (adjusting for flotation costs) increased by 88%, allowing the firm to declare a 1.5-times covered dividend of 9p a share.

Source: Company accounts, Sharecast, consensus analysts' forecasts. 2018 adjusted for £0.6 million flotation cost. Financial year to January.

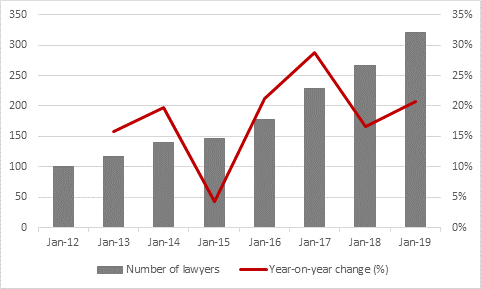

“The firm also added 55 more fee-earners to its books as its rapid growth trajectory and platform-based model saw applicants flock to join. That could set the scene for future increases in profits, earnings and the dividend, which is also supported by a net cash balance sheet, the result of Keystone using some of its November 2017 flotation proceeds to pay off its debts.

Source: Company accounts. Financial year to January.

“The platform means Keystone is almost a ‘virtual’ law firm, as lawyers can work more flexibly, without having to go into an office and with the support of Keystone’s legal network and IT and security framework. The networked model also allows lawyers to refer work to colleagues and support other cases and projects within the firm.

“Keystone’s shares have shed a little ground today but they are still trading at pretty much their all-time high after a terrific run and on the face of it that may be the only knock on the stock at the moment, because the shares are quite highly valued.

“Forward price/earnings (PE) ratios of 36 times for the year to January 2020 and 32 times for January 2021 look pretty racy and while the dividend is growing the forecast yield is around 2%. The FTSE 100 trades on around 13 times earnings with a yield of 4.5% - but then the index’s aggregate growth prospects are much more modest and Keystone Law may still appeal to momentum and growth seekers, especially as that 36-times forward rating could be deceptive if sales and profits maintain their current trajectory.

“The PE multiple could come down pretty quickly if that is the case, although the risk is that even a minor profit disappointment could hit the shares hard, as the £154 million market valuation offers little by way of downside protection, relative to the forecast profits of £5.3 million and £6.1 million for the next two years.”